The Bank for International Settlements (BIS) has one draft to the future of central bank digital currencies (CBDC). The tokenization of fiat currencies has “great potential”, but must be done in a uniform and controlled system. What the coalition of leading financial institutions doesn’t like so much: cryptocurrencies and decentralized finance (DeFi).

Cryptocurency: a “flawed system”?

It’s no surprise, BIS has never been a big advocate of the crypto industry. “Structural problems” have been attributed to the DeFi sector in the past. Criticism of decentralized financial technology should not be missing in the latest report either. Crypto and DeFi have shown how tokenization can work. However, cryptocurrencies are “a flawed system that cannot take on the future role of money”. The BIS further criticizes:

Crypto is self-referential and has little contact with the real world. It lacks the anchor of trust in money provided by the central bank.

But that’s not all: stablecoins are also criticized by the financial institution. Supposedly these would “sprout like mushrooms to fill the vacuum by mimicking central bank money.” The implosion of the crypto universe over the past year has shown that there is no substitute for real money. Sure, Terra and FTX have damaged the image of the crypto industry. In the same breath, however, one would have to mention the most recent banking crisis or the creeping devaluation of “real money”.

Trust in the central bank

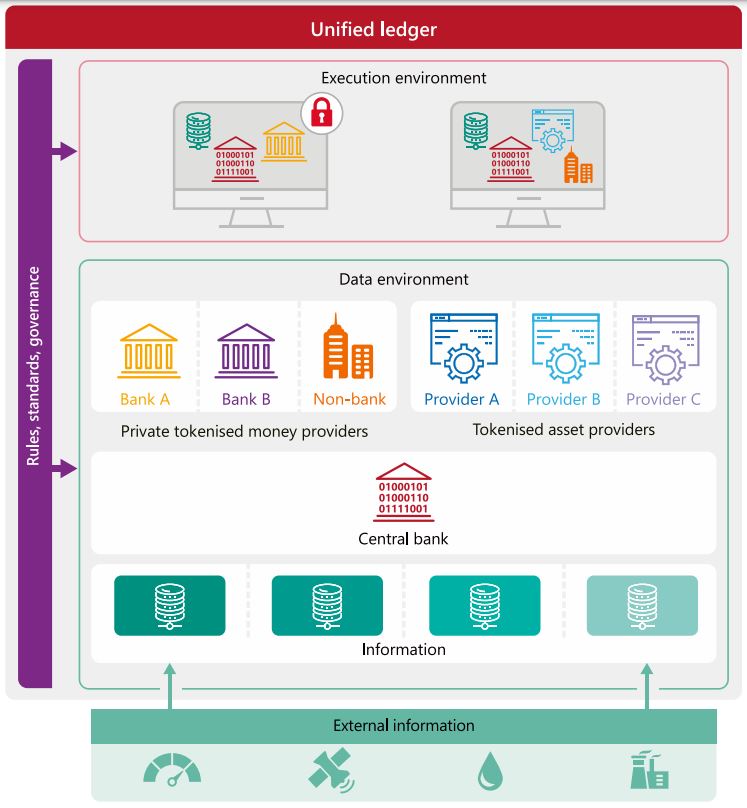

According to the BIS, the banking industry’s attempts to privatize blockchain systems for fiat currency tokenization have resulted in disjointed “silos.” They lack the ability to communicate and collaborate. There are enough examples with SWIAT from DekaBank or the quorum blockchain from JP Morgan. However, the BIS has developed a draft CBDC that aims to improve interoperability between banks around the world. Key to the supposed success: A so-called “uniform ledger”. The BIS explains:

The full benefits of tokenization could be realized in a unified ledger, since settlement finality is created by central bank money co-located with other claims. By boosting confidence in the central bank, a joint venue of this nature has great potential to improve the monetary and financial system.

It remains to be seen whether central banks such as the ECB will incorporate such a draft into the already advanced development of the digital euro. In addition, large financial institutions are already testing with public blockchains such as Polygon. Even the otherwise restrictive Bank of China recently tokenized securities on Ethereum. So, is there really a need for another report on the allegedly failed crypto-technology, which at the same time emphasizes how important the central bank is?

- Michaël van de Poppe: Bitcoin to Hit $500,000 This Cycle? 🚀💸 Or Just Another Crypto Fairy Tale? - December 21, 2024

- What is the Meme Coin Bonk, Price Predictions 2025–2030, and Why Invest in BONK? - December 18, 2024

- BNB Price Analysis: 17/12/2024 – To the Moon or Stuck on a Layover? - December 17, 2024