Table of Contents

Central banks around the world are exploring Central Bank Digital Currencies (CBDCs), representing a new form of money. These digital currencies promise to revolutionize the way people and businesses conduct payments and manage finances. Discussing CBDCs is crucial in the context of modern financing because it has the potential to fundamentally change financial systems, enhance financial inclusion, and boost economic efficiency. This article provides a comprehensive overview of CBDCs, their benefits, challenges, and impact on the global financial ecosystem.

What are CBDCs?

Central Bank Digital Currencies (CBDCs) are an electronic form of currency issued and controlled by central banks. Unlike traditional money that may exist in digital form like bank deposits, CBDCs exist exclusively in electronic form and promise direct accountability, security, and efficiency within the payment system. CBDCs are divided into two main categories: retail and wholesale.

- Retail CBDCs are designed for the general public’s use, facilitating daily transactions and serving as a digital counterpart to cash. This type enables direct interaction between the central bank and citizens, potentially improving financial inclusion by providing access to digital money for those without bank accounts.

- Wholesale CBDCs are intended for transactions between financial institutions rather than the general public. This type aims to improve the efficiency and security of financial transactions, such as interbank payments and securities settlements, leveraging blockchain technology or other forms of distributed ledger technology (DLT) to streamline operations.

CBDCs differ from cryptocurrencies and traditional digital currencies in several key ways. While cryptocurrencies like Bitcoin are decentralized and operate on a public blockchain, CBDCs are centralized, issued, and regulated by the nation’s central bank. This centralization allows for greater control over monetary policy and financial stability. Unlike cryptocurrencies, which can be highly volatile, CBDCs are stable and pegged to the value of the country’s fiat currency, offering a secure and regulated digital payment method.

Historical Context

The evolution of money and digital currencies has been a gradual process, influenced by technological advancements and changing economic needs. The concept of digital currency is not new, with various forms of electronic money and payment systems emerging over the last few decades. However, the emergence of CBDCs marks a significant milestone in this evolution, reflecting a shift towards more centralized, secure, and efficient digital currencies.

The interest in CBDCs has been sparked by the rise of cryptocurrencies and the increasing demand for digital payment options. In response, central banks began to explore the potential of issuing their digital currencies to enhance payment systems, increase transaction efficiency, and strengthen the control over the monetary supply.

Key developments in the CBDC landscape include pilot programs and research initiatives by several countries. For example, the Bahamas launched the Sand Dollar, the world’s first fully implemented CBDC, while China’s digital yuan pilot has expanded to several cities, testing the digital currency’s use in real-world scenarios. Similarly, the European Central Bank and the Federal Reserve are exploring the potential of a digital euro and a digital dollar, respectively, through research and development efforts.

These developments highlight the growing interest and experimentation with CBDCs worldwide, underscoring their potential to transform the global financial ecosystem by providing a more efficient, secure, and inclusive monetary system.

Benefits of CBDCs

- Enhanced Efficiency of the Payment System: CBDCs offer the potential for significant improvements in the efficiency of payment systems. With faster, more secure, and cheaper transactions, CBDCs can minimize the delays and costs associated with traditional payment methods. This is particularly important in an international context, where cross-border payments can be lengthy and costly. Central Bank Digital Currencies also open the door to new innovative payment solutions, including smart contracts and micropayments, increasing the overall efficiency of the financial ecosystem.

- Improved Financial Inclusion: One of the key benefits of CBDCs is the potential to improve financial inclusion by providing access to financial services for those currently outside the traditional banking system. This is especially significant in developing countries, where a large portion of the population may have limited access to banking services. CBDCs allow individuals to store and manage money digitally without the need for a traditional bank account, reducing entry barriers and supporting economic activity and growth.

- Greater Control Over Monetary Policy: CBDCs give central banks direct control over the money supply and enable more precise and effective implementation of monetary policy. For example, central banks could theoretically apply negative interest rates directly to CBDCs, which could be useful in some economic situations. This greater control and flexibility can help central banks better respond to economic crises and support financial stability.

- Potential to Combat Financial Crimes: Through precise transaction tracking, CBDCs can enable central banks to fight more effectively against money laundering, terrorism financing, and other financial crimes. While this raises privacy issues, the transparency and traceability provided by CBDCs can significantly contribute to detecting and preventing illegal financial activities.

Challenges and Concerns

- Privacy Issues: One of the main concerns regarding CBDCs is privacy protection. While transaction transparency can help combat financial crime, it also means governments could have the ability to monitor citizens’ financial transactions. This potential oversight raises concerns about data privacy and freedom.

- Risk of Cyber Attacks: Like any digital technology, CBDCs are exposed to the risk of cyber attacks. Security incidents can undermine public trust in digital currency and have serious consequences for financial stability and currency confidence.

- Impact on Traditional Banking Systems: The adoption of CBDCs could have a significant impact on the traditional banking sector, especially if people start transferring their savings from banks to CBDCs. This could reduce banks’ ability to lend and have far-reaching consequences for the entire financial system.

- Technical and Logistical Challenges in Implementation: Developing and deploying CBDCs is technically complex and requires extensive logistical planning. Challenges include ensuring interoperability with existing financial systems, building secure and resilient infrastructure, and ensuring that the digital currency is accessible to all citizens.

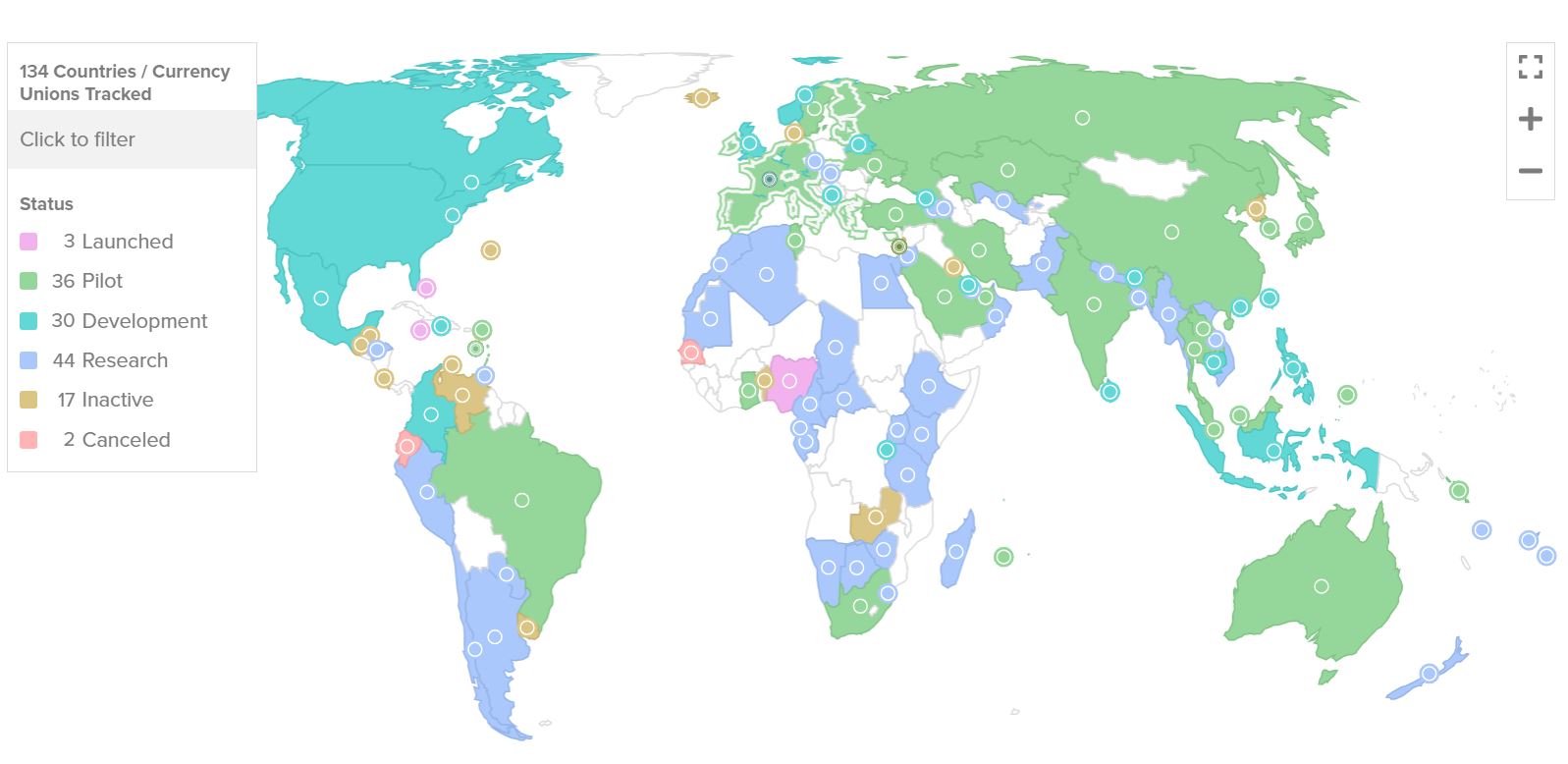

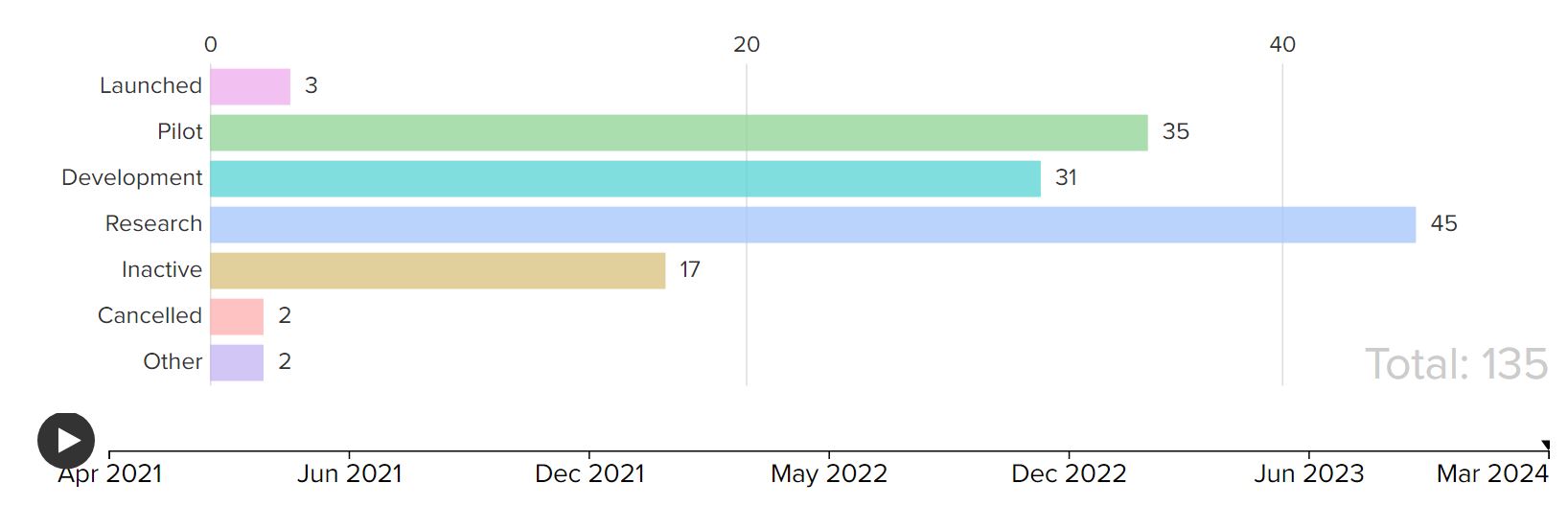

Global CBDC Initiatives

Around the world, central banks are exploring the possibilities of CBDCs, with some countries having already launched pilot programs or fully implemented digital currencies. For example, The Bahamas introduced its digital currency, the Sand Dollar, while China continues extensive testing of its digital yuan in various cities.

Pilot programs and studies provide key insights into the practical use of CBDCs, including challenges related to technical implementation, impact on financial markets, and public acceptance. The variety of approaches countries take to CBDCs also shows the diversity in objectives and strategies, from improving domestic payment systems to enhancing international trade and financial inclusion.

While some countries focus on retail CBDCs available to the public, others are exploring wholesale CBDCs designed for transactions between banks and financial institutions. This diversity of approaches allows for the analysis of different models and their economic impacts, helping to better understand the potential and challenges associated with CBDCs.

Future Outlook and Conclusion

The potential impact of CBDCs on the global financial ecosystem is significant. CBDCs offer the opportunity not only to streamline payment systems and improve financial inclusion but also to strengthen monetary policy and combat financial crime. However, it’s crucial to carefully consider the challenges, particularly in areas of privacy, cybersecurity, the impact on traditional banking systems, and technical implementation.

As the world’s economies increasingly lean towards digitization, CBDCs represent a logical step in the evolution of money. However, the adoption of central bank digital currencies requires a comprehensive approach that encompasses not just technological development but also regulation, cross-country collaboration, and public dialogue.

The future of CBDCs and their role in the global financial system will depend on countries’ ability to address these challenges and create robust frameworks that support their successful deployment. Monitoring how CBDCs evolve in response to changing technological innovations and the financial needs of the population will also be important.

In conclusion, the adoption of CBDCs brings both opportunities and risks. Their success will depend on a careful balance between innovation and protection, between efficiency and privacy, and between global ambitions and local needs. As the world prepares for a potential future with CBDCs, it’s clear that this digital revolution could bring substantial changes for all stakeholders in the global financial system, offering the chance to build a fairer, more efficient, and inclusive financial world.

This article provides just an introduction to the complex and dynamically evolving topic of CBDCs. As technology and global financial markets develop, continuing research and discussion on how CBDCs can best serve the public interest and support sustainable economic growth will be important.

- Why Online Advertisers Should Request Website Traffic Data from Google Analytics Instead of Using SEO Tools Like MOZ or Ahrefs? - March 24, 2025

- North Carolina’s Bold Move: State Bill Proposes Investing 10% of Public Funds in Bitcoin - March 22, 2025

- Justin Sun Stakes $100 Million in Ethereum on Lido – What Does It Mean for the Market? - March 19, 2025