Despite Ethereum’s price facing mid-term challenges, the inflow of funds into ETH stocks and ETFs could act as a catalyst for a rebound from the $2,000 level.

Previously, Ethereum experienced a volatile month, with a monthly drop of 11.6% and a cumulative decline of 34% over six months.

However, as crypto market activity picks up again and with risk appetite shifting ahead of today’s Federal Reserve meeting, the market is showing signs that Ethereum’s price could be forming a local bottom.

This outlook is further reinforced by the accumulation of ETH by institutional entities, such as Bhutan.

🚨BREAKING: Royal Government of Bhutan has begun accumulation of $ETH according to @ArkhamIntel pic.twitter.com/ZwjAARz8LW

— Ethprofit.eth 🦇🔊 (@Ethprofit) September 17, 2024

Will inflows into ETH stocks and ETH ETFs act as a catalyst for a rebound after the FOMC meeting?

The core of Ethereum’s recent price movement lies in the inflows into ETH stocks and ETH ETFs, which began trading after receiving SEC approval on May 23, 2024.

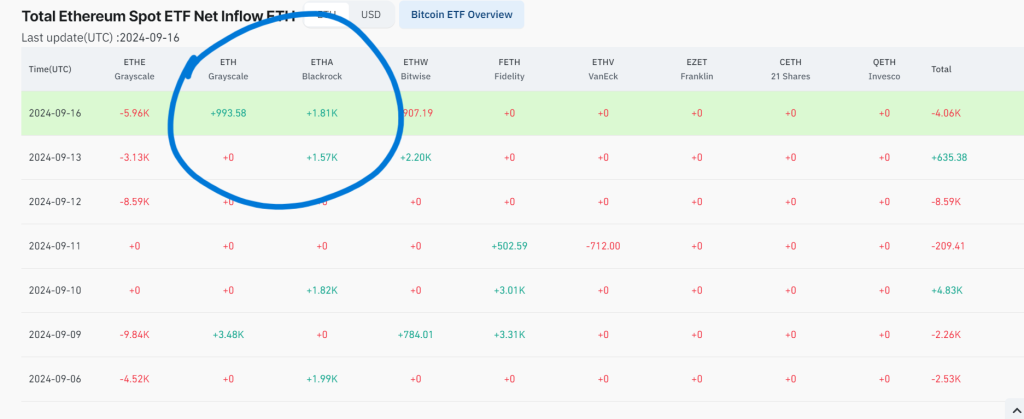

However, since their launch, many have complained about significant outflows from Ethereum ETFs, mainly due to Grayscale’s slow conversion of its once-popular Ethereum Trust Fund.”

eth etf is negative half a billion dollars flow since launch

madness pic.twitter.com/nroKpZot7j

— 🤨 (@danupsher) September 15, 2024

Although many expected Grayscale to increase its Ethereum holdings after converting to an ETH ETF, the actual impact has been rather negative. Since May, former trust holders have actively sold their ETH stocks, leading to nearly $500 million in outflows.

Upon closely examining this week’s Ethereum ETF fund flows, although the overall trend of net outflows still dominates, there are signs of improvement. Most notably, since last Friday, Blackrock’s ETHA ETF and Grayscale’s ETH ETF have shifted to net inflows.

The FOMC meeting is just 2 days away.

According to @Polymarket, there is now a 50% chance of a 50bps rate cut.

What's your prediction?#FOMC #SwissCircle #USA #SwissTalk pic.twitter.com/IIDxj6dmTg

— Swiss Circle (@swiss_circle) September 16, 2024

ETH Price Analysis: Is Ethereum Price Set to Explode After the FOMC Meeting in September 2024?

Currently, Ethereum’s price is battling with the lower trendline support on the mid-term timeframe, trading at a market price of $2,310 (24-hour increase of +1.81%).

After experiencing price volatility, ETH bulls are trying to regain momentum. Previously, ETH’s price plummeted 34% after forming a “death cross” on August 3 due to losing support at the 200-day moving average.

Now, more than a month later, the daily chart is finally showing signs of reversal. Bulls have successfully defended the lower trendline, confirming a double-bottom support at $2,133.

Despite challenges for Ethereum’s price in USD on the mid-term timeframe, inflows into ETH stocks and ETFs could fuel a bounce from the $2,000 level.

This sets the stage for a retest of the upper resistance, and the trend is progressing well. Ethereum’s price is facing its first major obstacle: the declining 20-day moving average resistance, currently at $2,389.

Breaking above this moving average is crucial for Ethereum’s price structure and could push the price back above the 200-day moving average, potentially forming the much-needed “golden cross” pattern.

This move could be driven by a 50-75 basis point interest rate cut at tomorrow’s FOMC meeting—a larger reduction than the 25 basis points expected by traders.

However, if panic selling occurs or if Jerome Powell continues to stir market uncertainty, the situation could worsen, and Ethereum’s price may fall below the $2,000 mark.

Based on our key RSI indicator, momentum seems to favor an upward move, with the current RSI reading at 40, indicating that Ethereum is in an oversold state and well-positioned for a rebound.

Ethereum Price Prediction: How High Could Ethereum Go in September?

Despite challenges for Ethereum’s price in USD on the mid-term timeframe, inflows into ETH stocks and ETFs could fuel a bounce from the $2,000 level.

Overall, the upward move from this point could target the 200-day moving average of $3,200 (potential increase of 38%), while the downside risk could see ETH plummet to $2,000 (a potential decline of 13.45%).

This gives Ethereum a risk-reward ratio of 2.86 for September, making it an attractive entry point for ETH bulls who remained resilient during the August “death cross.”

- CryptoQuant Analyst: Bitcoin Nowhere Near Its Peak – Buckle Up, Hodlers! - December 21, 2024

- Chainalysis: $2.2 Billion Lost to Crypto Hacks in 2024 - December 21, 2024

- Bank of Japan leaves interest rate unchanged: Impact on the macroeconomy and the crypto market - December 20, 2024