Table of Contents

Last week, inflows exceeding 1 billion USD were recorded in investments related to Bitcoin-based assets.

The cryptocurrency rally is causing investors to invest more in the digital sector. Proof of this is the current price of BTC, which is finally selling above 60,000 USD. This more promising phase has also been reflected in the price and circulation of assets related to BTC, which have seen good inflows in recent days.

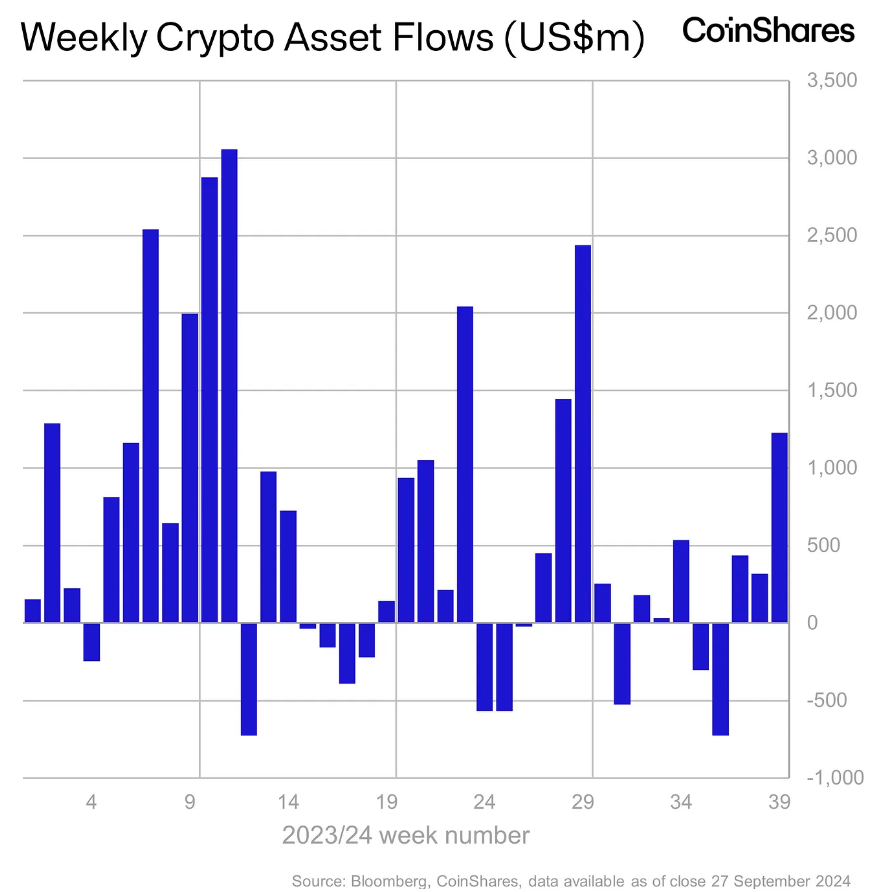

CoinShares’ recently released report points to this scenario. According to the company, this is the third consecutive week of growth in the sector. The record is positive inflows exceeding 1.2 billion USD, when considering the last week of September.

Bitcoin-based products were the top choice for investors

There are some investors who still regret not having invested in Bitcoin when the asset was still in its early stages. Therefore, every chance of buying the token at a reduced value is seen as a good opportunity to invest and, who knows, increase your returns.

Following this logic, the recent bearish scenario was ideal for those who wanted to bet on the asset. This was clear in the recent price recovery of the token, which sold above 66 USD thousand in the week analyzed by the CoinShares report.

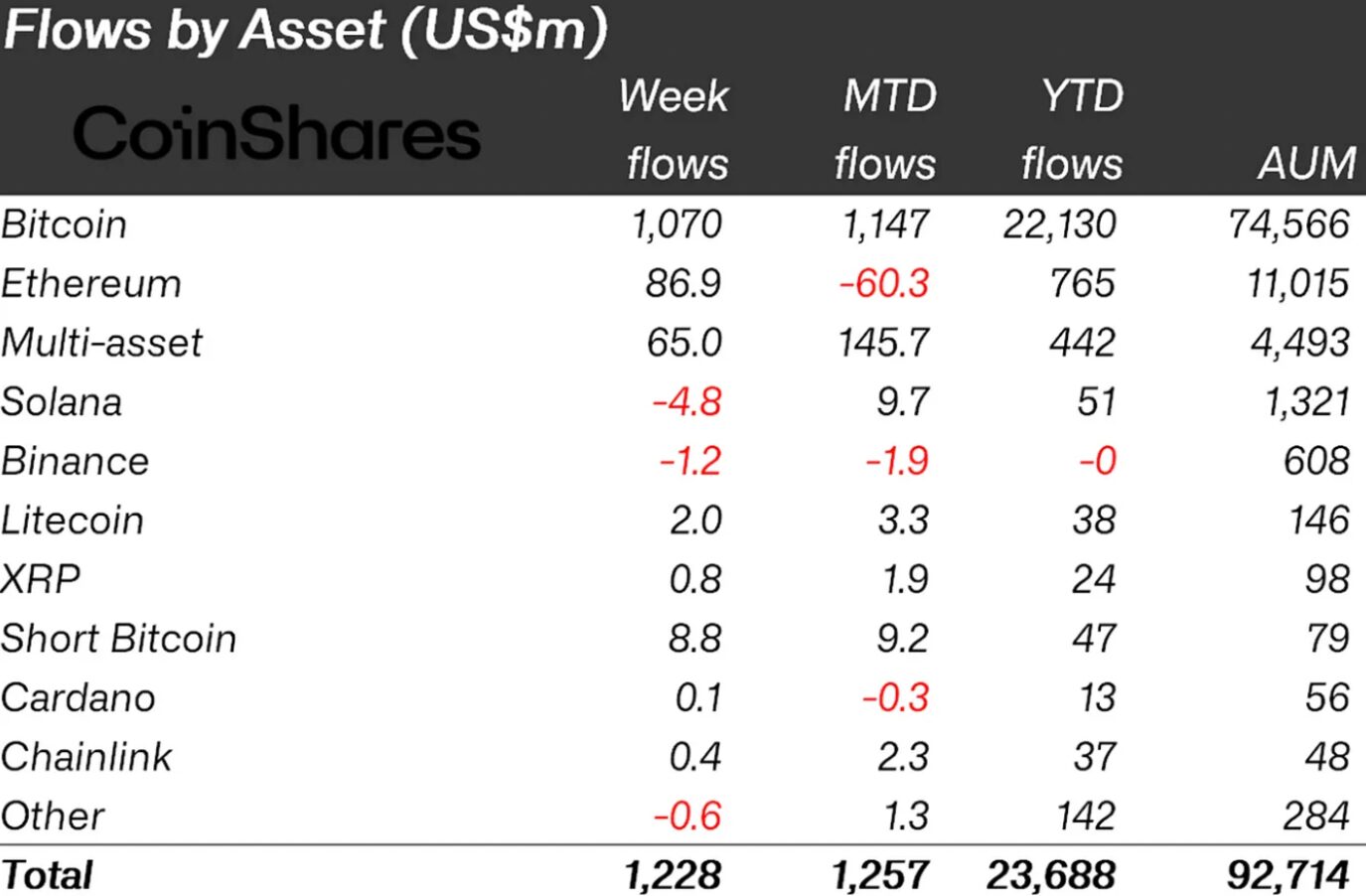

However, according to the company, exchange-traded products still had a better return, indicating that investors are exploring more market options. This was mainly the bet of institutional investors. The investment flow in this type of asset attracted around US$ 1 billion in net inflows in the last seven days alone. This corresponds to 87% of the total amounts moved and indicated in the report.

Ethereum-based products are back on the rise after weeks of negative balances

According to CoinShares, the new wave of highs was also good for Ethereum-based products. After five weeks of negative flows, the assets accumulated positive inflows of 87 million USD.

These are the first positive results since August. This indicates that investors may be looking at alternative products and tokens other than BTC. This should bode well for the market in the coming days.

However, it is worth mentioning that the ETH token has not performed as well as other cryptocurrencies. At the moment, the main tokens are trading above the average of the last few days. This is not the case for the Ethereum network. This is because the asset has seen a drop of almost 6% in the last fifteen days, while the other assets have increased in price.

Positive change as a result of US economic policy

CoinShares’ head of research James Butterfill believes that the increased inflows into digital assets are a result of the US government’s latest actions. He also says that investors may be influenced by the SEC’s recent approval of new products.

In fact, the price of most cryptocurrencies has risen following the latest decisions by the Federal Reserve. After trying to contain the country’s economic crisis in several ways, the agency decided to cut interest rates by 50 points. This has improved living conditions in the country, with greater access to loans and lower mortgage rates, for example.

Furthermore, lower interest rates have made traditional investments less sought after. Therefore, digital assets have ended up gaining more prominence and having positive repercussions.

The report also points out that the Fed’s actions have boosted investor interest. This was based on data from the firm Alternative, which released a chart showing investors’ “emotions and sentiments.” The market’s greed index stood at 61 points as soon as the measures were taken.

Could Bitcoin reach a new all-time high this year?

There are currently a lot of expectations surrounding BTC’s growth . This is because, so far, the token has had a very busy year. At the beginning of the year, the asset received more attention from investors due to expectations regarding the approval of BTC ETFs. Then, there was a lot of speculation surrounding the asset’s halving, which happened in April. Amid all the FOMO surrounding the token, the all-time high appeared in March.

After that, the decline occurred, especially because of the economic crisis in the United States and the instability of the market. Therefore, this recovery in prices may rekindle the hope of new growth later this year.

However, this reality may not be found any time soon. This is because the FED‘s decision to cut interest rates is quite recent. This indicates that optimism may not last for long or the crisis may worsen again. In addition, there are other factors influencing the current scenario of the digital asset market.

The election of the new president of the United States is an example of this. So far, everything indicates that the dispute between Donald Trump and Kamala Harris will be quite close. The polls do not point to a concrete result, causing uncertainty to continue to hang over the market.

Therefore, there is no way to predict what BTC’s fate will be this year. However, investors should prepare for a possible rise, not only in Bitcoin but also in other cryptocurrencies. Investing in tokens with growth potential is the best way to prepare for the period of stability that is to come.

- CryptoQuant Analyst: Bitcoin Nowhere Near Its Peak – Buckle Up, Hodlers! - December 21, 2024

- Chainalysis: $2.2 Billion Lost to Crypto Hacks in 2024 - December 21, 2024

- Bank of Japan leaves interest rate unchanged: Impact on the macroeconomy and the crypto market - December 20, 2024