Table of Contents

The Ethereum Classic Ecosystem

The Ethereum Classic ecosystem mirrors Ethereum’s in many ways, supporting the development and operation of decentralized applications (dApps) and smart contracts. However, ETC’s core mission is to preserve the integrity of the blockchain and uphold the immutability of decentralized systems.

- Smart Contracts and dApps: Like Ethereum, ETC allows developers to create smart contracts—self-executing agreements deployed on the blockchain. These contracts are immutable and run autonomously without third-party intervention.

- Decentralization: Ethereum Classic is committed to decentralized governance with no interference from third parties. All changes must pass through community consensus, and decisions are not made by a central authority.

- Financial Applications: ETC also supports decentralized finance (DeFi) applications, including decentralized exchanges (DEXs), lending platforms, insurance, and other financial products that operate through smart contracts.

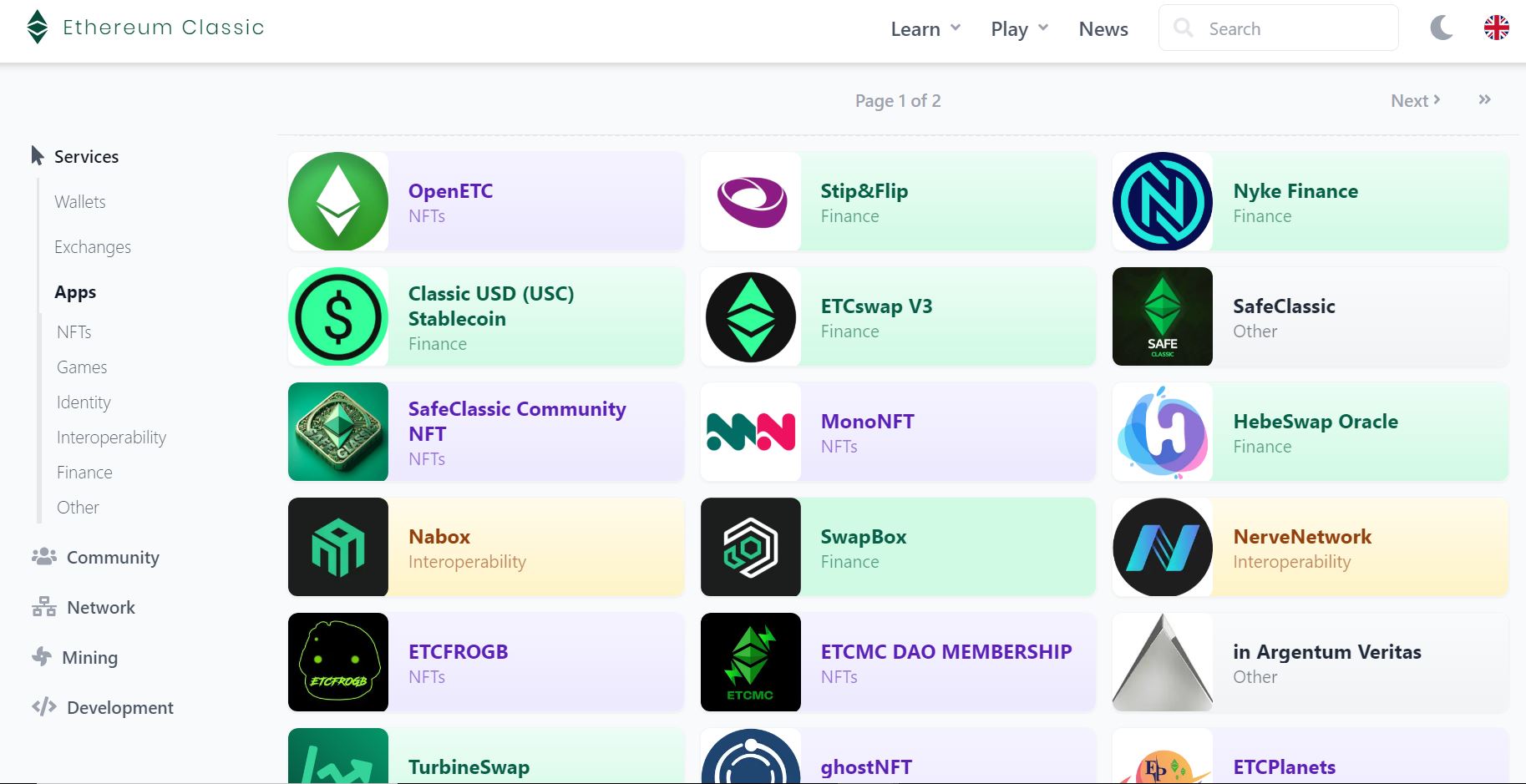

Examples of dApps Running on Ethereum Classic

Several decentralized applications (dApps) are actively running on the Ethereum Classic blockchain, showcasing its potential for innovation and decentralization:

- Ethernode: A platform for managing full node clients on Ethereum Classic, allowing users to easily deploy and manage blockchain nodes.

- TokenMint: This tool makes it easy to create tokens on the Ethereum Classic blockchain without requiring programming skills. Users can develop their own tokens and integrate them into their applications.

- Saturn Network: A decentralized exchange (DEX) that facilitates token trading on the Ethereum Classic blockchain. Saturn allows users to trade directly from their wallets without relying on a centralized exchange.

- ETC Swap: A decentralized cryptocurrency exchange platform that uses smart contracts to execute secure and transparent trades on the ETC blockchain.

These applications represent some of the most active projects on Ethereum Classic, harnessing the power of smart contracts and decentralized solutions. Through its commitment to immutability and decentralized governance, ETC continues to provide a secure and trustworthy platform for dApp development.

Ethereum Classic (ETC) places a strong emphasis on the security and immutability of its blockchain. One of its key characteristics is its refusal to make interventions, like the one that led to the creation of Ethereum (ETH), ensuring that ETC stays true to its original protocol.

Proof of Work (PoW) Mining

Ethereum Classic continues to use the Proof of Work (PoW) consensus mechanism, meaning ETC can be mined using hardware like GPUs and specialized ASIC devices. Unlike Ethereum, which transitioned to Proof of Stake (PoS) with the “The Merge” upgrade, ETC maintains its mineable status through the traditional PoW model.

Use Cases of Ethereum Classic

ETC is primarily used for building decentralized applications (dApps) and creating smart contracts. Some notable use cases include:

- DeFi Applications: Similar to Ethereum, ETC supports decentralized finance applications like lending platforms, exchanges, and insurance.

- Asset Tokenization: Real-world assets such as real estate, gold, or commodities can be tokenized on the ETC blockchain, allowing these tokens to be traded and transferred between users.

- Internet of Things (IoT): ETC also targets the deployment of decentralized systems for IoT, where smart contracts can automate interactions between devices.

- Security Solutions: Due to its immutability, Ethereum Classic is well-suited for security applications, where ensuring that data remains unchanged or tamper-proof is essential.

Price History of Ethereum Classic (ETC) Up to 2024

ETC has had a volatile price history since its creation:

- 2016: After its split from Ethereum, ETC’s price was around $0.60.

- 2017: As the entire crypto market surged, ETC reached a high of approximately $45, driven by growing interest from the community and miners.

- 2018: Following a market-wide downturn, ETC’s price fell back to around $4–5 by the end of the year.

- 2021: A significant surge in 2021 saw ETC peak at around $176, reflecting a bullish phase across the crypto market.

- 2022–2024: After a drop in 2022 due to broader market corrections, ETC’s price stabilized between $20 and $30, with occasional fluctuations.

Price Prediction for Ethereum Classic (ETC) 2024–2030

2024: The price of ETC is expected to range between $30 and $40. This growth will be supported by the Bitcoin halving, increased demand for mining, and the development of decentralized applications. As the cryptocurrency market stabilizes, ETC will solidify its position as a platform for dApps and security applications.

2025: In 2025, ETC’s price could rise to $40–50, driven by increased interest in decentralized finance (DeFi) and the use of smart contracts. The continued mineability of ETC will attract former Ethereum miners, further bolstering demand.

2026: By 2026, a price dip to $20–30 is expected. While the development of dApps, asset tokenization, and applications in the Internet of Things (IoT) will strengthen demand, a bearish post-halving market cycle may lead to a temporary decline. Collaborations with other blockchains will improve interoperability, but prices may still reflect broader market trends.

2027: The forecast for 2027 suggests a price rebound to $30–35. Increasing demand for security solutions and scalable dApps will drive growth. ETC’s immutability will make it a popular choice among corporations and government institutions.

2028: In 2028, ETC’s price could climb to $40–60. A new Bitcoin halving, advancements in IoT, and broader blockchain adoption will fuel growth. ETC may be used to create complex real-world applications, attracting more developers and users.

2029: The price of ETC in 2029 is predicted to range between $100–120. The development of new DeFi tools and collaboration with other blockchains will strengthen ETC’s market position. Improvements in scalability and security will also contribute to price growth, as the cycle approaches its peak post-halving.

2030: By 2030, ETC’s price could reach as high as $150. Ethereum Classic will have established itself as a key player in decentralized applications, smart contracts, and security systems. Continued platform development and innovation will attract further investment and user adoption.

Future Plans for Ethereum Classic

- Scalability Improvements: The ETC development team is focused on enhancing network performance to handle higher transaction volumes, enabling ETC to compete with other blockchain platforms.

- Interoperability: A key goal is improving interoperability with other blockchains, allowing seamless transfer of tokens and data across networks.

- Security Upgrades: Given ETC’s history of attacks, the platform is continually enhancing its security measures to increase its resilience against future threats.

Why Invest in Ethereum Classic?

- Immutability: ETC remains committed to its original vision of an immutable blockchain, making it attractive to investors who value decentralization and security.

- Mining: Unlike Ethereum, which has moved to Proof of Stake (PoS), ETC continues to allow mining via Proof of Work (PoW), making it a compelling option for miners.

- dApp Ecosystem: ETC supports a wide range of decentralized applications, offering future growth potential across industries.

- Future Growth: Planned upgrades and the expanding dApp ecosystem provide strong growth prospects for ETC.

If you’re interested in more technical details and the vision for ETC, it’s recommended to check out the Ethereum Classic whitepaper for further insights.

- Why Online Advertisers Should Request Website Traffic Data from Google Analytics Instead of Using SEO Tools Like MOZ or Ahrefs? - March 24, 2025

- North Carolina’s Bold Move: State Bill Proposes Investing 10% of Public Funds in Bitcoin - March 22, 2025

- Justin Sun Stakes $100 Million in Ethereum on Lido – What Does It Mean for the Market? - March 19, 2025