Table of Contents

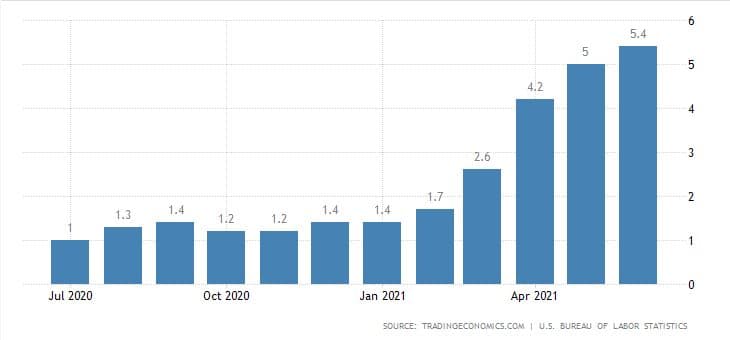

One week has passed since the previous analysis for gold (XAU / USD) and with that comes an important update. Important mainly because it is a few days since the new inflation data for June were published. Inflation reached a record 5.4%. Which is the highest number in the last thirteen years. In fact, the last time inflation was so high was in the 1980s.

Gold and inflation

It has been more than a month since the monstrous decline, which was caused by the then publication economic projections Federal Reserve Bank. Their estimates were quite bearish for gold. In short, they managed to significantly change expectations and investors were forced to react somehow. And unfortunately they responded with massive sales.

In any case, the month is a long time and we mainly obtained data for June, which tell us that inflation continues to rise. Although there is a growth of only 0.4 pp between May and June, it is a growth. It is definitely clear that inflation is not declining for the time being. But will it be enough for gold? As I tried to explain on Thursday, the situation on the markets is enough chaotic, because no one really knows what the Fed will come up with.

It seems to me more and more that the public doesn’t trust them at all, so it is expected inflation (not real) higher. Thus, on the one hand, for gold bullish, the markets are calculating higher inflation, but at the same time it is expected that in the event that inflation is torn from the chain, the Fed will eventually have to intervene in the form of rate reduction. But this is no longer for bull gold, on the contrary.

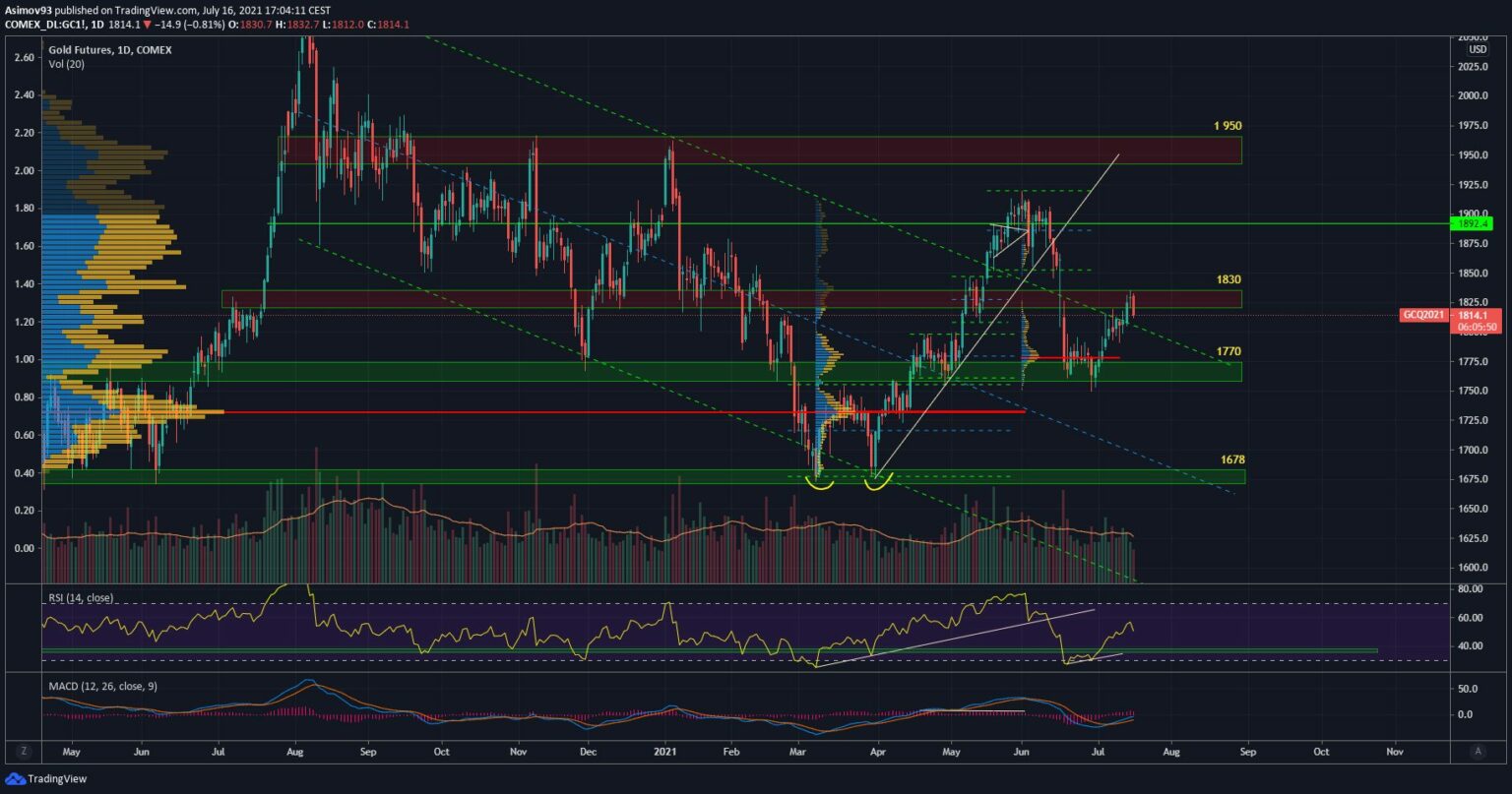

Current situation at 1D TF XAU / USD (gold)

We know from the previous analysis that gold had a reflection and subsequent growth from the S / R level of 1,770 USD / ounce in total uncertain. There were many rejections, but the course was still pushing up, which in itself suggested that inflation expectations remains at a high level. During the week we managed to break through the top wall of the drawn channel, quite sharply and quickly the price rose to another key S / R level of 1,830 USD / ounce.

The process stopped completely at this level, and at the time of writing this analysis (Friday night), the market had fallen off. In order for the yellow metal exchange rate to continue to expand, it is, of course, necessary that the weekly close be at the S / R level of 1,830 USD / ounce. If we close as in the chart, the prospects for continued growth are quite weak.

That 1,830 USD / ounce is really enough strong level, so be it dismissive the reaction was expected. Which does not mean, however, that the market will not be able to pull out yet. If this does not happen, we must take the price reflection as definitive and then the real decline is back after 1,770 USD / ounce. And then we’ll see what comes.

In the event that gold falls below the said band, it will become more likely that we will see an annual low test of USD 1,678 / ounce in the foreseeable future. Of course, there must be a breakthrough of 1,770 USD / ounce first.

Indicators

Based on RSI, according to the evolution of the curve, the momentum up was really decent and the expansion accelerated. However, an obvious break is coming. Then it would mean that the daily RSI did not even reach the limit of 70 points. There was a bullish cross on MACD a few days ago. Take the market signal as an impetus for growth, which has weakened significantly today.

In conclusion

For gold, the current situation is really like Pyrrhic victory. On the one hand, it has yellow metal on its side high inflation, but on the other hand the Federal Reserve declares that inflation is not a problem, because it is only the so-called. transitional. Which in turn pushes gold down.

And if over time it turns out that it is not temporary, theoretically it is for the precious metal good news. But then the Fed is forced raise interest rates, but in return bull for gold is not. Does it seem complicated to you? I’m not surprised, because the described complicated really is. Unfortunately, this makes decision-making in relation to gold very difficult.

ATTENTION: No data in the article is an investment board. Before you invest, do your own research and analysis, you always trade only at your own risk. Cryptheory team strongly recommends individual risk considerations!

- CryptoQuant Analyst: Bitcoin Nowhere Near Its Peak – Buckle Up, Hodlers! - December 21, 2024

- Chainalysis: $2.2 Billion Lost to Crypto Hacks in 2024 - December 21, 2024

- Bank of Japan leaves interest rate unchanged: Impact on the macroeconomy and the crypto market - December 20, 2024