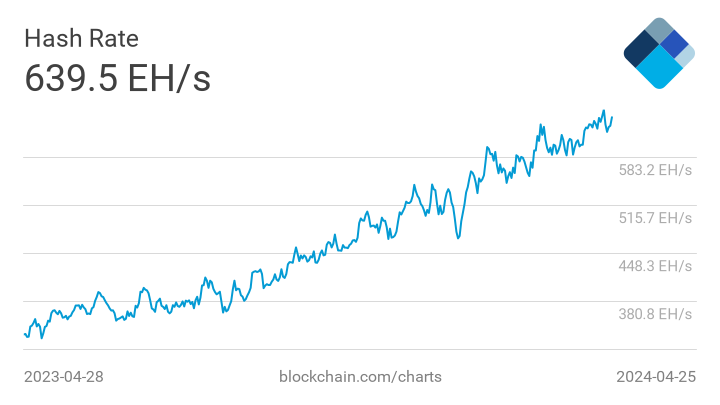

The hashate, or total computing power spent on BTC mining, has apparently rebounded from the bottom and continues to recover significantly. However, it will take some time to return to the levels that preceded the BTC mining ban in China.

BTC Hashrate rebounded from the bottom

According to recent data, the BTC hashrate is at around 105 EH / s. It is significantly more than 58.46 EH / s a month ago, when the hashrate fell sharply after confirming information about the ban on BTC mining in China.

Hashrate secures the entire BTC network against a potential 51% attack and is also a good indicator of the miners’ sentiment towards BTC itself. If the hashrate is growing, it can be easily translated so that their demand for BTC itself is growing (it is advantageous for miners to invest more and more in mining).

Conversely, if the hashrate declines, it is generally a bad signal that miners’ confidence in BTC is declining, as they are reluctant to invest more money in expanding infrastructure and consuming the energy they spend on mining at a given price and sentiment. However, the previous period, despite the fall of the hashrate from historical highs of around 198 EH / s to the mentioned level of around 58 EH / s, was very specific in that the miners did not stop mining voluntarily – those in China, where there were clearly the most, were forced to do so. .

At the same time, the interest of miners in other countries in the world in BTC mining is growing significantly. Yesterday, we informed you that many of them are investing another hundred million dollars in their infrastructure in order to multiply their share in the extraction of the most famous cryptocurrency.

According to data from BTC.com, the trend of increasing hashrate in recent days will lead to the fact that, for the first time after four adjustments of mining difficulty to lower values, the difficulty of mining will increase. The current estimate, based on current data, envisages an increase in difficulty of around 4%. Mining difficulty is adjusted according to the hashrate – if the hashrate decreases, so does the difficulty of mining and vice versa. Thus, like the hashrate, the difficulty of mining has fallen sharply in recent weeks – since its peak, BTC mining is now “easier” by as much as 54%.

“In the short term, we expect the difficulty of mining to increase slowly and gradually for the rest of this year due to the growing hashrate,” means Edward Evenson of Braiins, which operates the Slush Pool.

At the same time, however, Evenson does not expect Chinese miners to be able to resume production in other regions outside mainland China in the coming weeks. Rather, he expects it to be a lengthy process lasting several months. “It will take some time for these machines to turn on and we will return to an all-time high in terms of global hashrate.” he said, adding that the state could do so sometime in the first or second quarter of 2022.

The trend of increasing hashrate is a positive signal, as it underlines that BTC miners believe in long-term growth in the value of BTC. Otherwise, Chinese miners would not seek to re-establish their business in other regions as soon as possible, and mining giants from other parts of the world would not accumulate capital to further develop their key infrastructure.

In the long run, events a few weeks ago may be positive for BTC. Although the hashrate has temporarily declined, China has lost its dominant position in its mining, making it more decentralized.

- Trump Is Holding Off on Buying Bitcoin Until It Drops to $60,000 - March 11, 2025

- Why Technical Analysis in Crypto Is Almost Useless in 2025? - March 10, 2025

- Crypto Expert: “Buy XRP and Wait – Don’t Wait to Buy XRP” - March 10, 2025