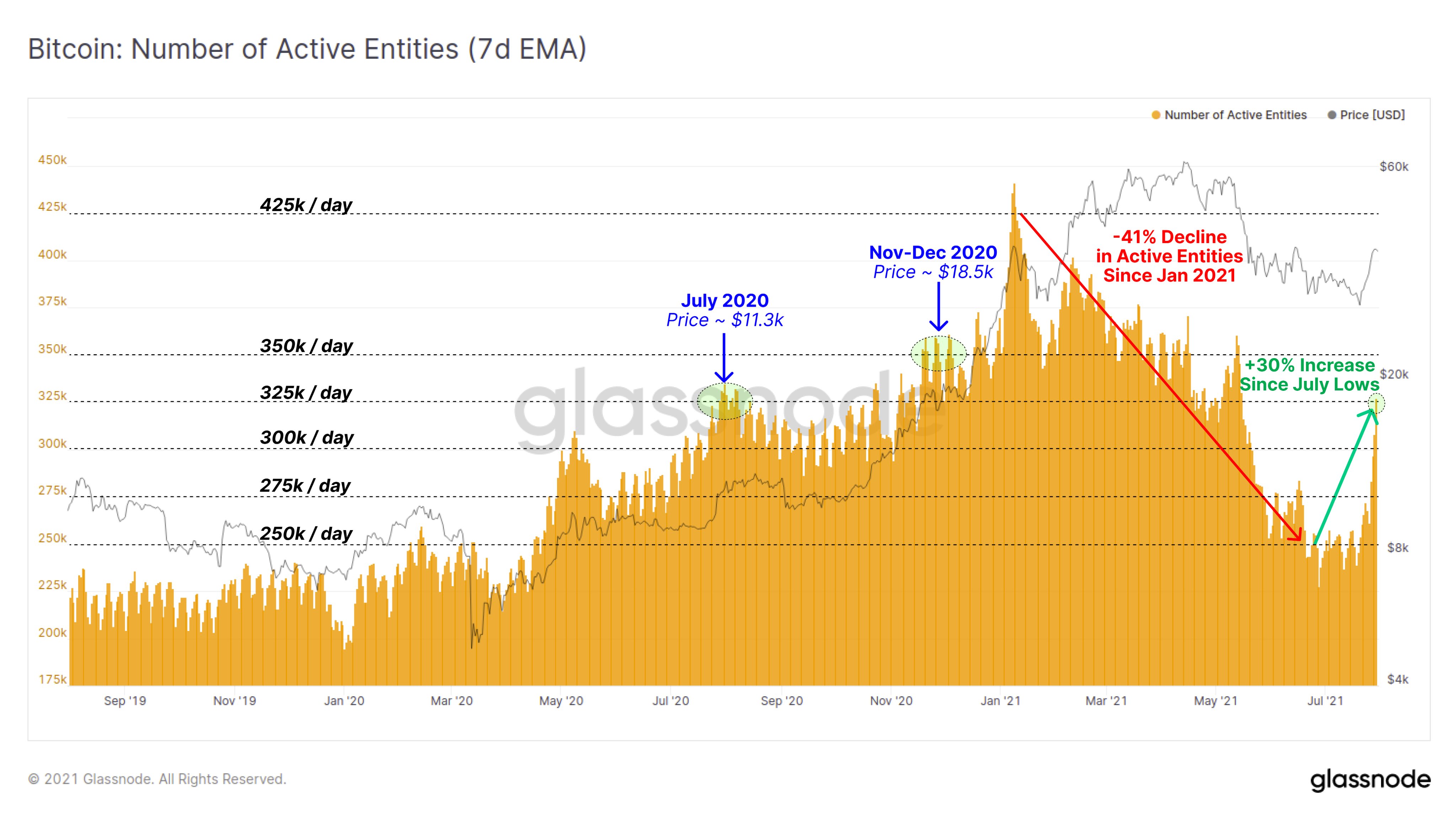

Recent data show that the number of active BTC addresses increased during July by 30%. In addition, the amount of Bitcoins stored at addresses with 100 to 10,000 BTC has increased to an all-time high 9.23 million Bitcoins.

The bullish trend started a renewed interest in BTC

The resumption of BTC growth after the May correction apparently created a better mood among traders and especially hope on the way to a new historical high. Recent data suggest that many new users have entered the cryptocurrency cycle.

With these reports came the popular analytical platform Glassnode. According to the data, the number of active BTC addresses increased significantly in the last week of July. Up to 30% increase from 250,000 to 325,000 active users. Statistics suggest that this is the largest increase since the 41% drop period, which took place from January to early July. At that time, the number of addresses was constantly decreasing from the original ones 425,000 to 245,000.

BTC has seen a resurgence in Active Entities over the past week, rising by 30% from 250k to 325k active entities per day. This degree of activity was sustained in July 2020 when BTC prices were around $ 11.3k in Q2-2020.

Growing accumulation

With further data came the analytical company Santiment, according to which the amount of Bitcoin stored at addresses with 100 to 10,000 BTC is for the first time worth 9.23 million Bitcoins. That’s about $ 364 billion. The previous all-time high was recorded on April 5, just a week before BTC beat $ 64,000.

The latest increase in BTC’s activity comes in a situation where BTC is constantly gaining strength. After Tesla CEO Elon Musk revealed on July 22 that his company SpaceX owns Bitcoins and has no plans to sell them.

“In the last four weeks, these addresses have been collected by over 170,000 BTC. It’s a staggering pace that we could compare to the period at the end of December 2020, just before BTC’s massive rocket rise that began in 2021. At that time, prices skyrocketed from $ 29,000 to $ 40,800.”

- Trump’s inauguration is approaching, but crypto promises may take a while - January 14, 2025

- Fidelity: 2025 will be the year of global Bitcoin adoption - January 14, 2025

- Ethereum: Inflation continues, but bulls continue to target $20,000 - January 14, 2025

![Best Platforms for Copy Trading in [current_date format=Y] 20 Best Platforms for Copy Trading](https://cryptheory.org/wp-content/uploads/2024/12/copy-trading-120x86.jpg)