After two bullish reports, AAVE outperformed large parts of the crypto market. And at Compound, too, things are currently running smoothly. These are the reasons.

The crypto market turned positive again today. The prices of BTC and most of the Altcoins are printing the green candle of the day. This is especially true for tokens from the field of decentralized financial services (DeFi). With a 24-hour plus of 18 percent, Aave, the governance token of the crypto lending protocol of the same name, is the top performer among the top 100 altcoins at the time of going to press.

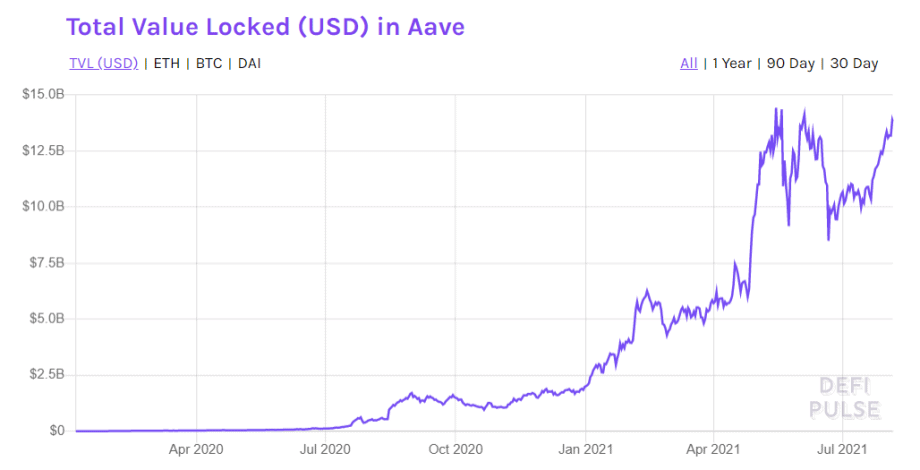

While the Aave rate is still far from its all-time high at USD 661, the USD volume of the assets stored in the DeFi protocol (Total Value Locked, TVL) is already scratching back to the record level of May 15. And that despite the fact that around 2,700 ETH have been withdrawn from the ecosystem since yesterday.

Investors also seem to be cold about the fact that global financial market regulators are increasingly turning their attention to the DeFi sector. The latter also increasingly include crypto hedge funds. This is the result of a study published in May by the “Big Four” auditing company PwC. According to this, crypto hedge funds are mainly invested in BTC and ETH – 92 percent trade BTC, 67 percent ETH; As the only DeFi protocol, Aave was represented in 27 percent of the crypto hedge fund portfolios in the PwC study.

Compound integrates Aave

In addition, the DeFi Protocol Compound announced the integration of AAVE on August 4th. This means that AAVE holders now have the option of storing Aave tokens in Compound. For the provision of liquidity for crypto lending, they in turn receive a reward in the form of cToken (here: cAAVE). cTokens can be exchanged for the respective asset at any time. The Governance Token COMP is also distributed proportionally across the various liquidity pools.

The integration in Compound could further stimulate the demand for Aave. However, it is unlikely that Compound is directly responsible for the current rally. At the time of writing, AAVE tokens worth USD 6,000 have just been deposited in compound – so the liquidity pool is only being set up.

Bitwise launches Aave fund

One day before the compound announcement, Beriets had another report scratching the hooves of Aave cops. The crypto investment company Bitwise launched two new DeFi funds on August 3rd: one for AAVE and one for UNI, the governance token of the decentralized exchange Uniswap.

“Uniswap and Aave are the two largest DeFi protocols in our DeFi index and are the largest decentralized exchange and the largest decentralized credit protocol in the world, respectively. Bitwise’s vision is to make the opportunities that are emerging in the cryptocurrency space more accessible and we are excited to take another step with the world’s first Uniswap and Aave mutual funds,

says Bitwise CIO Matt Hougan in the press release on the new fund quote. The Uniswap course is also currently looking back on a successful week: At the time of going to press, UNI is trading around 20 percent above the previous week’s level. You can find out how to earn money with Uniswap here.

- Solana Price Analysis – December 18, 2024: The Slippery Slope of SOL 🚀📉 - December 18, 2024

- Bitcoin Price Analysis – 16/12/2024: A Dance in the Ascending Channel - December 16, 2024

- What is Monero, Price Predictions for 2025–2030, and Why Invest in XMR? - December 16, 2024