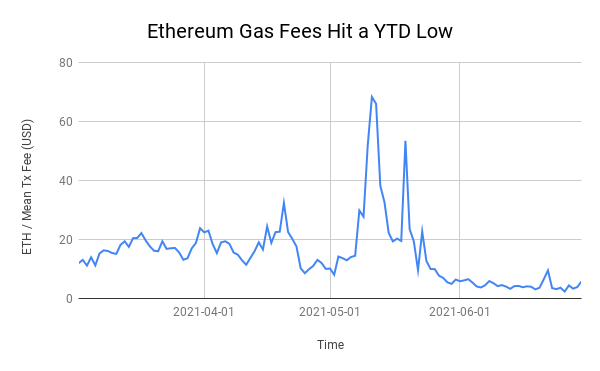

During the first half of this year, the ETH network suffered from disproportionately high transaction fees, which discouraged many people from using the network. The growing interest in cryptocurrency farming also played a significant role in the amount of these fees. Smaller investors were looking for other, cheaper alternatives such as Binance Smart Chain. Today, however, the fees on the ETH network are the lowest in the last year – but is it low enough?

Fees are at an annual minimum

During the first half of this year, charges for the use of the ETH network reached record levels. They reached a peak in May, reaching almost $ 70 per transaction, regardless of size. In some places, however, some transaction fees exceeded $ 100, which was liquidating for smaller investors. From this point of view, ETH was used mainly by whales and wealthier investors, for whom even such fees were negligible.

Currently, however, the situation has changed completely, with fees on the ETH network falling by an incredible 94% in just 2 months, which is one of the steepest drops in transaction fees since 2015. Average transaction fees are currently around $ 4.

Competitors are getting better and better

Although transaction fees on the ETH network are the lowest in the last year, the amount of $ 4 per transfer is still too high compared to competitors. There are a number of competitors that ETH has to face and so far manages this task very well, despite inefficient networks, and ETH is an increasingly sought-after cryptocurrency of large institutional investors, as evidenced by the frequent outflow of ETH from exchanges. This, of course, reduces the offer on the exchange and increases the value.

There are many competitors for the post of king in the field of smart contracts and new projects are constantly appearing that have this bold goal. Below is a comparison of some selected competitors in terms of speed of transactions and costs of their transfer.

ETH currently handles 13 transactions per second at an average price of $ 4 per transfer.

Solana handles up to 50,000 transactions per second, currently 1,814 transactions per second at an average price of $ 0,00025 per transfer.

Elrond reached 263,000 transactions per second on testnet, currently 15,000 transactions per second at an average price of $ 0.001 per transfer.

Polkadot it currently handles up to 3,000 transactions per second, and in the future, thanks to parachains, the theoretical limit is up to 1 million transactions per second, at an average price of $ 0.15 per transfer.

Cardano handles 1,000 transactions per second, and in the future, thanks to the second layer of Hydra, it can be up to 1-2 million transactions per second at an average price of $ 0.23 per transfer

ETH’s competitors are incomparably better in these statistics. It should be noted that ETH 2.0 will increase the transaction limit to 100,000 per second. ETH also recently completed a London hardfork, which will significantly adjust the policy of creating transaction fees. However, this does not necessarily mean their reduction.

Summary

ETH is currently finally usable for smaller investors who cannot afford to pay transaction fees in the amount of tens of dollars on a regular basis. London hardfork will also bring a change in fees, which will make these fees clearer and more transparent. However, the question remains when such acceptable transaction fees on the ETH network will last.

- What Could Bitcoin’s Price Be in 25 Years? A Lambo or Just a Latte?” 🚀💸 - December 23, 2024

- Solana Price Analysis – December 18, 2024: The Slippery Slope of SOL 🚀📉 - December 18, 2024

- Bitcoin Price Analysis – 16/12/2024: A Dance in the Ascending Channel - December 16, 2024