The IMF warns of capital outflows in developing countries and advocates international regulations in the crypto space.

The International Monetary Fund (IMF) has one on October 3rd report on “The Crypto Ecosystem and Challenges of Financial Stability” published. In this report, the IMF looks at the opportunities that cryptocurrencies could create for people in developing and emerging countries. However, the (many) potential risks (“challenges”) quickly overshadow the report. Finally, the institution is calling for the freedom of movement in the crypto space to be curbed, ideally through international regulations that no longer allow taxes to be bypassed.

Technological innovations as a driver of global payments

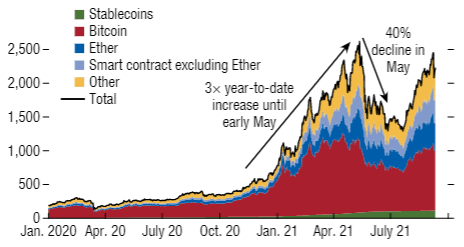

First of all, the IMF recognizes that technological innovations offer the possibility of “cheaper, faster, more accessible” and cross-border financial offerings. He also admits that DeFi has the potential to develop into a platform that can offer “more innovative, more inclusive and more transparent” services. This offer is particularly supported by the increasing adoption of crypto currencies in different areas. To do this, the IMF used market capitalization as a benchmark, which has increased for crypto assets despite the setback in May.

The challenges to financial stability

The committee also sees this as a challenge to financial stability. The IMF assigns developing and emerging countries a special role. On the one hand, they could benefit more from the advantages, on the other hand, the macro-financial risks are greater. The main focus in both cases is on “cryptoization”.

The IMF basically categorizes the following challenges that arise for financial stability in different areas:

| area | challenges |

| Crypto ecosystem | a) Operational, cyber and governance risks (such as system breakdown, hacking / scams, lack of transparency that leads to losses) b) Integrity (of the market and with regard to AML / CFT) c) accessible and trustworthy data d) Cross-border payments |

| Stablecoins | a) How stable are stablecoins? b) Approaches to domestic and global regulation and oversight |

| Macro-Financial | a) Cryptography, Capital flows and restrictions b) Contagion of monetary policy to other countries c) Bank disintermediation |

Note: AML: Anti-Money-Laundering, CFT: Combating the financing of terrorism

So far, the challenges have not yet reached a level at which they would acutely endanger financial stability. Nevertheless, this is to be expected in the future with a further increase in market capitalization.

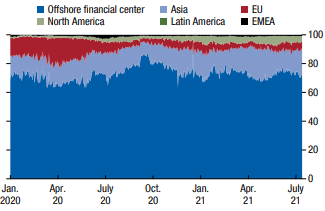

In addition, the IMF defines the large speculative factor as with “meme currencies”, the resulting data holes in on-chain activities and the many actors who operate from “offshore financial centers” as further problems. That means activities by actors who cannot be given an exact location.

Meanwhile, the IMF laments the regulatory authorities’ lack of capacities, skills and technologies. Ultimately, it sounds as if nobody in the world, and certainly not across the board, has had a chance to prevent or limit the establishment of crypto currencies and DeFi.

IMF demands

In order to meet these challenges, the IMF demands some things like: international standards, monitoring, access and standardization of data and own digital central bank currencies (CBDC). Care must be taken that the regulations are proportional to the risks and that the implementation is coordinated internationally. To this end, the IMF is focusing in particular on areas with acute risk such as wallets, stock exchanges and financial institutions. At the same time, it is important that the business does not disappear on non-transparent and difficult to understand platforms. For stablecoins, it is essential that the institutes offering them fulfill and acquire banking licenses.

With a view to the macro-financial risks in particular, the IMF is now calling for “re-dollarization projects” to be put into effect, for national policies to be strengthened and for CBDCs to be introduced. In addition, an offer should be created to enable cross-border payments, with the possibility of traceability by regulators. In addition, one must rethink existing cash flow restrictions.

The IMF is also of the opinion that developing and emerging countries should act more:

In particular, the authorities of the countries where stablecoins are widely used should be encouraged to establish a close coordination mechanism with the authorities where the stablecoin reserves are managed.

IMF, p.55

- CryptoQuant Analyst: Bitcoin Nowhere Near Its Peak – Buckle Up, Hodlers! - December 21, 2024

- Chainalysis: $2.2 Billion Lost to Crypto Hacks in 2024 - December 21, 2024

- Bank of Japan leaves interest rate unchanged: Impact on the macroeconomy and the crypto market - December 20, 2024