One can only speculate as to why Satoshi chose the number 21 million BTC. One possible explanation is the meme number 42 (from Douglas Adams’ The Hitchhiker’s Guide to the Galaxy, of course) half of which is 21. However, it could also have been pure arbitrariness that prompted the anonymous BTC father Satoshi Nakamoto to limit his digital peer-to-peer cash system to 21 million units.

Although they have led to some speculation, the motives are ultimately irrelevant. The only important thing is that there is this upper limit of 21 million BTC. Because with BTC, humanity has an asset at hand for the first time, the supply of which is finite.

One can say it so clearly: the invention of digital scarcity is nothing less than an innovation of the millennium. There are goods that are also scarce. Naturally limited commodities such as gold or oil are examples of this. But if you expand your perspective beyond the borders of planet earth, suddenly the yellow precious metal is no longer rare at all. There can only be absolute scarcity in the digital space. But creating absolute digital scarcity is no easy task. On the contrary.

The social layer enforces the limit

Because BTC is only limited to 21 million coins because the network participants agree on it. The original Satoshi code provides the limit.

But code can be changed. Therefore, in the end, it is not the code that is decisive for BTC, but the social consensus on which the system is based. Because 21 million BTC are ultimately just the rules of the game that Bitcoiners have agreed on. There would be no problem creating a coin, such as a hard fork, with supply capped at 20 million or less. However, this does not automatically make this coin scarcer in the actual sense of the word, since the players are missing.

The chess game analogy is therefore popular among Bitcoiners. You can change the rules of chess. But what is missing are the players. Chess is a game that has matured socially over centuries, and its cultural significance is unique. Nobody would think of implementing a new set of rules.

The analogy is also good because it shows how long social consensus building actually takes. Chess, for example, has been established in Europe since the early 13th century – in Asia and Persia its tradition is probably much older.

Compared to that, BTC is still in its infancy. The digital gold is only 13 years old – and has come a long way for that time.

Limiting the ceiling is only worth as much as the social class that enforces it. And this aspect is crucial.

A maximalist rampart

Bitcoiners can use a full node to actively decide which protocol rules they want to follow. Hence the saying “Don’t trust, verify!“. There are 21 million BTC precisely because bitcoiners chose to install the very software that sets the limit. This aspect of decentralized control is particularly important when it comes to money. Finally, history has shown that the monopoly on the creation of money always has led to taking advantage or inflation. Controlling the faucet of money is too enticing a tool to leave untouched.

It is precisely this social protective layer that Bitcoiners form around their favorite money that is repeatedly decried as “toxic maximalism” on social media. The operation of full nodes and the content-related defense of BTC is exactly what gives digital gold its value. Michael Saylor agrees:

I don’t want to hear you get mad about transaction fees and want to roll out smart contracts and change everything. […] I want to hear you will defend the network to the death against anyone who wants to break it or compromise it in any way,

let Saylor quote in the interview with Pomp.

And that’s exactly what it is: BTC is limited to 21 million coins because there is a critical mass of Bitcoiners who want exactly that and express their will through full nodes. It is also this aspect of decentralization that makes BTC perhaps the best store of value in human history.

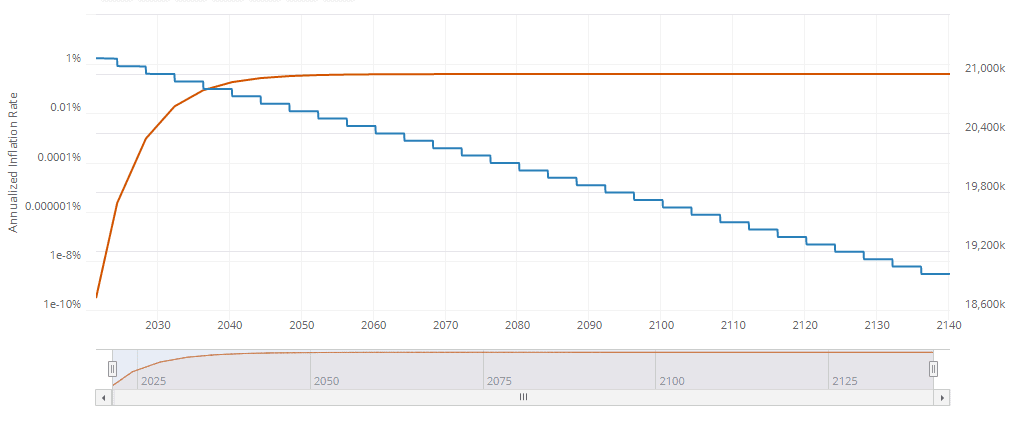

By the way: After the last BTC has been mined, it’s not all over. You can find out here how the cryptocurrency No. 1 will continue after the year 2140.

- CryptoQuant Analyst: Bitcoin Nowhere Near Its Peak – Buckle Up, Hodlers! - December 21, 2024

- Chainalysis: $2.2 Billion Lost to Crypto Hacks in 2024 - December 21, 2024

- Bank of Japan leaves interest rate unchanged: Impact on the macroeconomy and the crypto market - December 20, 2024