Table of Contents

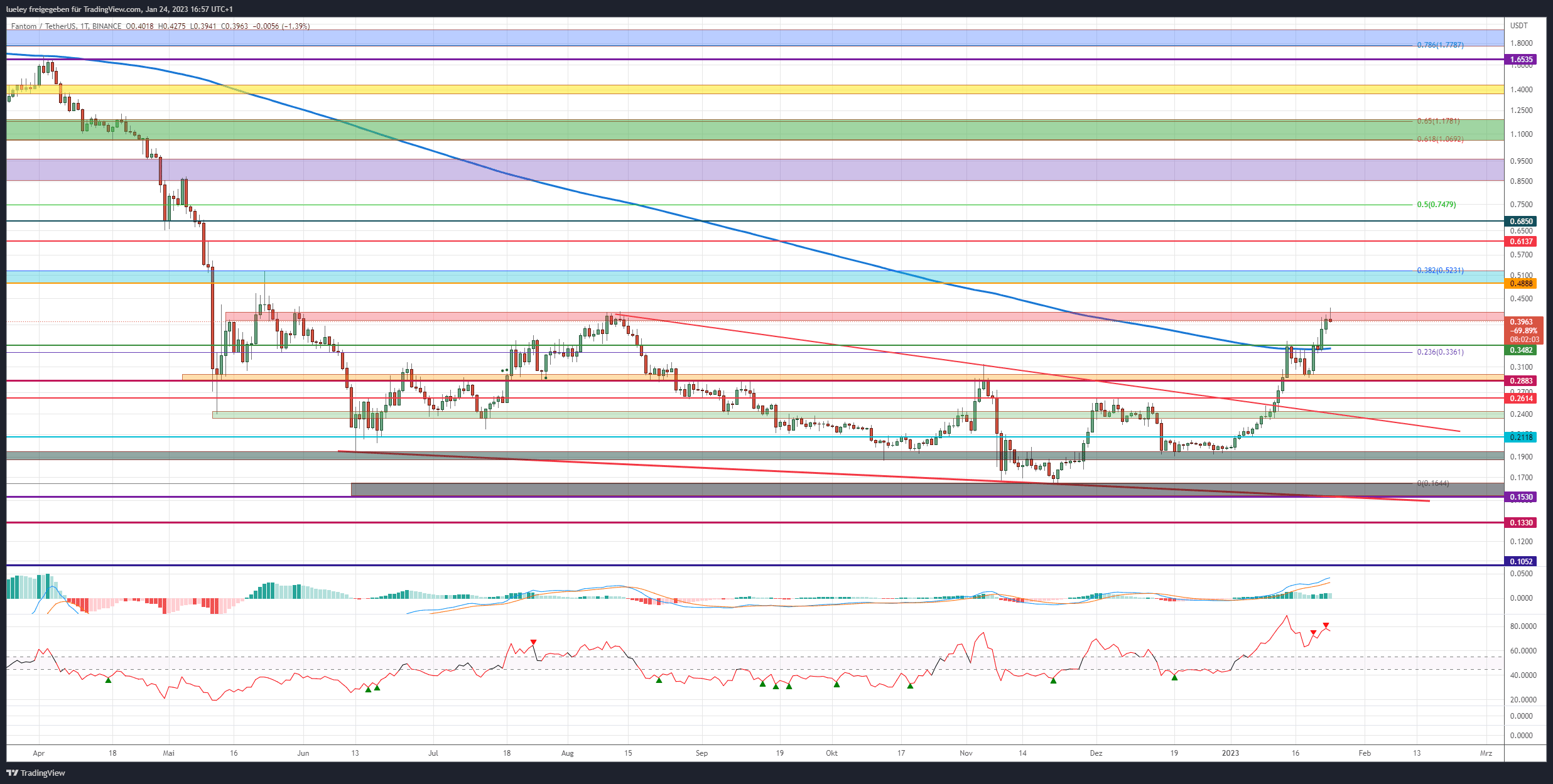

Since the beginning of the year, Fantom’s course has only known one direction: north. The bullish price breakout from the wedge formation on January 12th caused investors to invest more in the coin of the layer 1 blockchain. In a weekly comparison, the FTM price can increase by around 30 percentage points to the important resistance level at 0.40 US dollars. Fantom has gained 160 percent in value since the trend low in November. Fantom last had this “Ecosystem Vault” was launched to support new blockchain projects in the future. For this purpose, ten percent of the Fantom transaction fees are to be withheld and distributed to the developers. As soon as the FTM price can stabilize above the resist level at $0.40, investors will focus on the next relevant target range between $0.48 and $0.52. Only a sustained abandonment of the support mark at 0.33 US dollars would cloud the chart image again in favor of the bears.

Bullish price targets: $0.49/0.52, $0.61, $0.68, $0.75, $0.85, $0.96, $1.07/1.17, 1.36/1.44 $1.65

Fantom: Bullish price targets for the coming months

After rallying into the red resistance zone around $0.40 on Tuesday (Jan 24), investors have been taking profits for the past few hours. After the recent bullish price rally, this is not surprising. As long as the FTM price stabilizes briefly above the EMA200 (blue) around 0.35 US dollars, further attempts to break out above today’s high for the day are to be planned. A breakout will activate the next relevant target zone between $0.49 and $0.52. Fantom last failed here in May 2022. In addition, the higher-level 38 Fibonacci retracement runs in this area. If the FTM course breaks through the upper edge of the turquoise zone, the upward movement initially extends to US$ 0.61. A march through to the tear-off edge at 0.68 US dollars would also be conceivable. Here one should plan with strong resistance from the bears.

The chart picture is getting brighter and brighter

If Fantom can also pulverize this price mark in the medium term and also leave the 50 Fibonacci retracement at USD 0.75 behind, the purple resist zone will come into the eyes of investors. In the area between 0.85 and 0.96 US dollars, a price setback is to be expected in the first attempt. In order to aim for the maximum conceivable target area in the form of the Golden Pocket, Fantom must first break out dynamically above the US$ 0.96 mark. If the bulls manage to rise to $1.07, the next important price target would be completed. Significant profit-taking should be planned here. Only when the Bitcoin price can rise in the direction of US$ 30,000 is a rise above the yellow resistance area between US$ 1.36 and US$ 1.44 conceivable for Fantom. Only then would the way be clear for a march through to the maximum long-term price target of 1.65 US dollars.

Bearish price targets: $0.35, $0.29, $0.26, $0.24, $0.21, $0.19, $0.16/0.15, $0.13

Fantom: Bearish price targets for the coming months

If the bears manage to cap the FTM price in the red resistance zone around USD 0.40 and send Fantom into a consolidation, the strong cross-support from EMA200 and the horizontal line will come into focus first. The bulls are likely to push the course north again here. Only when Fantom falls below the 23 Fibonacci retracement at the end of the day can a retest of the orange support area around USD 0.29 be expected. If a double bottom forms at this price mark, the buyer camp could also plan a new attempt to rise here. On the other hand, a sustained abandonment of this zone would increasingly cloud the chart picture. A retracement to $0.26 should be planned for. If this horizontal support does not hold either, the cross support from the downtrend line and the green support area will be retested at $0.24.

Directional decision to be expected

In the medium term, this zone should decide whether Fantom can dip towards and below its yearly lows again or whether the bulls can muster enough strength to prevent a sell-off. If the bears also push the price below this chart area, the correction initially extends to $0.21. If this mark is ignored, a retest of the December 2022 lows is likely. Around $0.19, the bulls were there several times last year. A counter-movement must therefore be planned for. If, on the other hand, there are sensitive sell-offs on the overall market and Bitcoin slips towards the low of the previous year, Fantom should also target its low from November at 0.16 US dollars. Again, there is a good risk-reward ratio for a recovery move between the gray support area. Further sell-offs down to 0.13 or a maximum of 0.10 US dollars could no longer be ruled out until the FTM price dropped the US$ 0.15 mark at the end of the day.

Looking at the indicators, a first consolidation after the clear increase of the previous days should not come as a surprise. The RSI indicator is trading in the overbought territory and is also showing a bearish divergence. Overall, however, the MACD still offers room for further increases in the coming trading weeks.

- CryptoQuant Analyst: Bitcoin Nowhere Near Its Peak – Buckle Up, Hodlers! - December 21, 2024

- Chainalysis: $2.2 Billion Lost to Crypto Hacks in 2024 - December 21, 2024

- Bank of Japan leaves interest rate unchanged: Impact on the macroeconomy and the crypto market - December 20, 2024