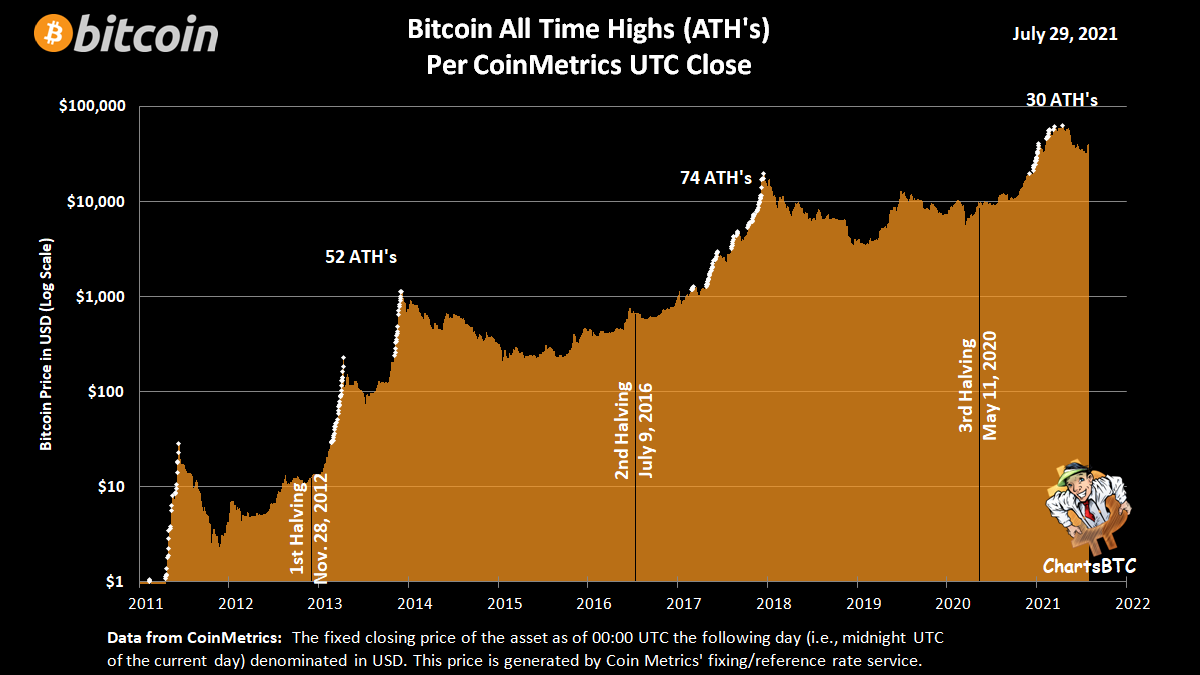

Analysts say BTC is preparing for a return that should lead it to repetition of the classic bull years of 2013 and 2017. When the high of $ 42,600 appeared on July 31, market forecasts are turning back to rising supercycle“.

BTC’s price action instead of a serious drop maintained its profits, which at the time of writing accounted for 23% per week.

“After a disturbing three months of news and price falls, it continued BTC in five green moon candles in a row. It increased approximately 10-fold in the second half of 2013, “ said Jeff Ross, founder and CEO of Vailshire Capital.

Thanks to its latest increase in the meantime BTC / USD broke its 21-week exponential moving average, which analyst Rekt Capital called a “bull market indicator”.

The number of illiquid BTCs is growing

Although Ross added that such a forecast is “just an estimate”, he has an increasing number of indicators. After reaching 83 EH / s, the hash rate is again above 100 exahashes per second (EH / s). The difficulty also saw the first positive signs since the May price crash.

“BTC is very high,” said Lex Moskovski, investment director of Moskovski Capital, next to Glassnode’s accompanying chart. The chart shows an increase in the number of illiquid Bitcoins. BTC accumulation so it goes on and few traders are willing to sell.

- CryptoQuant Analyst: Bitcoin Nowhere Near Its Peak – Buckle Up, Hodlers! - December 21, 2024

- Chainalysis: $2.2 Billion Lost to Crypto Hacks in 2024 - December 21, 2024

- Bank of Japan leaves interest rate unchanged: Impact on the macroeconomy and the crypto market - December 20, 2024