Bitcoin underwent its much-anticipated third block reward halving recently. While many in the community hoped for better price action in the months that led to the halving, Bitcoin’s price action since the halving has been fairly reassuring. In the months and days that led to the halving, for most stakeholders like miners within the Bitcoin ecosystem, levels of anticipation were certainly high.

On the latest episode of the Unqualified Opinions podcast, popular Bitcoin advocate Charlie Shrem spoke about the Bitcoin landscape, the impact of the halving, and the miner ecosystem that drives the network. Shrem highlighted that for large scale mining operations like the ones that drive the Bitcoin network, overarching narratives are extremely crucial, right from their funding to their business models.

However, in the case of Bitcoin, the fact that many mining pools are located in parts of China that offer extremely cheap electricity has raised concerns regarding the coin’s decentralized nature. Shrem added,

“It does scare me because consolidation in the mining world is a fear, especially when you have a few different companies. So like a fear is, for example, you have a few different mining companies only.”

Regarding the growth of monopolies and low levels of decentralization, Shrem added,

“And these companies eventually create like an association and a working group, and then these mining organizations decide to create like a self-regulatory organization. And then the next step is like blacklists and basically coins and addresses that they don’t want to accept. When that happens, Bitcoin is over and the miners know that.”

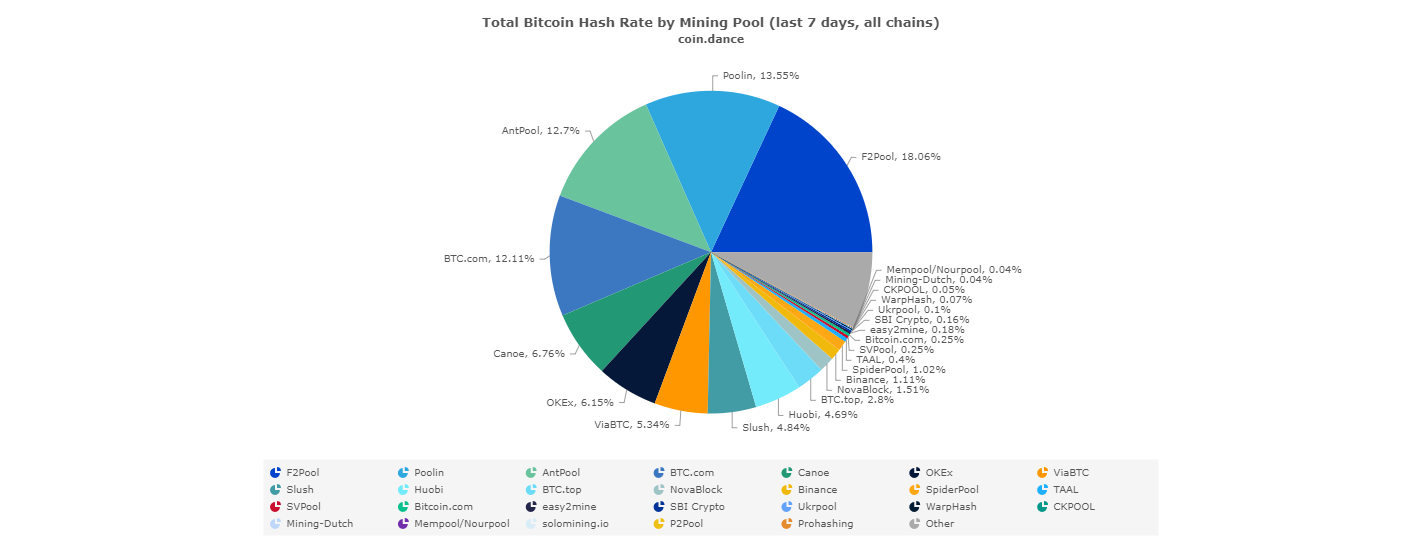

Source: Coin.Dance

Network data from the past 7-days with regard to the hash rate generated highlights the presence of strong pools that tend to dominate the Bitcoin network. While this doesn’t really translate into the absence of decentralization, various concerns have been raised regarding the location these pools are based out of, the answer to which is usually China.

Shrem, however, believes that the concept of a pool of miners also brings in benefits for the network. Shrem added that mining pools do add a strong level of efficiency to the mining operation and the network. He argued,

“There were times that mining pools and there still are, get 30-40% of the, uh, network hash rate, but that’s okay for two reasons. One, it brings about efficiency. So you’re bringing about, now all these miners are head to head with their margins…they’ll do R&D and create more efficient chips, efficient computer systems that’ll mine more efficiently and it’ll be more secure for a Bitcoin.”

You should be interested in: Award-Winning Filmmaker Torsten Hoffmann Launches Bitcoin Documentary Cryptopia

- Michaël van de Poppe: Bitcoin to Hit $500,000 This Cycle? 🚀💸 Or Just Another Crypto Fairy Tale? - December 21, 2024

- What is the Meme Coin Bonk, Price Predictions 2025–2030, and Why Invest in BONK? - December 18, 2024

- BNB Price Analysis: 17/12/2024 – To the Moon or Stuck on a Layover? - December 17, 2024