Table of Contents

On July 3, the Chinese government announced known to subject the export of gallium and germanium to increased controls. In the future, export will require a license. Gallium and germanium are important metals in the production of semiconductors, transistors, lasers and other electronic components. Above all, manufacturers of microchips are dependent on them. Meanwhile, the artificial intelligence boom increases the demand for high-performance chips and intensifies the international struggle to manufacture, develop and trade semiconductor products.

USA and China: competition in the tech sector

According to the China Chamber of Commerce statement, the new rule will come into effect on August 1. Exporting without a permit is then a punishable offense. The Department of Commerce justifies the action with the protection of national security. US politicians argued similarly last fall when they decided to impose new sanctions on China in the chip industry. They denied China access to certain semiconductor products. These include Nvidia’s powerful A100 chips and the latest version, the H100.

Artificial intelligence is exacerbating the situation

According to media reports, the US Department of Commerce is now also considering tightening export regulations. Especially for special chips that are used when using artificial intelligence. When it comes to developing these chips, the USA is ahead of the game. However, China owns most of the rare earth elements needed for manufacturing. According to the daily News China produces 95 percent of the world’s gallium and 67 percent of germanium.

Artificial Intelligence: A threat to Bitcoin?

While developed countries are vying for dominance in the tech industry, the question for the crypto industry is whether the increasing demand for chips poses a threat to the mining sector. Crypto miners also need powerful chips for their hardware. Other sectors, such as the automotive or solar industry, also require these components. The chip manufacturers optimize their products for the most promising sectors.

Not all chips are the same and not all contain the same raw materials. Mining chips don’t lend themselves as well to AI support and vice versa. Nvidia, for example, only announced this year that it would withdraw from the crypto sector and focus more on developing AI chips.

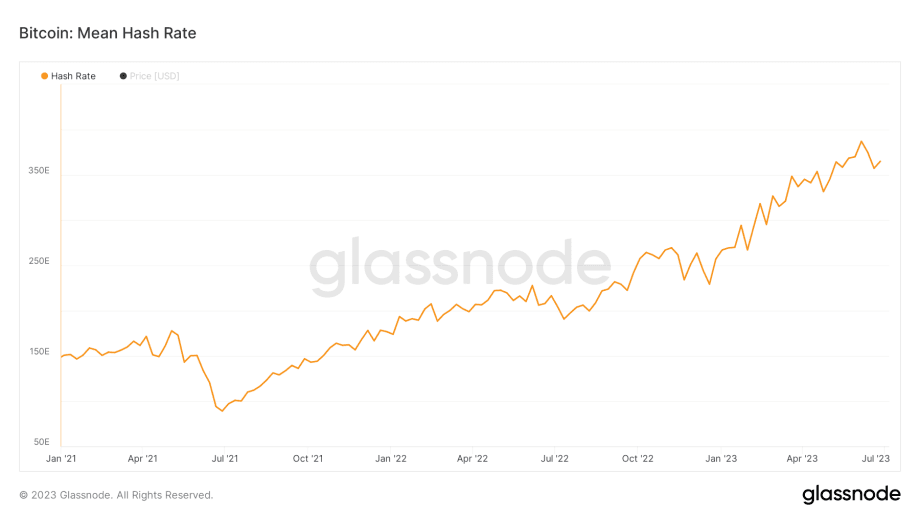

Despite this, Bitcoin has not lost any of its computing power. A look at the hash rate shows that the network continues to develop unimpressed.

Jack Dorsey enters the mining business

Just days after Intel’s news, Twitter founder and Bitcoin proponent Jack Dorsey announced plans for the mining sector. With his company The Block he wants to build mining devices. The fintech announced that it had purchased “large quantities” of chips from Intel. The Block also builds its own chips. However, until the development is complete, the company will use Intel products. By manufacturing its own devices, the fintech wants to counteract the centralization of the supply of Bitcoin mining ASICs. The market is currently dominated by two major providers, Bitmain and MicroBT.

How banks use artificial intelligence in risk management

- Michaël van de Poppe: Bitcoin to Hit $500,000 This Cycle? 🚀💸 Or Just Another Crypto Fairy Tale? - December 21, 2024

- What is the Meme Coin Bonk, Price Predictions 2025–2030, and Why Invest in BONK? - December 18, 2024

- BNB Price Analysis: 17/12/2024 – To the Moon or Stuck on a Layover? - December 17, 2024