According to Eric Balchunas, ETF’s chief analyst for Bloomberg, the BTC futures ETF could have a 75% chance of being approved in the US by the end of October.

Legislation for BTC futures ETF

Balchunas points out that ETFs based directly on BTC, ie physically secured, they comply with the 1933 law, while the futures ETFs comply with the 1940 law. He commented that the new SEC president Gary Gensler favors the latter option.

He concluded that the approval process was in full swing and that they could be approved as planned. October is the month in which the SEC is expected to decide to approve and Balchunas sees a 75% chance of this happening.

In August, Galaxy Digital sent the SEC a request for ETF approval based on BTC futures after Gary Gensler himself stated that the agency would be more likely to approve ETFs that would not be supported directly by BTC but by BTC futures contracts.

Last week, Gensler reiterated that the SEC’s position is more tolerant of such applications.

“We have begun handling applications under the Investment Companies Act for exchange traded funds (ETFs) seeking to invest in CME-traded BTC futures,” he said at a talk at the Future of Asset Management North America conference. “In combination with other federal securities laws, the 40 Act provides greater protection for investors in investment funds and ETFs. I look forward to hearing and reviewing these submissions. ”

Thus, a key issue could be the Investment Companies Act 1940, the rules of which would provide greater protection than the Securities Act 1933.

The SEC has never concealed the fact that one of the main problems it sees in approving the BTC ETF is the lack of protection for investors, especially retail investors. ETFs based on physical BTCs would fall under the Securities Act of 1933, which provides less protection, while ETFs based on futures would fall under the Investment Companies Act, 1940, which provides greater protection.

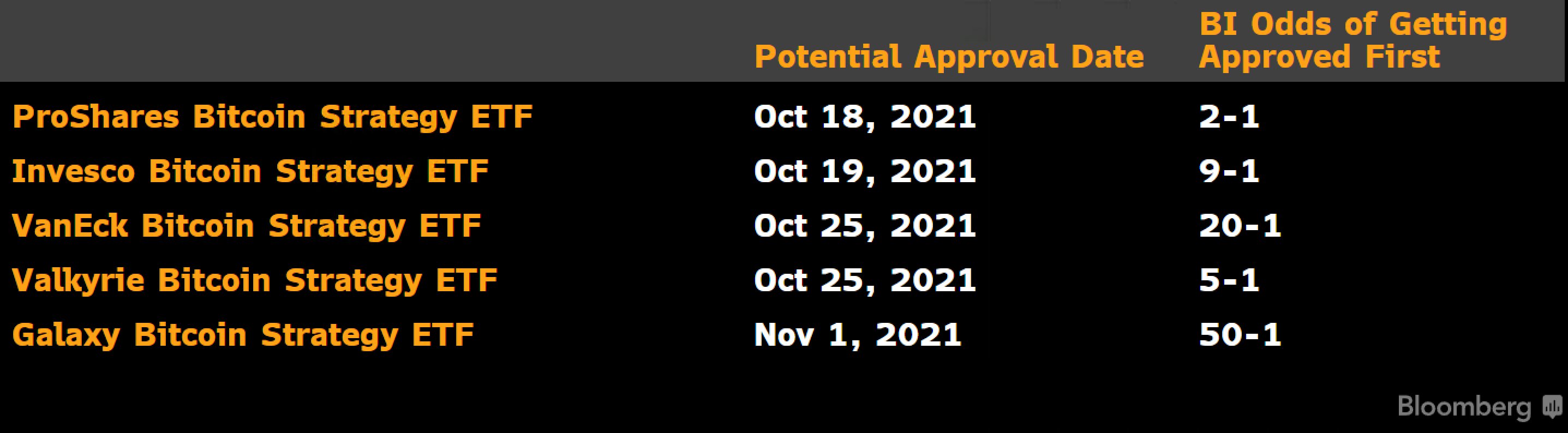

For this reason, the SEC has minor problems approving ETFs based on BTC futures, which could favor Galaxy Digital applications or other similar applications submitted by VanEck. According to Balchunas, the first ETF for BTC futures to be approved may be ProShares, which the SEC is expected to decide in October.

AMP Price Prediction 2021-2032

- CryptoQuant Analyst: Bitcoin Nowhere Near Its Peak – Buckle Up, Hodlers! - December 21, 2024

- Chainalysis: $2.2 Billion Lost to Crypto Hacks in 2024 - December 21, 2024

- Bank of Japan leaves interest rate unchanged: Impact on the macroeconomy and the crypto market - December 20, 2024

![Best Platforms for Copy Trading in [current_date format=Y] 21 Best Platforms for Copy Trading](https://cryptheory.org/wp-content/uploads/2024/12/copy-trading-120x86.jpg)