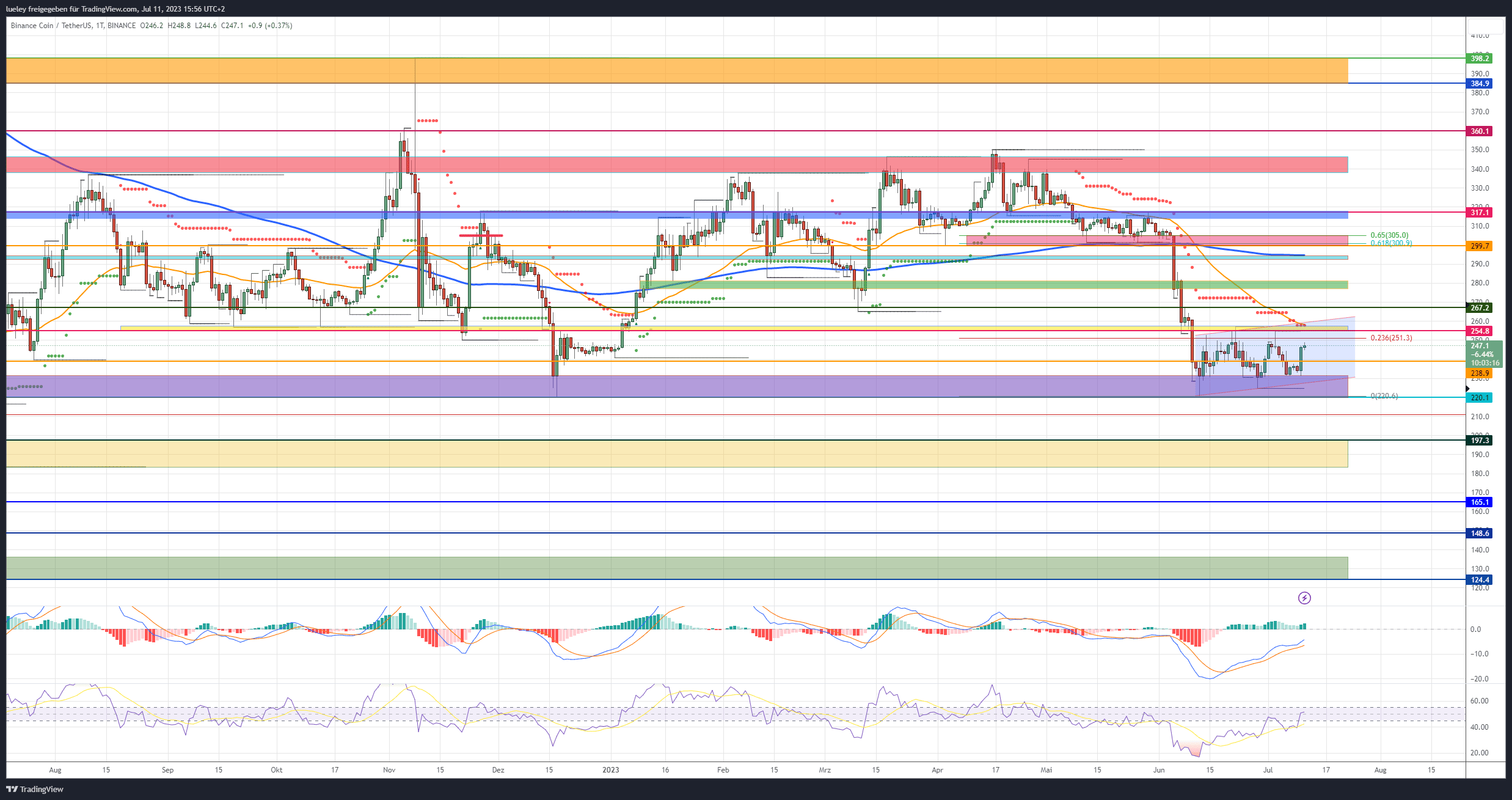

Despite the recent bad news about the departure of several executives from the Binance crypto exchange, the in-house Binance Coin (BNB) has been able to stabilize above the important support area between 231 and 220 USD for the time being. At the beginning of the week, the BNB price tended to be around six percentage points firmer at currently 246 US dollars. One reason can be seen in the announcement of the new token sale on the Binance Launchpad. The cryptanalysis company Arkham Research launches its ARKM token exclusively on Binance on July 17th. In order to be eligible for the token sale, interested investors have been able to have their BNB coins blocked for the Arkham Launchpad sale for a few hours. In the past, this procedure has already led to increased demand for BNB tokens while the pressure to sell has decreased at the same time.

It remains to be seen whether yesterday’s price movement will only be short-lived or whether it will ensure sustained price stabilization. Despite the recent recovery, the chart picture looks uncertain amid possible further regulatory issues for the largest crypto exchange. From a technical point of view, the price of the Binance Coin must first recapture the yellow resistance area around 254 US dollars in order to ban the risk of another sell-off. A dip below the 239 USD chart level would bring the purple support zone surrounding the lows of the last few weeks back into focus.

BNB: Bullish price targets for the coming weeks

Bullish price targets:254 USD/259 USD, 267 USD, 276 USD/281 USD, 293 USD, 301 USD, 314 USD/317 USD, 338 USD/346 USD

In the past few weeks, the buyer side has managed to prevent another sell-off to the low for the year at 220 US dollars. Despite this resistance, BNB price remains unchanged in a bearish flag formation. The danger of a further sell-off in the coming weeks would only be averted with a dynamic price breakout above the multiple resistance from EMA50 (orange), supertrend and the upper edge of the flag at 257 US dollars. If the bulls succeed in recapturing this area and the BNB price can then recapture the horizontal resistance level at 267 US dollars, a follow-up movement in the direction of the green resist zone is possible.

If the Binance Coin then jumps further north above the USD 281 mark, there will be a short-term preliminary decision at USD 293. The EMA200 (blue) is currently running in the turquoise zone. A breakout above this should lead the BNB price to the old tear-off edge at US$ 301. This is also where the golden pocket of the current recovery movement runs. A price bounce to the south seems likely due to the uncertainty surrounding Binance. If, contrary to expectations, the bulls succeed in a dynamic recapture, a subsequent recovery towards the last highs around 317 USD would be conceivable.

The BNB price was unable to overcome this chart mark several times in May. Only if the blue resist zone can be sustainably breached would an upward movement in the direction of the yearly highs between USD 338 and USD 346 be considered.

BNB: Bearish price targets for the coming weeks

Bearish price targets: 239 USD, 231 USD/220 USD, 211 USD, 197 USD/183 USD, 165 USD, 148 USD/124 USD

As long as the bears can cap the BNB price below the yellow resist zone and thus avert a breakout of the flag, a price pullback must be planned at any time. A drop below the support at 239 USD would already significantly increase the probability of a sell-off towards 231 US dollars.

This endorsement mark must not be abandoned by the buyer side. Otherwise, a retest of the low for the year at 220 US dollars threatens. Should the course mark of 220 US dollars be undershot, the possible threatens Liquidation of a 150 USD million position price carnage in the Venus Lending protocol.

As a result, Binance Coin is likely to break straight into the next target range between 197 and 183 USD. Although a technical counter-reaction is to be planned here, the probability of an expansion of the correction would increase significantly in the coming months of trading. If the BNB price also gives up 165 USD in the medium term, the Binance Coin could fall back to the support area between 148 and 124 USD.

Looking at the indicators

In the 4-hour chart, the RSI indicator was able to generate a buy-signal recently, but with a value of 69 it is not far from an overbought state. The RSI was also able to recover to the neutral zone between 45 and 55 in the daily chart. Although the MACD indicator is currently showing a slight buy signal, it is still trading below its 0 line. In the weekly chart, both indicators also show slight stabilization tendencies, but continue to trade in bearish territory.

Glassnode is a leading blockchain data and intelligence platform. Offering the most comprehensive library of on-chain and financial metrics, they provide a holistic and contextual view of crypto markets through understandable and actionable insights.

The data and statistics provided by Glassnode are trusted by the world’s leading investors, hedge funds, banks, asset managers and crypto companies.

- Michaël van de Poppe: Bitcoin to Hit $500,000 This Cycle? 🚀💸 Or Just Another Crypto Fairy Tale? - December 21, 2024

- What is the Meme Coin Bonk, Price Predictions 2025–2030, and Why Invest in BONK? - December 18, 2024

- BNB Price Analysis: 17/12/2024 – To the Moon or Stuck on a Layover? - December 17, 2024