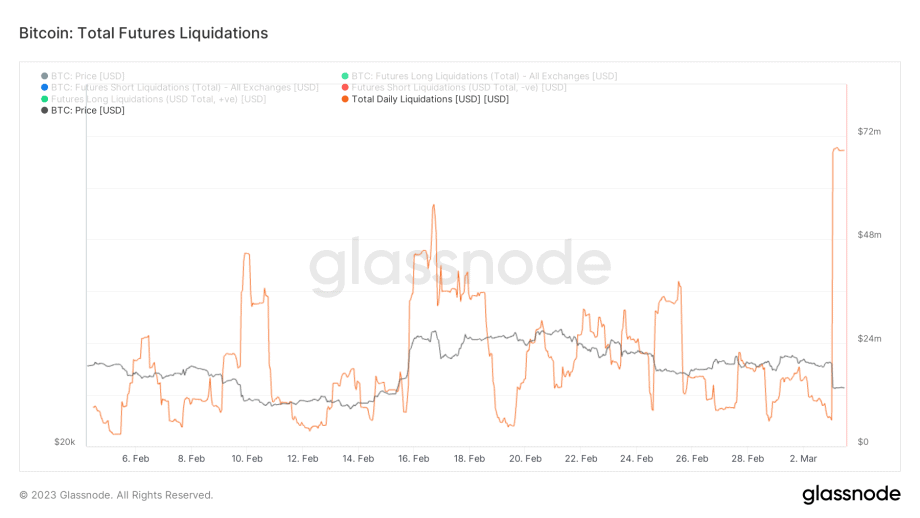

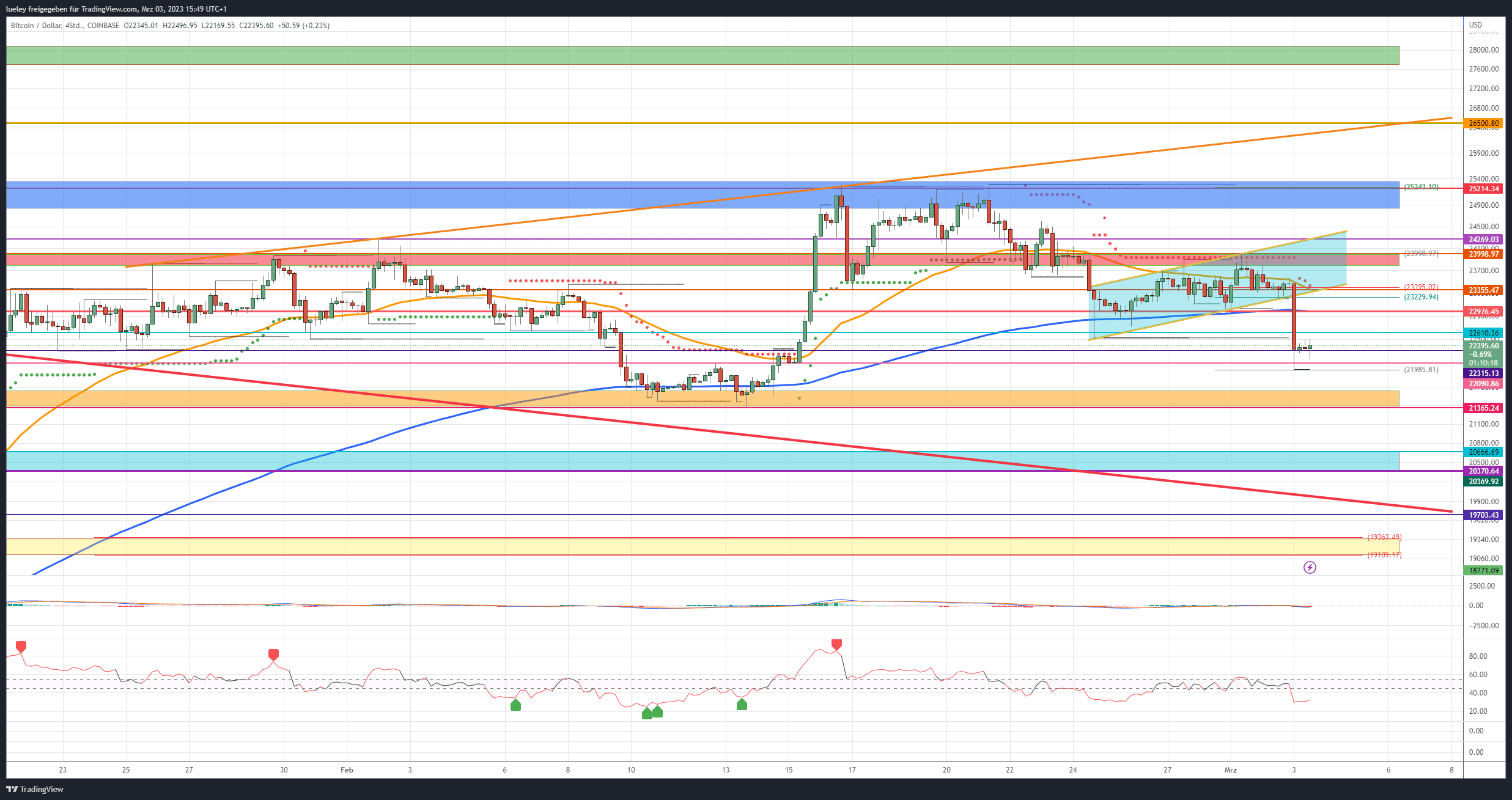

In the early hours of the yesterday’s morning, the Bitcoin price slipped significantly south to 21,988 USD within a very short time. In the last 24 hours of trading, the key crypto currency has tended to be 4.2 percent weaker. This confirmed the forecast of the previous Bitcoin analysis, according to which the Bitcoin course was about to make a directional decision. March 3rd, meanwhile, marks the biggest bitcoin sell-off so far this year. BTC long positions worth over 60 million USD were liquidated in a matter of hours. Within the last 12 months, this liquidation cascade was the third of its kind after the Terra crash and the FTX bankruptcy in 2022. The much-discussed bearish divergence in combination with continued strength of the US dollar index DXY and the new revelations about the US -cryptobank Silvergate (SI) also triggered the bearish dissolution of the flag formation from the last price analysis.

Yesterday’s liquidation cascade was the third of its kind in the past 12 months, following the Terra crash and the FTX bankruptcy in 2022. Despite the negative news, Bitcoin is likely to stage a near-term recovery as the cryptocurrency is significantly oversold. Negative funding rates are currently giving the buyer camp a high incentive for a new entry into Bitcoin. A temporary price recovery in the direction of 23,367 US dollars is therefore conceivable. The positive signs on the US stock market in the early afternoon underscore this scenario. However, if the BTC price dynamically breaks below its daily low, a direct correction extension into the orange support area should be planned.

Bitcoin: Bullish price targets for the coming trading weeks

- Bullish price targets: 22,610 USD, 22,976 USD, 23.229/23.395 USD, 23,795 USD, 23,998 USD, 24,269 USD, 24,842 USD, 25,214/25,338 USD, 26,500 USD.

As expected, the Bulls had to give up at short notice. Now it is important not to allow a new daily low. A first sign of a recovery would be a jump above the $22,610 mark towards $22,976, which is now acting as a resist. Here the EMA200 (blue) runs in the 4-hour chart. If BTC price reclaims this resistance, a crucial showdown between bulls and bears will occur between $23,229 and $23,355.

In addition to the golden pocket of the last movement, the super trend and the EMA50 (orange) in the 4-hour chart, the lower edge of the broken bear flag can also be found here. In view of the uncertainty surrounding Silvergate Bank, a sustainable recapture seems difficult to imagine. However, a bounce back into the bear flag would indicate that the buy side has not given up yet. That would put the weekly high at 23,998 back into focus.

If Bitcoin surpasses the price mark and then targets and breaks the cross-resistance at $24,269, this would be very bullish. If the price stabilizes above $24,269, a follow-up rise into the blue resist area is to be expected.

Once again, the buy side should try to fire above $24,520 towards the sell high at $25,338. Only when this price mark has been broken by the 4-hour closing would the path towards the maximum imaginable short-term target of US$ 26,500 be conceivable.

Bearish Bitcoin price targets

- Bearish Targets: 22,315 USD, 22,090/21,985 USD, 21,643/21,366 USD, 20,897USD, 20,666 USD, 20,370 USD, 19,703 USD, 19.363/19.109 USD

The bears took their chance and caused a sell-off. In order to continue to push the BTC price down, the sell-side must sustainably undercut the support at $22,315. Bitcoin is then likely to retreat back into the $22,090 to $21,985 range. A break of the daily low would result in continued selling towards the $21,643-$21,366 orange support area. Here, with the Supertrend and the EMA200 (blue) in the daily chart, there are still two strong supports.

Giving up the low of February 13th would cloud the chart picture again.

If the Bitcoin bulls remain abstinent here and the BTC price cannot find a footing, the turquoise zone will come into focus immediately. Intermediate lows from January 2023 can be found between $20,666 and $20,370. The bulls must be there to avert a sell-off back below the psychologically important $20,000 mark. In the short term, this area therefore remains the maximum bearish price target.

If Bitcoin does not find a bottom in this area, the target marks at 19,703 US dollars and especially between 19,363 US dollars and 19,109 US dollars will become the focus of investors.

Looking at the indicators

The RSI is in an oversold state on the 1 hour and 4 hour charts, which is why a technical recovery move seems possible in the near term. On a daily basis, however, the RSI as well as the MACD indicator have now generated fresh sell signals – not a good sign for the buy side.

In the weekly chart, the RSI indicator slipped back into the neutral zone between 45 and 55. Only the MACD still has a buy signal active here. In the short term, however, this should be ignored.

- Bank of Japan leaves interest rate unchanged: Impact on the macroeconomy and the crypto market - December 20, 2024

- Memecoins more popular than Bitcoin? Striking results from a Binance survey - December 20, 2024

- Bitcoin breaks records: Bigger than gold ETFs and now the top 7 asset worldwide - December 20, 2024