Table of Contents

Experts believe that Bitcoin (BTC) is entering a bull run this week, and that it could reach record prices. A bull run is when the majority of investors buy, demand exceeds supply, market confidence is high, and prices rise.

This optimism is based on the cryptocurrency’s recent appreciation and historical BTC price performances, which follow so-called Bitcoin halvings. These movements occur every four years and reduce the volume of Bitcoin in circulation.

Below, we point out some signs that may indicate a sustainable rise in cryptocurrency prices, truly configuring a bull run (also called a bull market).

How long does a Bitcoin bull run last?

In short, a bull market is a market that rises for a relatively long period of time. In other words, the prices of assets such as stocks, real estate, and cryptocurrencies rise rapidly and significantly, while investors buy more assets. In a bear market, the opposite occurs. As for how long these phenomena last, there seems to be little consensus.

According to Jappa, CEO of Blockware, in the halving cycle, historically a bear market lasts about a year, while a bull market lasts for three years.

For Ryan Lee, lead analyst at Bitget Research, a Bitcoin bull market usually lasts for several months, extending to more than a year. For example, the 2020-2021 bull run ran from the second half of 2020 to the end of 2021.

David Nikzad, co-founder of DeFi.Gold, says that bull markets usually last between 12 and 18 months, and bear markets usually have longer periods, sometimes two years.

“It is often necessary to do a retrospective analysis before there is a broad recognition of the exact moment in which the market migrates from one phase to another”, highlights Jappa, CEO of Blockware.

How to know if Bitcoin is in a bull market?

Nikzad is one of those who believe that Bitcoin is on the verge of a bull market, as is analyst Crypto Rover. According to Nikzad, Bitcoin tends to enter this phase between 150 and 170 days after the halving. “And we are currently in that range,” he highlighted.

Previously observed patterns suggest that BTC price peaks around 480 days after the halving.

Bitcoin’s last halving occurred on April 19 this year, when the bonus paid to BTC miners was halved to 3,125 BTC. The final halving is scheduled to take place in 115 years. It will be the moment when the amount of Bitcoin in circulation will reach its maximum supply of 21 million.

According to Nikzad, among the biggest indicators that the market is moving into a bull market are: breaking the resistance level, increasing trading volumes and growing market optimism, which leads people to buy.

According to Ryan Lee, chief analyst at Bitget Research, the criteria for defining a Bitcoin bull market may not be so straightforward. According to him, the bull run will begin when Bitcoin breaks through a resistance level of $70,000, with strong volume, and remains above this mark.

“Given that the market is influenced by these macro factors, I suggest caution until Bitcoin shows sustainable growth in the coming weeks and breaks significant resistance levels,” says Ryan Lee of Bitget Research.

Some say the bull market is already here

On September 27, BTC reached $66,000 for the first time in two months. This occurred after inflation recorded in August (2.2% year-on-year) was slightly lower than expected (2.3%).

This factor has led to speculation that the Federal Reserve will implement a larger interest rate cut at its next meeting on November 7 in order to prevent the US economy from facing a recession in 2025. Lower interest rates are generally positive for BTC.

Other factors are driving Bitcoin’s price. One of them is the recent approval of listing options on BlackRock’s iShares Bitcoin Trust spot ETF. This should boost liquidity in Bitcoin markets, offering investors new ways to speculate on BTC’s price movements.

Since the beginning of September, Bitcoin has risen by more than 10%, and the trend is expected to be even higher in October, a month that has historically been favorable for the asset.

“Above all, what matters is simply price performance. And Bitcoin is outperforming itself,” says Mason Jappa, CEO of Blockware. According to him, the data indicates that we are already in a Bull Market.

Georgii Verbitskii, former director at eToro Russia, said that the Bitcoin market is bullish when it quickly starts reaching new all-time highs in prices. “But that is not the case,” he said.

According to him, while BTC is approaching its previous all-time high, the cryptocurrency has not yet managed to break the $70,000 resistance level (and has already fallen below the $66,000 recorded in September).

Verbitskii, who is also the founder of the TYMIO protocol, believes that Bitcoin will see significant growth in the last three months of this year, based on its previous performance in Q4. Barring any “economic corrections,” he predicts that the price will reach $100,000 by the end of December.

In turn, Geoffrey Kendrick, head of crypto research at Standard Chartered, told Forbes that the price should rise to $125,000 if Donald Trump wins this year’s US presidential election or to $75,000 if Kamala Harris wins.

General sentiment rises, but individual interest falls

For Ryan Lee of Bitget Research, the status of a Bitcoin Bull Market can be assessed by the following indicators:

- Higher Highs and Higher Lows : Bitcoin consistently forms higher highs and higher lows during pullbacks, signaling upward momentum.

- Moving averages: An uptrend is generally seen when the 50-day moving average crosses the 200-day moving average.

- Increased Trading Volume : Strong buying activity and significant increases in volume typically accompany rising markets.

- Market sentiment : High investor confidence, driven by news of growing adoption, partnerships and regulatory clarity reflect an optimistic outlook.

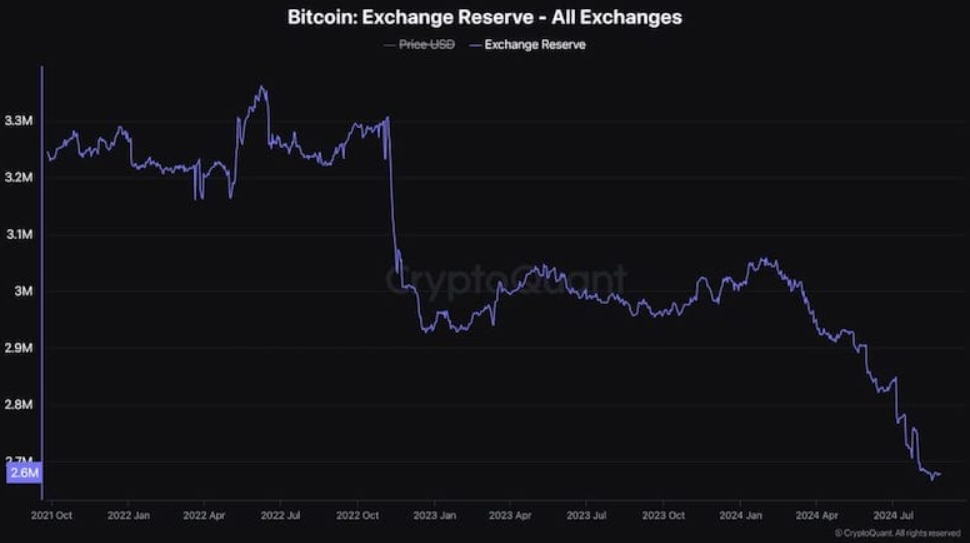

- On-chain metrics: Indicators such as a growing number of long-term holders and a drop in exchange balances suggest that holders are unwilling to sell.

- CryptoQuant Analyst: Bitcoin Nowhere Near Its Peak – Buckle Up, Hodlers! - December 21, 2024

- Chainalysis: $2.2 Billion Lost to Crypto Hacks in 2024 - December 21, 2024

- Bank of Japan leaves interest rate unchanged: Impact on the macroeconomy and the crypto market - December 20, 2024