Competition in Bitcoin exchange-traded funds (ETFs) is heating up as major issuers, including Fidelity, have unveiled changes to lower their fees.

According to James Seyffart, ETF analyst at Bloomberg Intelligence, Fidelity has cut its fees to 0.25% from 0.39% previously and is offering a 0% fee waiver until July 31st.

Bitcoin ETF issuers are cutting fees

Including Fidelity, 5 of the 11 issuers have revised their fee structures or offered temporary fee waivers after receiving feedback from the U.S. Securities and Exchange Commission on January 8. Securities and Exchange Commission had received.

On a more serious note… here's all the firms doing the hard work behind the scenes. @Fidelity has lowered their fees all the way down to 25bps and is also offering a fee waiver to 0% through July 31, 2024 pic.twitter.com/Ao0WmICBFh

— James Seyffart (@JSeyff) January 9, 2024

Bitwise has reduced its lowest fee ever from 0.24% to 0.20%, with a waiver of 0% for 6 months or 1 billion; Wisdomtree has reduced its fee from 0.50% to 0.30%, also with a 0% waiver for 6 months or 1 billion.

Invesco & Galaxy maintained the exemption and reduced the fee from 0.59% to 0.39%. Valkyrie made a significant adjustment, reducing the fee from 0.80% to 0.49% with an additional exemption to 0% for 3 months.

SEC account compromised, false approval notice posted

While the entire crypto community nervously waits for the SEC’s final decision on the Bitcoin ETFs, the commission has broken the suspense by posting a false announcement on its official social media account /span> posted about the approval for listing and trading of Bitcoin ETFs.

The @SECGov twitter account was compromised, and an unauthorized tweet was posted. The SEC has not approved the listing and trading of spot bitcoin exchange-traded products.

— Gary Gensler (@GaryGensler) January 9, 2024

“The SEC’s Twitter account was compromised and an unauthorized tweet was posted,” SEC Chairman Gary Gensler said. “The SEC has not approved the listing and trading of spot Bitcoin exchange-traded products.”

The security team at X (formerly known as Twitter) has confirmed the breach after an initial investigation.

“Our investigation has determined that the compromise was not due to a breach of X’s systems,” said X’s security team in a post. “Rather, an unidentified individual gained control of a phone number associated with the SEC account through a third party.”

“We can also confirm that two-factor authentication was not enabled at the time the account was compromised,” the post said.

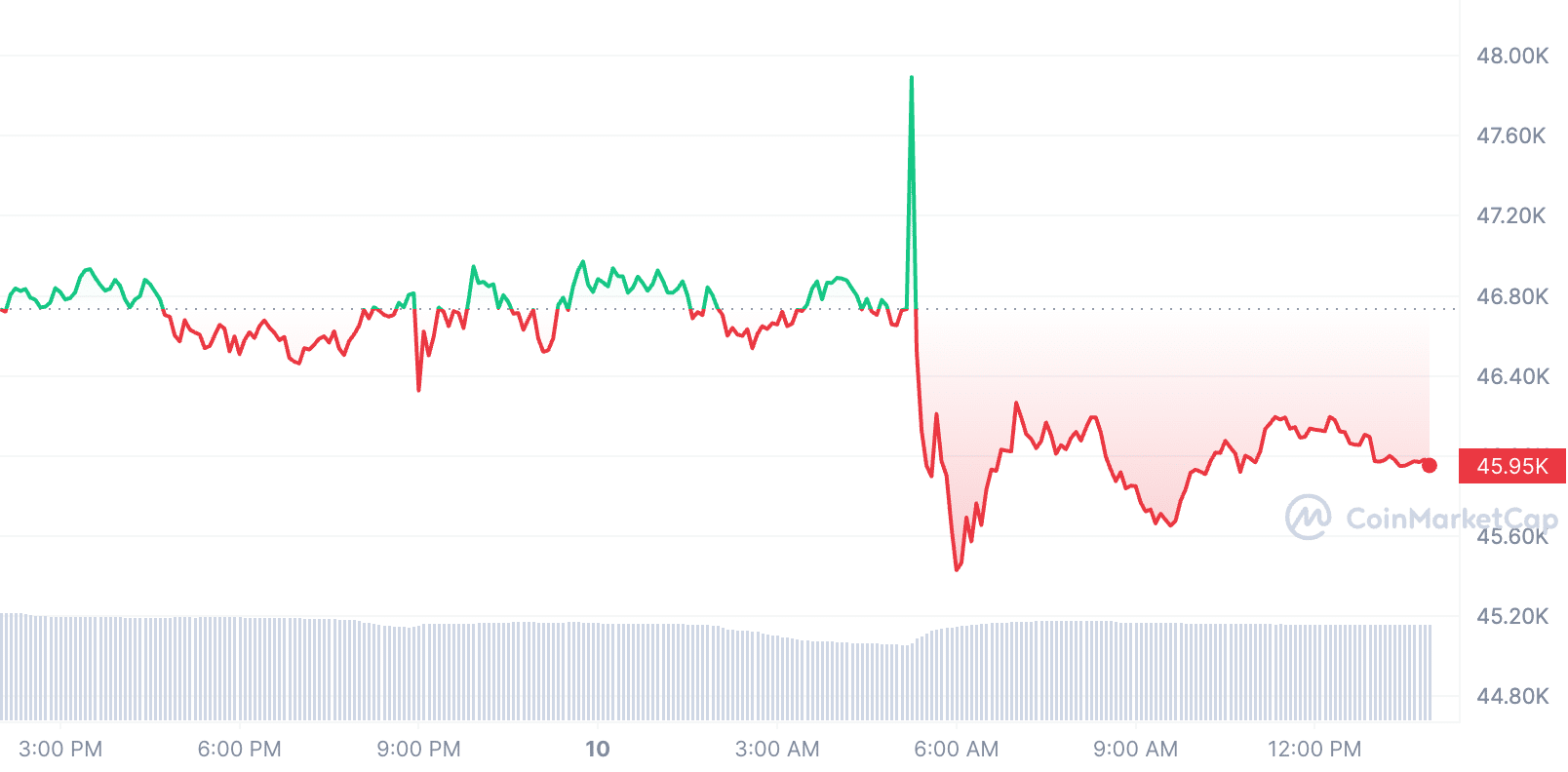

Many users have expressed their frustration and disappointment with the SEC’s unprofessional approach. Although Bitcoin price briefly hit $48,000 after the false approval announcement, it fell below $46,000 after the clarification and is currently trading at $45,953, according to CoinMarketCap corresponds to a decrease of 1.8% compared to the level 24 hours ago.

- Michaël van de Poppe: Bitcoin to Hit $500,000 This Cycle? 🚀💸 Or Just Another Crypto Fairy Tale? - December 21, 2024

- What is the Meme Coin Bonk, Price Predictions 2025–2030, and Why Invest in BONK? - December 18, 2024

- BNB Price Analysis: 17/12/2024 – To the Moon or Stuck on a Layover? - December 17, 2024