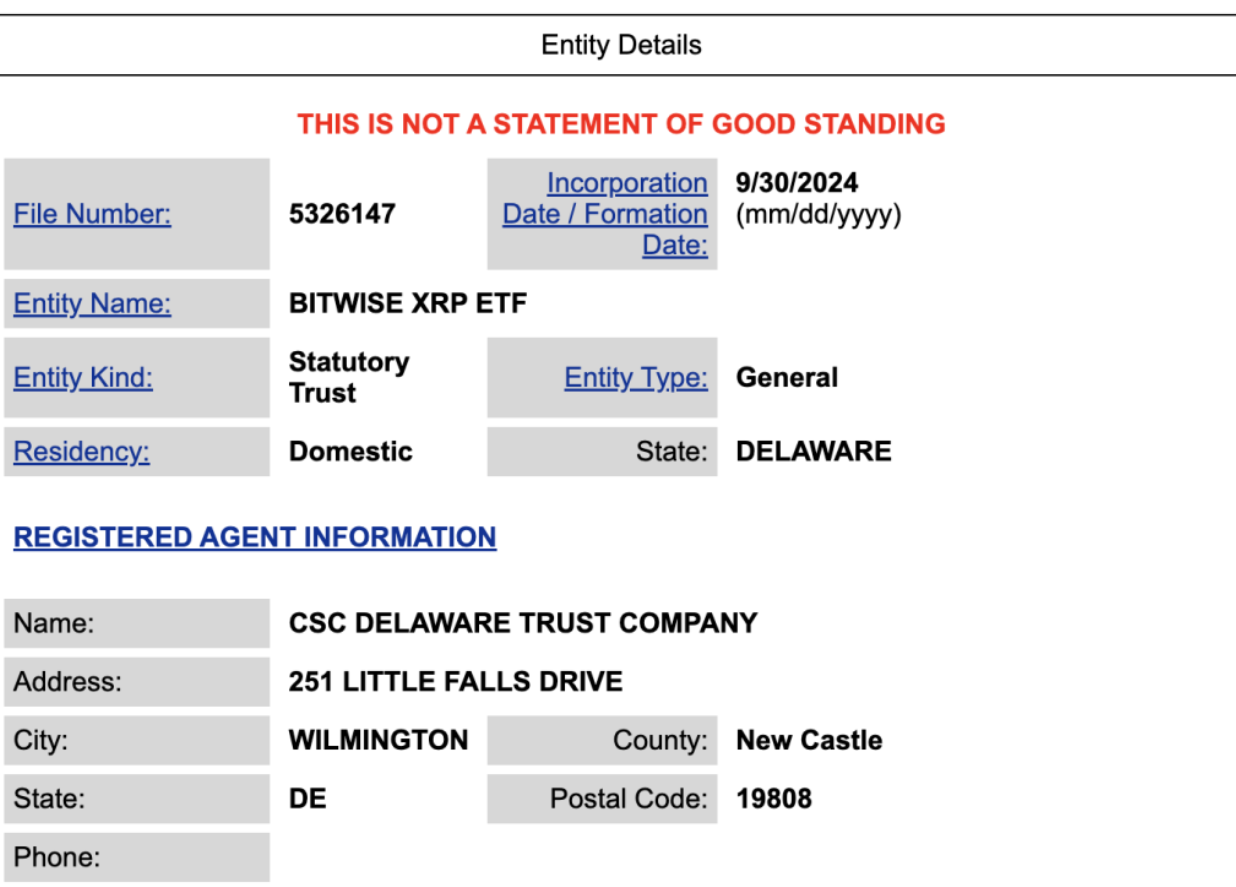

Asset management firm Bitwise filed paperwork with the Delaware Department of Corporations on September 30 for an XRP exchange-traded fund (ETF ). The filing includes a registration for a Delaware Statutory Trust, a business-oriented trust legally recognized in the state of Delaware. Bitwise, BlackRock, and Fidelity are among the first to register trust entities for Bitcoin (BTC) and Ethereum (ETH).

This step is taken before applying to list and trade ETF shares based on these cryptocurrencies. Likewise, registering a trust entity is the first step to applying to list and trade an ETF.

*BITWISE XRP ETF FILING IS GENUINE, SPOKESPERSON CONFIRMS

Source: DB | Coins: XRP

— db (@tier10k) October 1, 2024

Ripple Payments Paving the Way for Potential XRP ETF Launch

Last month, Grayscale announced plans to launch an XRP trust investment product, with the potential to eventually turn it into an XRP ETF.

In 2021, Grayscale was forced to terminate the previous trust due to the SEC’s lawsuit against Ripple Labs, which alleged that Ripple sold XRP as an unregistered security. However, that legal dispute ended earlier this year when Ripple settled with the SEC for $200 million.

With XRP’s regulatory status cleared, the door is open for U.S. exchanges to relist XRP, and companies like Grayscale to develop new XRP-related investment products.

Nonetheless, the regulatory environment for cryptocurrencies remains unpredictable.

For an XRP ETF to become a reality, it would have to comply with SEC regulations, which have been cautious about cryptocurrency ETFs, especially given previous disputes surrounding the securities classification of Ripple and XRP.

XRP last fell 2.7% to $0.60 on Wednesday, reflecting a wider downturn in the cryptocurrency market due to rising tensions between Iran and Israel.

Ripple CEO Defends XRP ETF Potential

In February, Ripple CEO Brad Garlinghouse expressed support for an XRP ETF, suggesting that investors would appreciate the diversification the product provides.

“I think it’s a natural thing,” he said in a Bloomberg interview . “There will be other ETFs. It’s like the early days of the stock market. You don’t want to be exposed to one stock or one company. You generally want to think about diversifying your risk, so you’ll see other ETFs.”

- CryptoQuant Analyst: Bitcoin Nowhere Near Its Peak – Buckle Up, Hodlers! - December 21, 2024

- Chainalysis: $2.2 Billion Lost to Crypto Hacks in 2024 - December 21, 2024

- Bank of Japan leaves interest rate unchanged: Impact on the macroeconomy and the crypto market - December 20, 2024