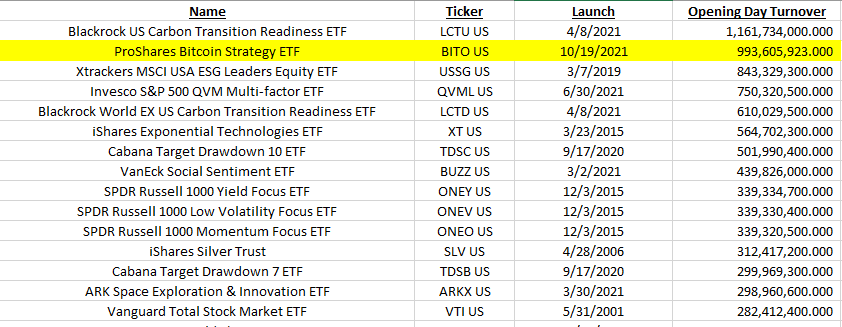

The publicly traded fund ProShares BTC Strategy (BITO) recorded the highest “natural” trading volume in its history on an opening day among ETFs, reaching just over $ 1 billion at the end of the opening day.

BITO recorded the highest volume during the opening day among ETFs

ProShare’s BTC futures ETF began trading on the New York Stock Exchange (NYSE) on October 19 with an opening price of $ 40.88. BITO closed the day at $ 41.94, with a total of 24.313 million shares changed hands, equivalent to over $ 1 billion.

It is second overall and lags behind the ETF Blackrock US Carbon Transition Readiness, which made $ 1.16 billion in its April debut. It was “unnatural” because he was run by “one pre-planned giant investor.” The daily volume of LCTU in the days after launch also fell to $ 2 to 6 million.

Even more interesting, in just one hour after the launch of the ETF, it generated a trading volume of around 11.6 million shares. This means that the volume in dollars was around $ 500 million. By comparison, the Vanguard S&P 500 ETF (VOO), one of the most popular ETFs, recorded approximately 883,000 shares over the same period.

Bloomberg analyst Eric Balchunas pointed out that $ 280 million was traded in the first 20 minutes, making BITO one of the “15 best starts of all time, surpassing the gold-price ETF and the Nasdaq.”

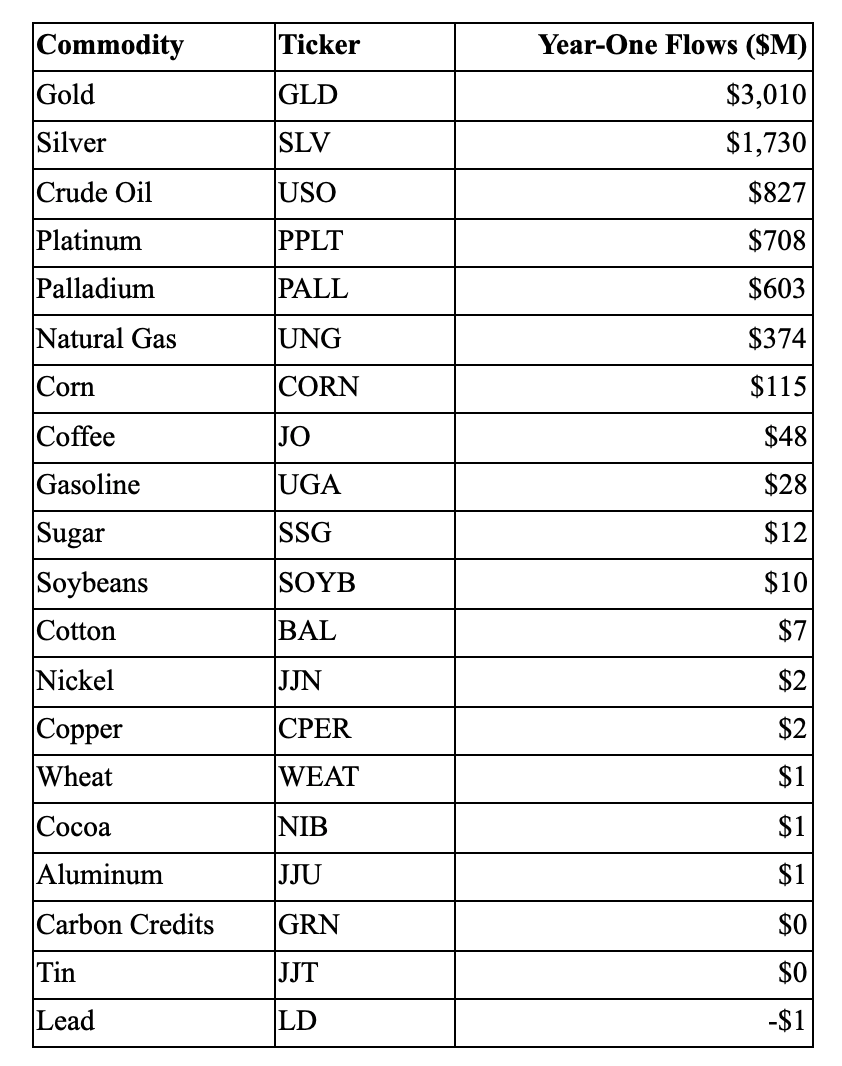

All this suggests that ProShares ETFs could be considered a heavyweight for the industry in terms of net flows during the first year in 12 months. According to FactSet, the two best commodity ETFs are gold and silver flows in year-one, $ 3 billion and $ 1.7 billion.

source: Twitter

source: TwitterWhile bull performance represents a significant milestone for ProShares and the cryptocurrency sector, Balchunas warned that this could have implications for another company in line to launch its own BTC futures ETF:

“Today’s result is also that it will be much harder for the next ETF in a row to succeed. Time is of the essence. Every day counts because once the ETF becomes known as “the one” and has tons of liquidity, it’s virtually impossible to overtake it. “

Valkyrie’s ETF is set to be the second product to join BITO on the NYSE this week. They changed his ticker to BTFD, which is slang for Buy The Fucking Dip. to capital losses.

How to Trade on Binance (2021)

- Trillionaire Fund: We expect several countries to adopt Bitcoin - January 2, 2025

- Analyst predicts “Grand Finale” for Altcoins in early 2025 - January 2, 2025

- Dutch crypto analyst: “This is the right time to buy XRP” - January 2, 2025