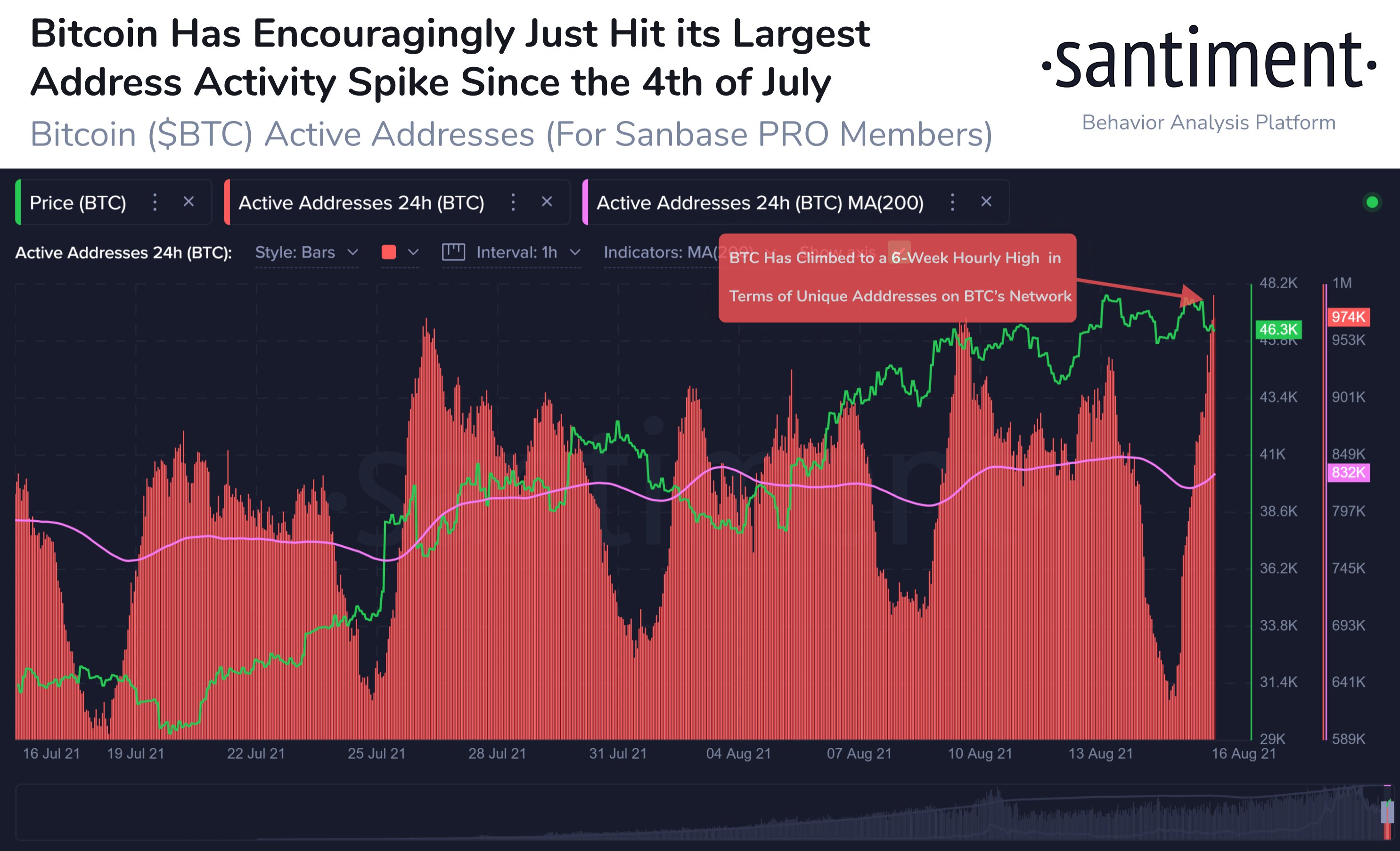

On August 16, 2021, nearly one million active addresses were recorded on a Bitcoin blockchain in just 24 hours.

Almost one million active addresses in 24 hours

This was revealed by the Santiment analytical platform, which notes that there has been a sharp increase in activity, the largest since 4 July. The peak time occurred between 18:00 and 19:00 UTC, when the price BTC ranged between $ 46,600 and $ 46,300 and just before the decline, when it dropped to $ 45,600 in two hours.

The graph also shows a kind of cyclicality in the total number of active addresses on the BTC blockchain in 24 hours.

In fact, since July 19, four cycles can be distinguished, which are very similar to each other in both number and duration, with peaks in activity in the first days of the week and a significant decline over the weekends.

Especially during the last weekend, the number of active addresses in 24 hours fell below 650,000, which has not happened since mid-July, ie. Before the last drop in the price of BTC below $ 30,000. However, the following Monday, 850,000 active addresses were not exceeded and yesterday the 950,000 threshold was exceeded.

Active addresses confirm the dominance of institutions

The fact that during weekends, when retail investors are more active and institutional investors less, the number of active addresses decreases regularly, with the next peak being in the first days of the week, ie. when companies start a working week, it confirms this narrative.

In fact, it is now clear that the increased activity in the cryptocurrency markets, and in particular in the BTC blockchain, is due to large institutional investors rather than tens of millions of small retail investors.

Also, for some time now, the average value of individual transactions on a BTC blockchain has consistently exceeded $ 300,000, clearly revealing the dominance of whales. However, it should be added to this figure that the median is much lower (less than $ 800) and that this figure does not take into account off-chain transactions, such as through the Lightning Network.

In addition, the median value of individual chain transactions is strongly influenced by significant capital movements on stock exchanges, which are often carried out with a minimum number of transactions but with a considerable size.

- What Could Bitcoin’s Price Be in 25 Years? A Lambo or Just a Latte?” 🚀💸 - December 23, 2024

- Solana Price Analysis – December 18, 2024: The Slippery Slope of SOL 🚀📉 - December 18, 2024

- Bitcoin Price Analysis – 16/12/2024: A Dance in the Ascending Channel - December 16, 2024