Although the price BTC recently returned to mid-May levels, the number of daily transactions recorded on the blockchain is still not growing.

In fact, since the end of July, the number of daily transactions in the BTC chain has been constantly between 180,000 and 270,000, well below the 300,000 mark, which has been exceeded almost continuously since June last year.

BTC: still few transactions?

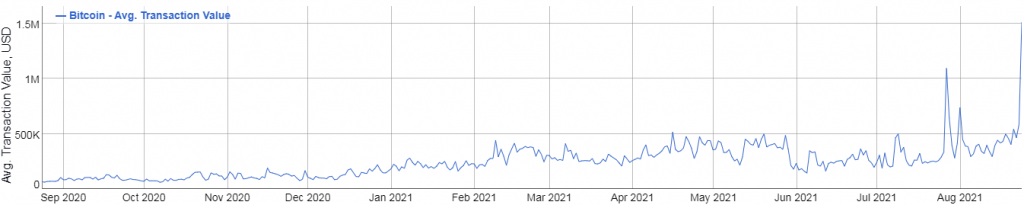

If we look at the average value of an individual transaction, we find that it has been growing since September last year, with the peak at the end of July this year. The actual current level from this point of view is at an all-time high.

However, many small BTC transactions appear to be “moving” off-chain for lower fees through the Lightning Network, while only large transactions remain in the chain.

Glassnode report

A recent report from Glassnode also reveals that while the price of BTC has been rising in recent weeks, other metrics in the chain are falling.

Indeed, the levels of some assets in the chain still do not appear to be responding to continued upward movements and have remained at historically relatively low levels since the May crash. Glassnode points out that the number of daily online transactions over the past five years has only been so low and is even similar to that of the bear market during 2018/2019.

This does not detract from the fact that the overall dynamics of supply has remained on the rise, for example the volume of BTC held by long-term holders has reached a new all-time high of 12.69 million BTC, breaking the previous record of October 2020.

With metrics on the chain that still have considerable room for growth and clear indications of a possible imbalance between low supply and possible growing demand, this seems appropriate to trigger a new bull cycle.

In other words, if market demand for BTC increases, which currently seems likely, it will lead to further price increases. Low metrics for BTC utilization in the chain suggest that demand still has plenty of room for growth, albeit only theoretically so far.

In addition, trading volumes in the cryptocurrency markets are not very high at present, especially compared to the volumes recorded during the bull run at the beginning of the year, confirming the hypothesis that there is still much room for growth, albeit only again for the time being theoretically.

From ETH to Avalanche: Chainlink is conquering the NFT sector

- Solana Price Analysis – December 18, 2024: The Slippery Slope of SOL 🚀📉 - December 18, 2024

- Bitcoin Price Analysis – 16/12/2024: A Dance in the Ascending Channel - December 16, 2024

- What is Monero, Price Predictions for 2025–2030, and Why Invest in XMR? - December 16, 2024