In contrast to competitor Ethereum (ETH), which was able to recover in the last 24 hours after the crypto market sell-off at the beginning of the week, the ADA price is showing noticeable signs of weakness and is currently trading below yesterday’s daily low. The ADA price follows the sell-off of the Binance Coin (BNB), which has again fallen in double digits in the last few hours of trading. Statements by SEC Chairman Gary Gensler classifying Cardano as unregistered securities along with other major layer-1 ecosystems such as Solana (SOL) and Binance Chain (BNB) are leaving their mark. Cardano CEO Charles Hoskinson even speaks of a coordinated attack on the crypto industry.

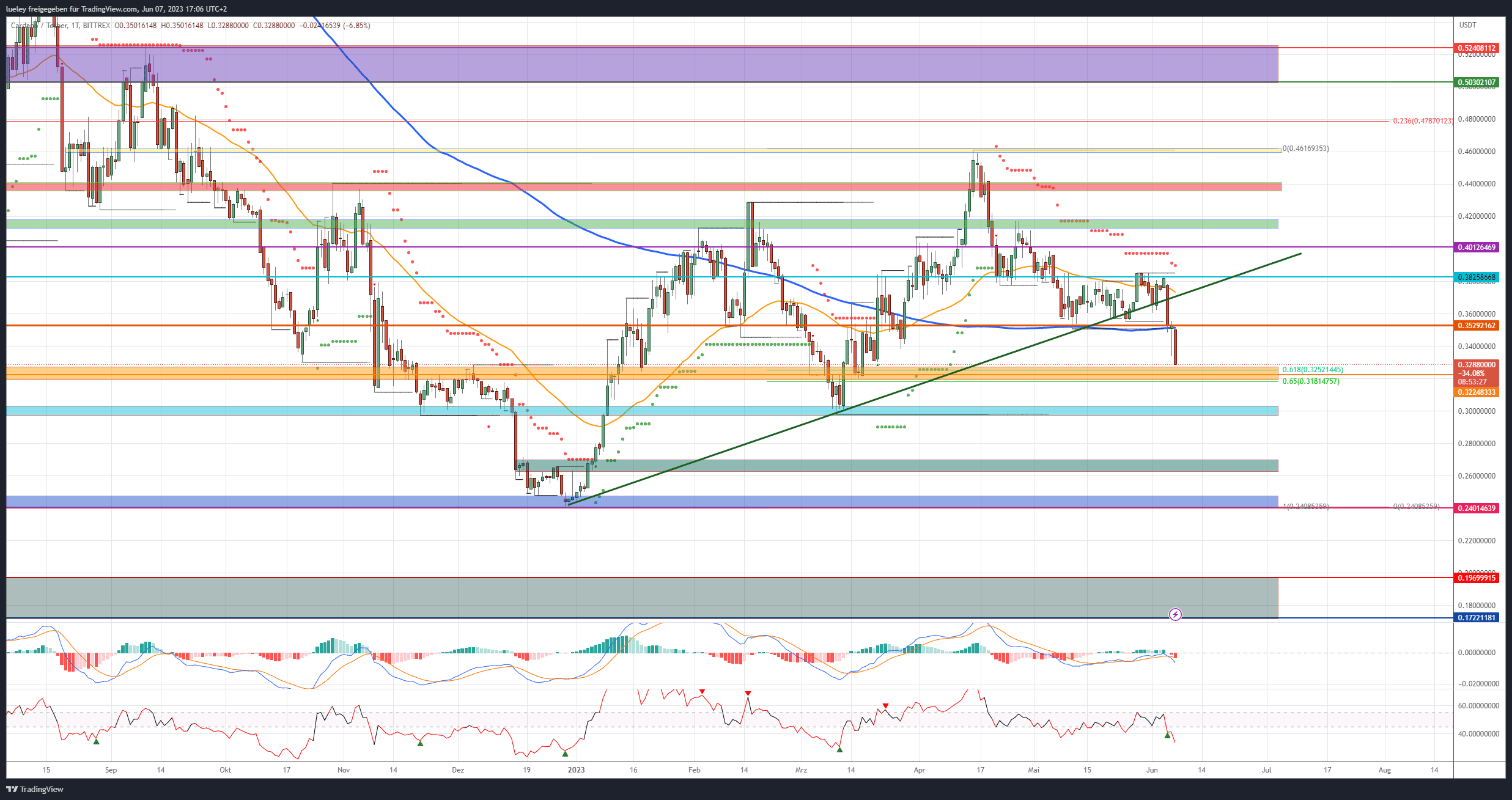

The technical upward trend that has been going on since the beginning of the year has thus ended for the time being. The successive further development of the Cardano network in the course of the last development phase “Voltaire” is also taking a back seat. In the short term, the buyer side must now do everything possible to prevent the ADA price from falling back below the support at USD 0.322 in order to avert a sell-off towards the March low of USD 0.302. Only the recapture of the central resistance area around 0.382 US dollars would turn the tide in favor of the buyer side.

Cardano: Bullish price targets for the next few weeks

Bullish price targets: 0.352 USD, 0.382 USD, 0.401 USD, 0.413/0.417 USD, 0.435/0.441 USD, 0.459/0.466 USD, 0.478 USD, 0.503/0.524 USD, 0.556 USD, 0.595 USD

In April, the ADA chart and the news about Cardano had a positive effect and caused the price to rise to the golden pocket of the last price movement at 0.461 US dollars. Not much is left of the positive mood. Cardano corrected by 28 percent to currently just over 0.333 US dollars and threatens to extend its correction in the short term. The buyer side can only prevent this if ADA can stabilize at the latest in the orange support area around 0.322 US dollars.

If a trend reversal succeeds, the bulls have to heave Cardano back above the resistance at 0.352 USD as quickly as possible. Recapturing the MA200 would be an important first step. Then the ADA price must use the momentum and start towards 0.382 USD. A directional decision must be planned here. Strong resistance awaits with the EMA50 (orange) and the broken trendline. Only if there is enough buying momentum and the supertrend is subsequently broken not far above is there a chance of a rise back above 0.401 US dollars in the direction of the intermediate high at 0.415 US dollars.

This will decide whether to make a fresh attempt towards the April 19 stall line at 0.436 USD. Only when this area has also been breached will the high for the year at 0.462 US dollars come into focus again. For the time being, this price level acts as the maximum increase target for the coming trading weeks.

Cardano: Bearish price targets for the next few weeks

Bearish price targets: 0.325/0.318 USD, 0.302 USD, 0.270/0.262 USD, 0.247/0.240 USD, 0.196 USD, 0.172 USD.

The bears are taking full advantage of the uncertainty surrounding the SEC lawsuit against Binance and Coinbase. Since falling below the support line at 0.352 USD, the downtrend has continued to accelerate. The Golden Pocket between 0.325 and 0.318 USD acts like a magnet on the Cardano price. Here the buyer side has to put up resistance. A break of the orange support area would result in an immediate correction extension towards March’s historical low around 0.302 USD. The first important price target would have been completed.

If there is no sustained price reversal here and Cardano also gives up this support at the daily closing price, the ADA price could immediately drop to the breakout level at the beginning of the year between USD 0.270 and USD 0.262. Here is the breakout level from January 5th of this year. This puts the historical low between 0.247 and 0.242 USD within reach for the bulls. At this price level, a bullish countermovement is to be planned at the latest. The buyer side will do everything to form a double floor.

If the crisis surrounding the SEC’s strike on the world’s largest crypto exchange Binance worsens in the coming weeks and Cardano slips below its 12-month low, a sell-off into the gray zone between USD 0.196 and USD 0.172 would be expected. dollars can no longer be ruled out.

Looking at the indicators

With relapse below the green uptrend line, the bullish trend is broken. At the same time, both indicators, RSI and MACD, have produced new sell signals. The RSI is slowly slipping into oversold territory at the 33 level. However, this should not be overestimated in the case of news-related price slumps. Looking at the weekly chart, the recent price weakness has also activated a short signal in the RSI. However, there is still a lot of room down here. The MACD also continues to trade below the 0 line and threatens to form a fresh sell signal at the end of the week, which could also cause Cardano to continue falling.

Glassnode is a leading blockchain data and intelligence platform. Offering the most comprehensive library of on-chain and financial metrics, they provide a holistic and contextual view of crypto markets through understandable and actionable insights.

The data and statistics provided by Glassnode are trusted by the world’s leading investors, hedge funds, banks, asset managers and crypto companies.

- Michaël van de Poppe: Bitcoin to Hit $500,000 This Cycle? 🚀💸 Or Just Another Crypto Fairy Tale? - December 21, 2024

- What is the Meme Coin Bonk, Price Predictions 2025–2030, and Why Invest in BONK? - December 18, 2024

- BNB Price Analysis: 17/12/2024 – To the Moon or Stuck on a Layover? - December 17, 2024