The largest cryptofonds ended in the red for the fourth week in a row. The rise in cryptocurrency prices, which could revive the interest of large investors in investment opportunities associated with digital assets, also did not help.

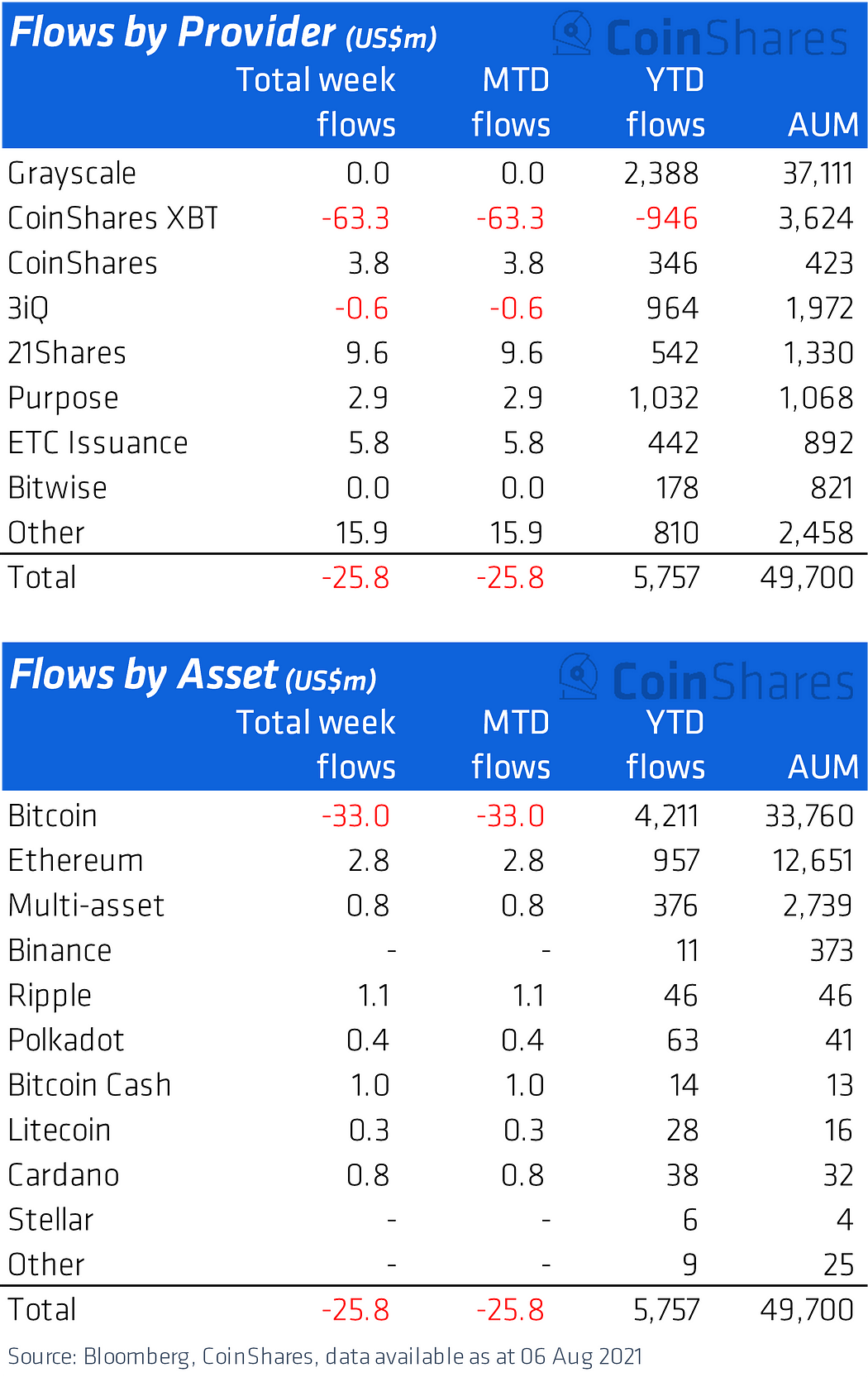

According to a new report by CoinShares, the manager of one of the monitored crypto funds, the investors withdrew $ 25.8 million of capital in the final settlement from the previous seven days (last week).

This time, the outflows concerned only the funds they concerned BTC. In total, investors raised $ 33 million. On the contrary, it ended in black numbers ETH (+2.8 million USD), XRP (+1.1 million USD), BTC Cash (+1 million), Cardano (+ $ 0.8 million) and also Polkadot (+ $ 0.4 million).

Coinshares publishes the results of the largest cryptofunds every week. In addition to its own results, it also informs about how Grayscale, 3iQ, 21Shares, Purpose, ETC Issuance or Bitwise did. Curiously, the biggest outflows took place at the Coinshares XBT fund, from which up to $ 63 million left.

Although there has been an outflow of capital invested in cryptophones, the total value of cryptocurrencies managed by the cryptocurrencies in recent weeks has risen to $ 50 billion for the first time since mid-May.

On the contrary, the negative is that over the last 10 weeks we have seen only one in which the inflow of capital into these funds would exceed the outflows – ie withdrawals. This suggests that these funds are still not renewing the institutional interest in investing in cryptocurrencies, which is far from reminiscent of “FOMO” from the beginning of the year, when these funds regularly absorbed hundreds of millions of dollars each week.

Start making money with Binance Savings

- Scaramucci: Bitcoin remains the favorite, but these altcoins offer enormous opportunities - January 3, 2025

- This is how many Shiba Inu tokens were burned in 2024 - January 3, 2025

- Bitcoin starts 2025 optimistically: course to 130,000 USD? - January 3, 2025

![Best Platforms for Copy Trading in [current_date format=Y] 18 Best Platforms for Copy Trading](https://cryptheory.org/wp-content/uploads/2024/12/copy-trading-120x86.jpg)