For some crypto disciples, DeFi is the embodiment of the crypto spirit of decentralized financial management. After all, the idea is based on crypto protocols that use smart contracts to automate financial transactions such as lending or trading – without any third parties.

It is therefore not surprising that DeFi made real quantum leaps in the 2021 bull market.

Decentralized vs centralized crypto exchanges

Chainalysis is now putting its burning glass on one aspect of this growth. The blockchain analysis company examines the sector of decentralized exchanges, so-called DEXs, for growth, trends and special features in contrast to centralized exchanges (CEXs). The latter describes classic BTC exchanges like Binance.

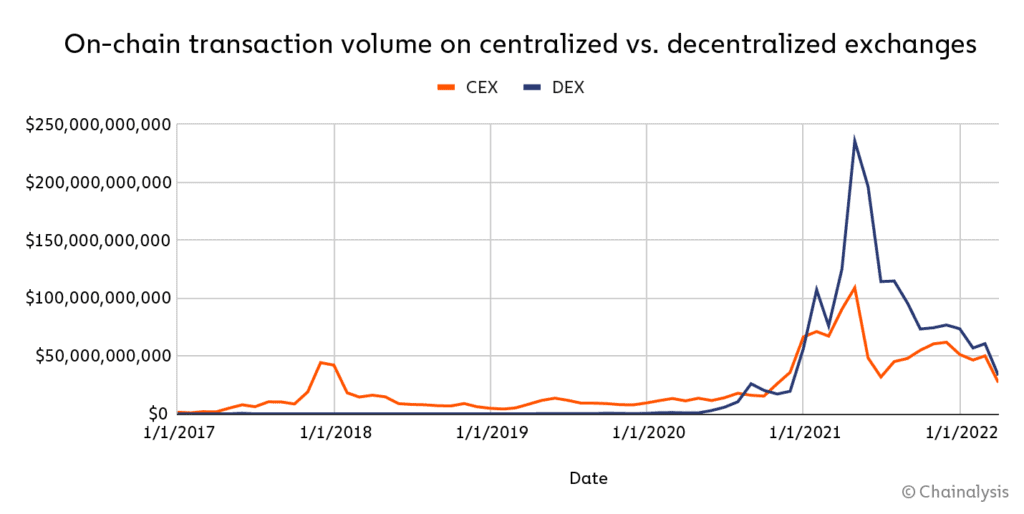

First the rise: In the spring of 2021, the on-chain volume traded on decentralized exchanges overtook that on central exchanges for the first time. In the middle of the year, the DEX on-chain volume was even more than twice as high at 230 billion. This comes from new data from Chainalysis.

“DEX dominance peaked in June 2021; this month, more than 80 percent of on-chain transaction volume was processed through DEXs,” the statement said Chainalysis Report.

But, and this is a big but: This is explicitly only about on-chain volume. The bulk of the trading volume traded on CEXs is recorded on the internal ledgers of the exchanges. Unlike DEXs, not every trade triggers an on-chain movement. As a result, on-chain volume is higher on DEXs by definition.

distribution and centralization

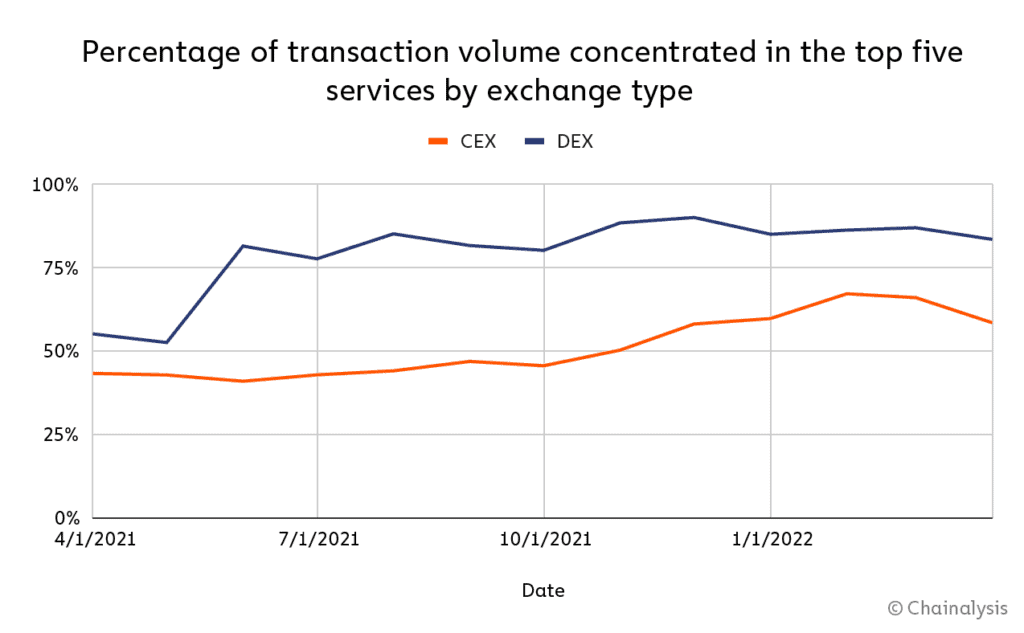

Similar to their centralized counterparts, decentralized exchanges are also showing an increasing concentration of market power.

“The top five decentralized exchanges currently support approximately 85 percent of the total DEX transaction volume during the period examined. This includes Uniswap, SushiSwap, Curve, dYdX and the 0x-Protocol.”

In other words: 85 percent of the transaction volume is accounted for by just five services. As can be seen in the chart, the market concentration in CEXs is less pronounced.

According to Chainalysis, however, the high market concentration is due to the “young age of the sector”. With increasing market maturity, the concentration should therefore also decrease.

DeFi: A sector in its infancy

Above all, the DeFi sector has tied up massive amounts of capital in the last year. Due to the sometimes exorbitant returns on so-called crypto lending, the “total value locked”, i.e. the aggregated trading volume (TVL for short), which investors have secured in DeFi protocols, rose to up to 250 billion US dollars. Prove that Counting of the data service DeFi Llama.

Finally the fall: Meanwhile, liquidity has declined to $105 billion. The correction was accelerated by negative news, such as the crash of Terra LUNA and its own stablecoin UST.

Yuga Labs disables code that allowed infinite creation of Bored Apes NFTs

- Solana Price Analysis – December 18, 2024: The Slippery Slope of SOL 🚀📉 - December 18, 2024

- Bitcoin Price Analysis – 16/12/2024: A Dance in the Ascending Channel - December 16, 2024

- What is Monero, Price Predictions for 2025–2030, and Why Invest in XMR? - December 16, 2024