With the growth of network activity and the price of ETH above $ 4,000, there has not been a day since the beginning of November with an average transaction fee below $ 30. With rising fees, some users may wonder if it makes sense to postpone time-independent transactions. Just as 5am flights tend to be cheaper than noon flights, should Ethereum users expect to pay less outside of business hours? An analysis of the basic data on fees on Ethereum by block suggests that it could be beneficial to schedule a transaction for the weekend in the US.

How transaction fees in Ethereum network vary by time and day of the week

After EIP-1559, Ethereum’s transaction fee mechanism includes a flat fee per block, called the base fee, that must be paid to be included in the block. The basic commission fluctuates depending on the demand for block space, increasing or decreasing between blocks by a maximum of 12.5% depending on the capacity of the previous block. At times of higher network traffic, demand for block space is more likely to exceed supply, resulting in higher base fees.

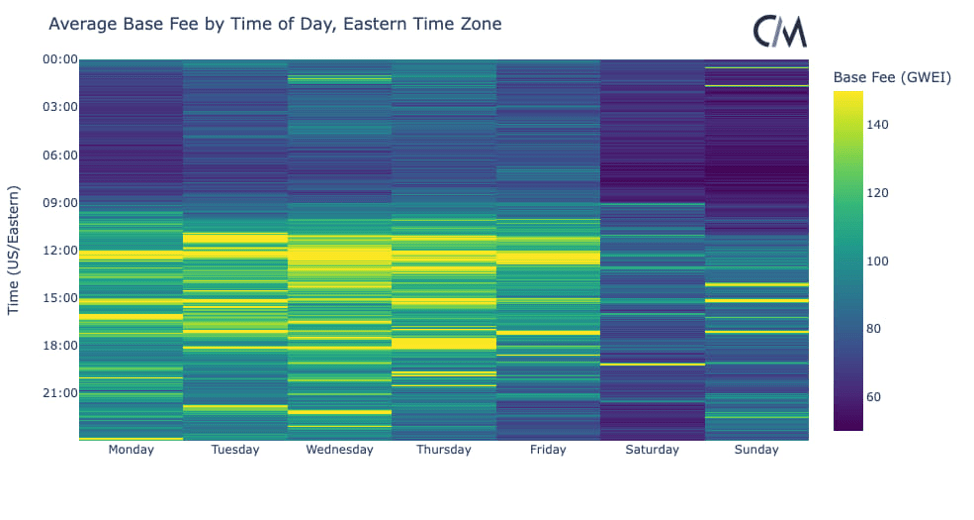

Although ETH is a network that is available worldwide 24 hours a day, 7 days a week, and 365 days a year, since the launch of EIP-1559 in August, basic fees troiugh working time in the United States have been higher. The chart below shows the average base fee (measured in GWEI) by minute and day of the week in New York/Eastern European Time. Lighter yellows represent higher typical base fees, while darker blues represent lower average base fees (This only covers base fees, while Ethereum users can now also pay a priority fee or tip for miners to support the inclusion of the transaction in the block).

Interestingly, the morning time frame from midnight to 8:00 has a lower base fee compared to working hours in the US (9:00 to 17:00). In addition, fees were lower at the weekend, with the Sunday morning period being particularly quiet and the base fee being less than 50% compared to the average Wednesday afternoon in New York.

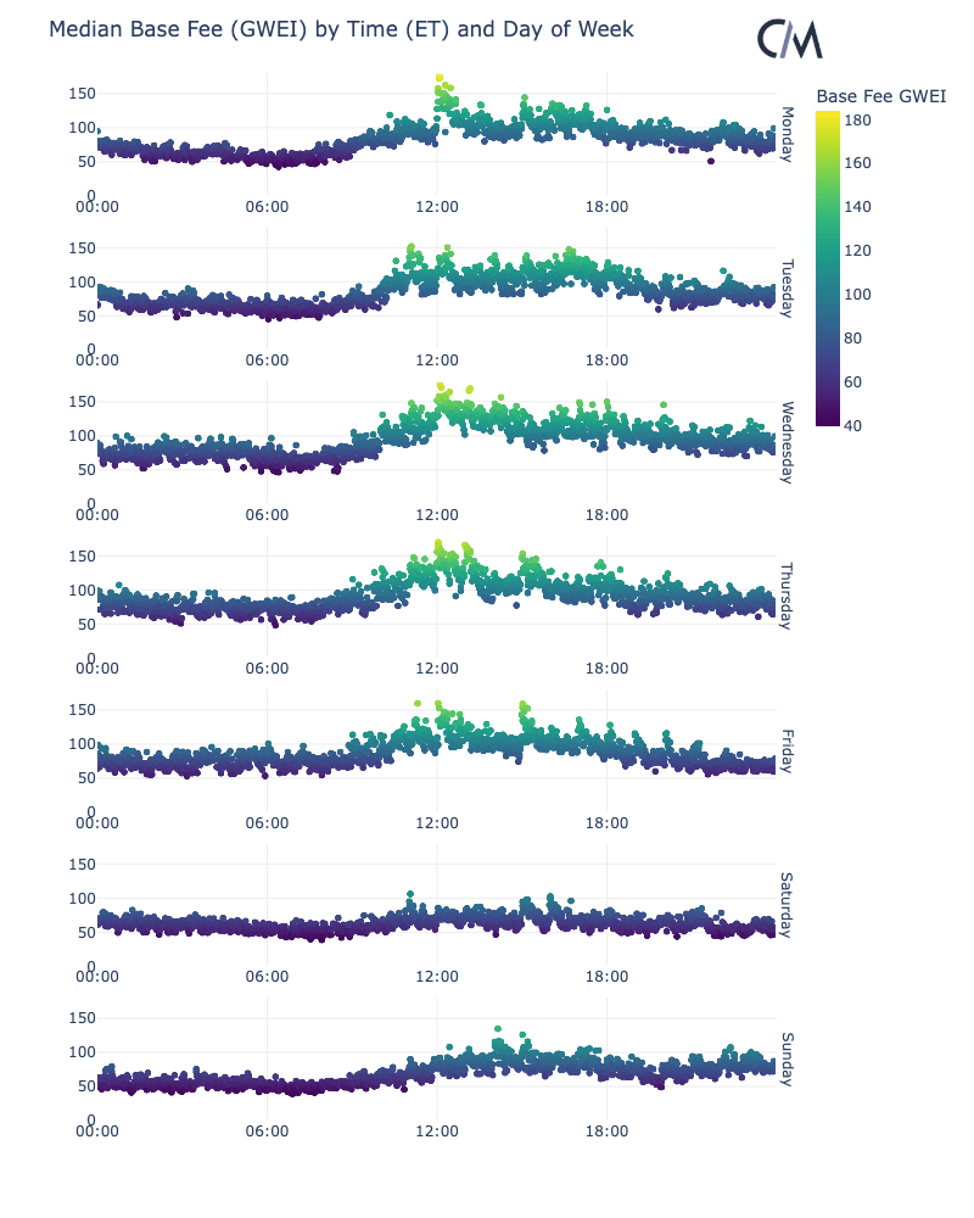

This pattern is also evident when you look at the median rather than the average for each minute and day of the week.

This can provide an interesting opportunity to schedule time-independent transactions and save a few dollars.

Images source: CoinMetrics

Is it worth investing in the BTC government bond?

- What Could Bitcoin’s Price Be in 25 Years? A Lambo or Just a Latte?” 🚀💸 - December 23, 2024

- Solana Price Analysis – December 18, 2024: The Slippery Slope of SOL 🚀📉 - December 18, 2024

- Bitcoin Price Analysis – 16/12/2024: A Dance in the Ascending Channel - December 16, 2024