Table of Contents

Cryptocurrencies and tech stocks have collapsed in the wake of the negative macro environment – inflation, rising interest rates, recession fears and high valuation levels. Between 50 and 90 percent, most cryptocurrencies and tech stocks are down from their all-time highs. But even outside of the crypto industry, many sectors have come under massive pressure. Well-known investors are increasingly saying that they equate the current situation with the dot-com bubble. But how useful is this comparison, especially with regard to the crypto sector?

ICO bubble 2.0?

While the internet is an infrastructure for transferring information, the blockchain is an infrastructure for transferring value, hence the expression “Internet of Value”. Companies are emerging on both infrastructures that enable new business models. As a result, many projects are founded, ergo also collect a lot of money in order to offer certain services in the future. That’s the theory.

With the bursting of the ICO bubble in late 2017 or early 2018, there was a collapse that was in no way inferior to the bursting of the dot-com bubble in terms of price correction. However, internet companies in the early 2000s were significantly closer to commercial implementation than the ICOs of 2017.

Consequently, it could be argued that the ICO bubble was just a kind of crypto precursor bubble to an even bigger bubble. The current correction in cryptocurrencies is primarily due to macroeconomic triggers, ergo less self-referential than the course correction of Internet companies during the dot-com bubble. However, this does not mean that there cannot be a long-lasting bear market because the crypto projects do not manage to develop commercially successful business models in the long term. Accordingly, the current price collapse would have been triggered by macroeconomic factors, but the absence of a trend reversal was due to the sector itself.

Crypto adoption: where do we stand in terms of time?

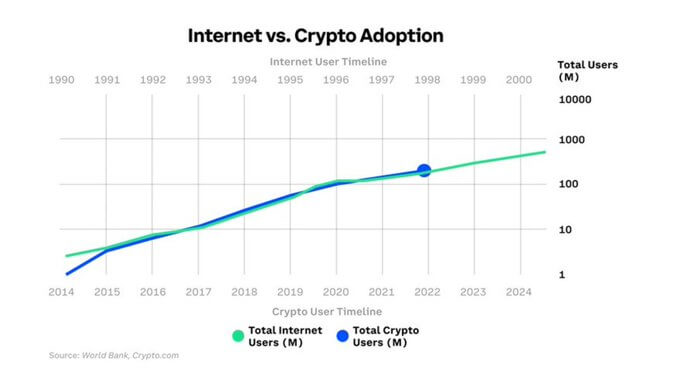

If you compare the blockchain establishment, then we are currently roughly where the Internet was around the year 1998/1999. This means that there are as many people using crypto applications in the world today as there were internet users just before the turn of the millennium.

However, one has to object here that the so-called adoption is progressing faster than with the Internet. Here is how the following chart from crypto investor Raoul Pal shows the adoption rate compared to the internet:

This concept in crypto can be best represented by this chart. Already it is the fastest rate of adoption of any technology in human history (113% per annum vs 63% for the internet). pic.twitter.com/XDeEPj2cPU

— Raoul Pal (@RaoulGMI) May 24, 2021

If the model is correct, then it shouldn’t be far before the establishment of crypto is at the same level of adoption as the internet was with the dot-com bubble. However, this chronological classification, measured by the number of users, does not have to say anything about whether the current crypto sector resembles a bubble comparable to that of the Internet back then.

Gartner Hype Cycle: How much substance is there in the crypto sector?

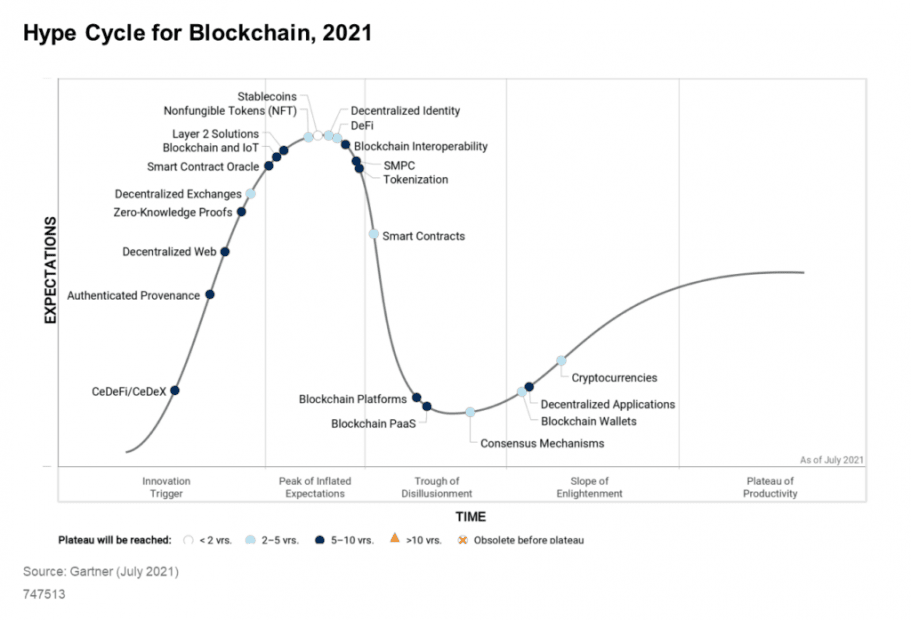

For this it is necessary to look at the maturity of the applications, i.e. to distinguish between hype and substance. The Gartner Hype Cycle, which classifies innovations according to their degree of maturity, can help here:

The current version of the Hype Cycle is almost exactly one year old (July 2021). Accordingly, the vast majority of crypto applications still have to go through a valley of disappointment. Should mean that the majority of crypto applications are at a level of particularly high expectations. Experience has shown that it can be assumed that those innovations will not be able to withstand the exaggerated expectations, ergo they are now or have already started to form bubbles. A point of view that certainly has a parallel to the dot-com bubble.

However, the graphic also shows different periods of time that are necessary for the commercial establishment of the individual application. Stablecoins, for example, only have a particularly short development time (< 2 years) before they are established on a large scale. NFTs are also looking forward to rapid adoption with an expected development time (2 to 5 years). The two examples show that it is important to segment the crypto market into sectors.

This in turn suggests that there are enough applications that prevent the crypto market from stagnating or starting a larger wave of disappointment. Accordingly, there is no need to be afraid of a fundamentally justified bear market – with the exception of external, macroeconomic influences.

Comparability problematic

A major difference from the dot-com bubble is the increased market efficiency in terms of information availability. Thanks to the Internet, crypto investors are informed more quickly today and dynamics and prices can develop faster. From this, the assumption can be derived that cycles develop more quickly, i.e. that bubbles form faster than they did in the early 2000s. This circumstance in turn makes it difficult to compare the pricing of cryptocurrencies and the pricing of Internet stocks at the time.

Another important difference can be seen in the valuation levels. Due to the significant expansion of the money supply, a company valuation of 100 million US dollars is no longer the same today as it was at the turn of the millennium. These and other examples show that the framework conditions have changed significantly. This makes a comparison all the more difficult.

BTC is not Netscape 2.0

Crypto critics in particular tend to compare BTC with the Netscape browser or AOL. At the dawn of the internet age, Netscape was what Google is today. The web browser, which has since failed, is considered a symbol of promising market leaders who are ultimately being pushed out by the competition.

In the case of a utility token project, one might gain something from this comparison. However, BTC is not about a company. Just as gold and silver have not been supplanted by other precious metals over the past few centuries, a Netscape moment for BTC is also very unlikely.

BTC’s track record and decentralization cannot be easily overtaken by innovation. BTC does not have to be efficient or particularly scalable. That is exactly its strength. It is not for nothing that BTC is the undisputed key cryptocurrency with a market dominance of 45 percent. It is precisely the BTC phenomenon, which cannot be classified in the logic of company valuations, that makes the comparison between the Internet and cryptocurrency so difficult.

Financial market bubbles are desirable

The internet and blockchain economy have in common that over 90 percent of all projects fail. Since the hurdles to setting up a cryptocurrency are significantly lower than starting a traditional company, the fail rate in the crypto sector is likely to be significantly higher than that of the internet sector.

That’s not bad, however. Bubbles and exaggerations are even necessary to provide visionary technologies and projects with sufficient attention, chapters and bright minds. So there are and will be many bubbles in the crypto sector, and that’s a good thing.

Dot-com and crypto: A difficult comparison

That doesn’t necessarily mean the big dot-com moment will happen, however. It is much more likely that the crypto sector in the current market phase will not go into a longer period of stagnation as it did during the dot-com bubble. Not even if the global economy is set on a course for recession for the time being.

There is currently still a lot of money and innovation in the market so that long-term stagnation of the prices as with the Internet companies at the beginning of the 2000s is to be expected. But above all: the adoption speed of crypto is higher than that of the Internet. This also reduces the risk of a longer dry spell.

Especially since a successful establishment of crypto can only be read from the courses to a limited extent. In this way, cryptocurrency prices can fall while the real and commercial benefits of the projects increase.

The conclusion

Despite some parallels between the Internet bubble and the crypto market, it takes a lot of imagination to make concrete deductions. The other framework conditions and the BTC phenomenon make it difficult to compare them to the Internet. Comparative charts for user adoption, as mentioned earlier in the article, can be useful for classification, but one should be careful not to make supposedly objective statements from them.

- CryptoQuant Analyst: Bitcoin Nowhere Near Its Peak – Buckle Up, Hodlers! - December 21, 2024

- Chainalysis: $2.2 Billion Lost to Crypto Hacks in 2024 - December 21, 2024

- Bank of Japan leaves interest rate unchanged: Impact on the macroeconomy and the crypto market - December 20, 2024