European Central Bank (ECB) is following the US Federal Reserve and leaving interest rates as they are. People in Brussels are afraid of a second wave of inflation and don’t want to hear about lower interest rates for the time being.

Finally, there is a risk that if interest rates are cut too early, a second wave of inflation could follow. People in Frankfurt absolutely want to prevent this, which is why the ECB is keeping a low profile on the issue of interest rate cuts.

No discussion about interest rates cuts

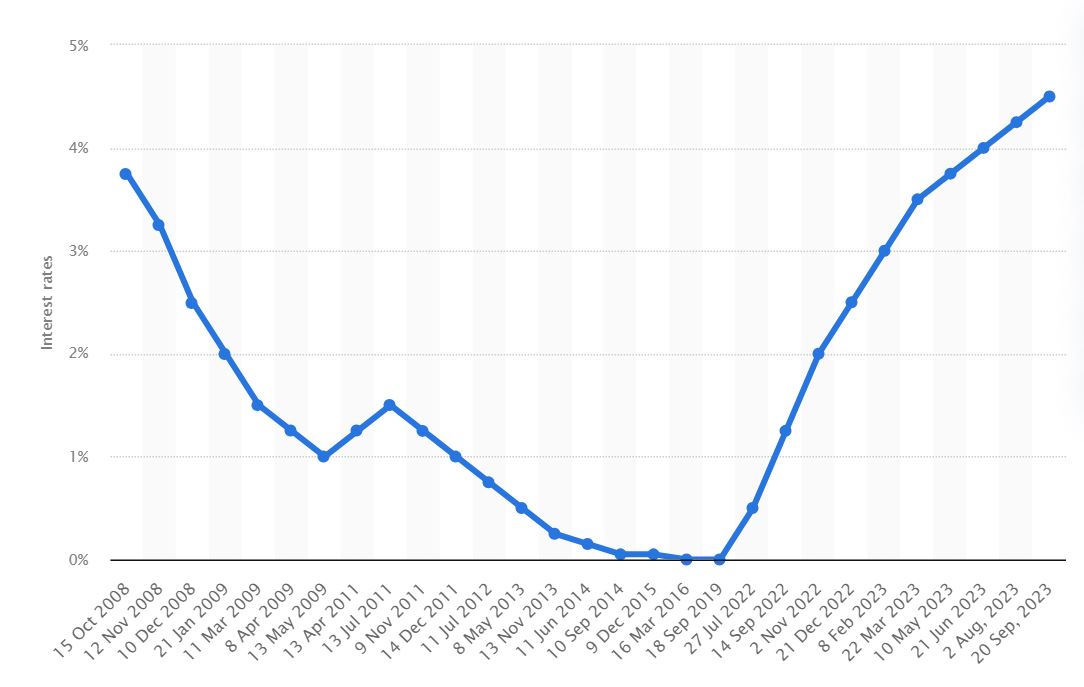

The key interest rate in the euro area therefore remains unchanged at 4.5 percent. This is the second highest level since the introduction of the euro common currency. This means that loan interest rates remain high, but savers can still hope for higher savings interest rates.

ECB boss Christine Lagarde also gave an outlook on the future at her press conference. It expects an inflation rate of 5.4 percent this year, which is slightly lower than the ECB expected in September. Next year, price increases are expected to fall to 2.7 percent, and for 2025 inflation is expected to be 2.1 percent, close to the target of 2 percent.

This is probably also the reason why the ECB is currently firmly rejecting any discussion about a possible reduction in key interest rates. Lagarde stated that the monetary authorities did not even discuss the issue at their last meeting.

Its a lot to do.

With this statement, the ECB President joined the warning voices in the euro area in their press conference. Numerous economists warned the ECB not to give in in advance, because the inflation crisis is far from being solved. Lagarde apparently sees the situation similarly; she points to the ongoing high inflationary pressure, triggered by high wage increases. These could trigger a wage-price spiral, which is why the ECB remains cautious.

The firewall is still holding up

This is likely to stay that way in the next few months. The head of the central bank indicated that she would not deviate from her course for the time being. In doing so, it counters speculation that was based on early interest rate cuts. This prospect is inspiring the markets, and this also applies to cryptocurrencies. These would also benefit from a reduction in key interest rates.

The ECB apparently wants to keep key interest rates at the existing level well into 2024. Pressure from the American Federal Reserve, which only announced on Wednesday that it would begin cutting interest rates in 2024, has not changed this. However, the markets remain optimistic for the time being and are hoping for price fireworks in the next few months.

- Michaël van de Poppe: Bitcoin to Hit $500,000 This Cycle? 🚀💸 Or Just Another Crypto Fairy Tale? - December 21, 2024

- What is the Meme Coin Bonk, Price Predictions 2025–2030, and Why Invest in BONK? - December 18, 2024

- BNB Price Analysis: 17/12/2024 – To the Moon or Stuck on a Layover? - December 17, 2024