Table of Contents

If you’ve actively traded in the financial or cryptocurrency markets before, you likely already know what futures are. However, many investors are still hesitant to venture into this market. These contracts cover a range of assets including precious metals like gold and silver, as well as natural gas, oil, wheat, and other commodities. Futures can also be traded on stocks, indices, and forex. One of the main draws of futures trading in the Czech Republic is the opportunity to buy or sell in your chosen market with leverage up to 1:30.

For investors eager to try their hand at futures trading and uncover its secrets, you’re in the right place. This article delves deep into the subject, aiming to thoroughly explain what this form of trading involves so you can decide if it’s right for you.

Fundamentals of Futures Trading

A futures contract, generally speaking, is a standardized contractual agreement to buy or sell a specific commodity or financial instrument at a predetermined price at a future date.

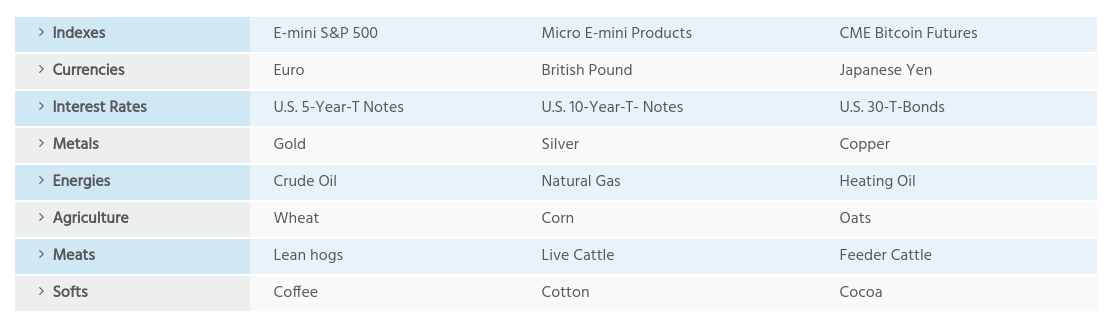

Such futures contracts can be made for a wide variety of asset classes, raw materials, or financial instruments. Hence, there are futures for commodities, stocks, forex, indices, and even bitcoin, among others. Agricultural commodities like lean pork, soybeans, or palm oil can also be traded via futures.

At first glance, futures might seem unusual, but they are structured quite logically. In essence, a future is the price you’re willing to pay for a particular product at a specific future time.

For example, you might come across a three-month futures market for oil. If the contract price is $50 per barrel, you simply decide whether you think oil will be worth more or less than $50 in three months. If your speculation is correct, you stand to make a profit.

Given that the most important commodities and financial instruments are often traded as futures, this generates a significant volume of supply and demand. This very dynamic ultimately forms the basis for prices on futures exchanges, which are highly liquid and thus ideal for future trading, including day trading.

In the futures investment sector, most brokers allow you to buy or sell futures contracts with leverage. This leverage can be up to 1:30 for currencies, 1:20 for gold and major indices, and between 1:2 and 1:10 for other asset classes.

There’s no requirement to hold onto your futures contract until it expires. Instead, you can usually exit the contract at any time. This allows you to lock in profits earlier or mitigate losses. Unlike options, futures require the contract holder to settle the contract, which is a key difference between futures and options.

Who is futures trading suitable for?

For most retail investors, futures have limited value. Their value comes from the possibility of using greater leverage, but leverage acts as a double-edged sword. Your profits are magnified, but your losses are as well.

However, futures could be useful for investing in assets beyond standard stocks, bonds, and real estate investment trusts (REITs). Instead of buying energy stocks, for example, you could purchase a futures contract on oil. Alternatively, you could invest in an exchange-traded fund (ETF) that tracks the value of a commodity.

While futures are an excellent tool for companies and advanced investors, most retail investors are better off with a simple buy-and-hold strategy that doesn’t require a margin account.

What assets can be traded as futures?

- Stocks: Some futures platforms allow trading in individual stocks. This is useful if you want to make more sophisticated trades, such as opening short and long positions or using leverage. In most cases, financial institutions will only offer futures markets on large stocks.

- Indices: Indices are probably one of the most popular futures markets because the volatility is much lower than other asset classes. These include the Dow Jones, S&P 500, NASDAQ 100 markets.

- Commodities: Trading commodities through futures allows you to speculate on the future value of hard metals, energy, and agricultural products without having to take direct ownership. Popular commodity trading markets available as futures include Gold, Silver, Platinum, Brent and WTI Oil, wheat, sugar, or soy.

- Currencies: One of the popular ways to speculate on the future value of currencies is through futures. They can be used to hedge currency risk. This plays an especially important role for internationally operating companies. It’s no wonder that in the USA, futures in euros are at the forefront, and in Europe, in dollars.

- Cryptocurrencies: Crypto futures can now be traded on regular global exchanges. They were introduced in recent years and strengthen bitcoin and other cryptocurrencies on their way into the financial world. Investors with a large amount of BTC can thus protect themselves against large price fluctuations.

- Interest Rates: Many of the top futures brokers also support markets with interest rates.

Reasons to trade futures

If you’re still unsure whether futures trading is safe for you or not, we’ve outlined some of the key advantages this particular market offers below.

Asset Diversification

As mentioned earlier, futures are an available option across dozens of financial markets. For example, speculating on “hard assets” like gold, oil, natural gas, and wheat would be quite challenging without the option of futures trading. You would need to physically purchase, store, and transport gold bars or barrels of oil. However, when you find a reliable broker for futures trading, all you need to do is speculate on the asset’s price increase or decrease. This allows you to trade a wide range of assets from the comfort of your home.

Long or Short Positions

Long and short positions are financial terms essential for understanding what futures are and how they work. A long position simply means you benefit from an increase in value. Anyone opening a long position speculates on the increase in value of the underlying asset. Conversely, with a short position, you can profit from declining markets.

Margin Trading

Some futures contracts will involve large quantities of individual items. For example, when trading oil futures, one contract will contain 1000 barrels, or in the case of corn, futures are traded in units of 5,000 bushels, which is roughly equivalent to 175,000 liters or 125,000 kilograms. This would mean having to spend tens of thousands of dollars.

Many brokers for futures trading allow you to trade contracts on margin, meaning you need to deposit a smaller amount of money to enter the market. The amount of margin required depends on several factors – for instance, whether you are a professional or retail client, the asset class, and your geographical location. Brokers with European regulation may offer up to 1:30 leverage, but outside of Europe, you might achieve up to 1:100 or more.

Futures Trading Hours

Futures trading operates similarly to traditional stock exchange trading. Most trades, therefore, take place during standard market hours – on weekdays from Monday to Friday. Futures can also be traded outside of standard market hours. Each futures exchange has its own rules regarding tradable hours.

For example, most exchanges in the USA allow futures trading from 5:00 PM on Sunday to 4:00 PM on Friday. On the other hand, futures markets in Europe are closed over the weekend. An exception is cryptocurrency exchanges, which allow futures trading 24/7.

Futures trading strategy

When trading futures, it’s crucial to adopt the right strategy because these are complex financial derivatives that come with a much higher risk/reward ratio than conventional assets. If you’re a complete novice in futures trading, we recommend considering some of the strategies described below.

Hedging

This is one of the main advantages of the futures market. Imagine owning stocks that are losing value. You’ve held these stocks for more than 3 years and can benefit from long-term ownership advantages. To avoid losing these advantages if the stock’s value drops, you can use futures.

You could open a long or short position in futures at the same cost. You sell the stocks that are dropping in value and make money. In this case, you don’t record a loss on the stock; you profit from its decline and can use the proceeds to reinvest in undervalued stocks. The same can be done with commodities using futures on oil, gold, silver, and other assets.

Market Correction Strategy

When an asset is undergoing a long-term upward trend, a market correction will eventually occur. This happens when investors exit their position to secure their gains. If you’re looking for a way to profit from market corrections, futures are ideal for achieving this goal. For novices, a market correction means the asset temporarily undergoes a downward price movement.

This could be due to many reasons, such as changes in central bank interest rates, political tensions, or war. Market uncertainty can also be caused by unforeseen events like the coronavirus, and we mustn’t forget about reports of major companies’ earnings that were worse than expected.

However, as mentioned, market corrections are only temporary, meaning that an upward trend is expected to resume in the following days or weeks. At this point, you can close your futures contract at a much more favorable price because when the value of the underlying asset falls, so does the price of the contract.

Potential Risks of Futures Trading

Like all financial instruments, futures trading involves several risks that need to be considered.

- You could lose money: As with any investment, you can lose money in the futures markets. The key is to accurately predict where the markets are most likely to go to make a profit. If your prediction is wrong, you will incur a loss.

- Leverage risks: Leverage is highly sought after by professional traders because they can trade with more money than they hold in their account. However, this carries significant risk. With each trade, you should pay close attention to margin requirements because nothing would be worse than an unexpected margin call. Therefore, it’s important to maintain a safety margin, keep additional required margin, and ensure extra liquidity in case of emergencies. Simply put, if your futures position falls below your margin balance, you will be liquidated.

- Complexity: Futures trading can be quite complex. You’ll need to understand contract length, strike prices, minimum margin size, and more thoroughly. Before investing, it’s important to devise a clear investment scenario. What price do you want to enter at, where is the stop loss set, and at what price do you want to take profit? You should also consider your own reaction to different scenarios to be prepared for any eventuality.

- Settlement: If you trade through futures, you are obligated to buy or sell the asset at the agreed date. Most futures traders offload their contracts before expiry, but there are no guarantees you will manage to do so. It depends on factors like current market liquidity. In many cases, it’s wise to offload your contracts well in advance.

Given the above risks, you should ensure you fully understand how futures trading works before investing your money.

Futures trading – conclusion

Futures are an intriguing investment form often referred to as the pinnacle of trading disciplines. No surprise there, as the leverage involved is quite high, accompanied by significant risks, including the total loss of investment. However, very high profits can be achieved quickly.

There’s no doubt that as a beginner, you shouldn’t invest in futures due to the high risks involved. It’s advisable to first set up a demo account, extensively test strategies, and gain experience. Only then should you approach futures trading with a clear strategy, a well-thought-out investment scenario, and most importantly, without emotion. However, futures are not only suitable for speculation; they can also be used for hedging a portfolio or securing returns. Therefore, delving into the world of futures is particularly worth considering for experienced retail investors.

- Michaël van de Poppe: Bitcoin to Hit $500,000 This Cycle? 🚀💸 Or Just Another Crypto Fairy Tale? - December 21, 2024

- What is the Meme Coin Bonk, Price Predictions 2025–2030, and Why Invest in BONK? - December 18, 2024

- BNB Price Analysis: 17/12/2024 – To the Moon or Stuck on a Layover? - December 17, 2024

![Best Platforms for Copy Trading in [current_date format=Y] 9 Best Platforms for Copy Trading](https://cryptheory.org/wp-content/uploads/2024/12/copy-trading-350x250.jpg)

![Top 10 Cryptocurrency Platforms for Grid Trading in [current_date format=Y] 10 Top 10 Cryptocurrency Platforms for Grid Trading](https://cryptheory.org/wp-content/uploads/2024/12/grid-trading-350x250.jpg)

![BingX Exchange: A Detailed Guide to Using, Trading, and Maximizing Features in [current_date format=Y] 11 BingX Exchange: A Detailed Guide to Using, Trading, and Maximizing Features](https://cryptheory.org/wp-content/uploads/2024/11/4-5-350x250.jpg)