Due to global economic uncertainties, the price of gold has reached a new all-time high, surpassing $2,582 per ounce. This phenomenon confirms the tendency of investors to view gold as a safe haven, especially in times of crisis.

Meanwhile, Bitcoin (BTC) and other cryptocurrencies have been facing periods of instability and even significant declines, which further highlights investors’ search for safer alternatives like gold.

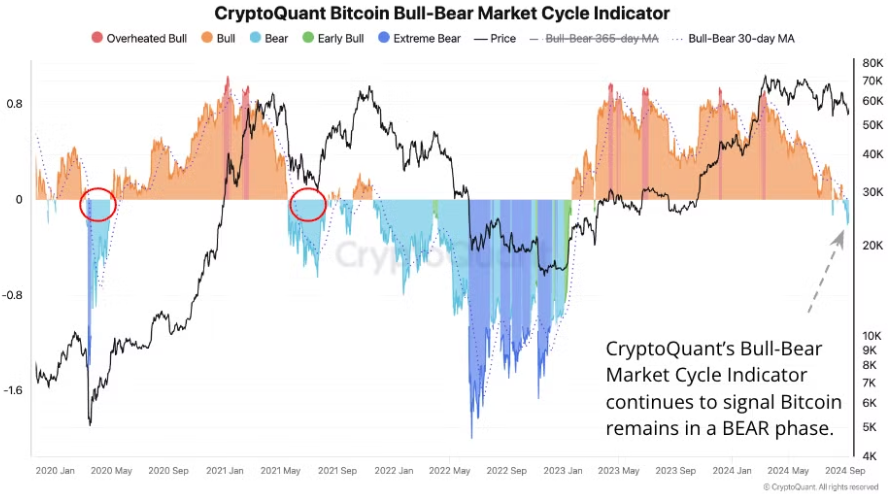

According to recent analyses from CryptoQuant, a renowned on-chain data provider, the cryptocurrency market has been in a downtrend since the end of August.

The company’s report emphasizes that while Bitcoin has depreciated significantly, gold has continued to rise, driven by geopolitical tensions. These include risks of armed conflict between Iran and Israel, as well as new developments in the conflict between Russia and Ukraine.

Gold moves in the opposite direction of stock and cryptocurrency markets

The correlation between Bitcoin and gold has hit one of the lowest points in the past year, revealing a market dynamic where, despite Bitcoin’s ongoing decline, gold has been showing upward momentum.

With recent declines in major U.S. stock indices, including the Nasdaq 100, S&P 500, and Dow Jones, investors have grown more cautious.

Since July, these indices have depreciated, negatively impacting Bitcoin’s value. In this scenario, many investors have opted to shift their resources to gold, seeking safety amid Bitcoin’s instability.

The same report indicates that, between September 10 and 16, Bitcoin suffered a depreciation of around 16%, while gold reached new historical highs.

At the same time, whales—large investors in the cryptocurrency market—have shown decreasing interest in Bitcoin, intensifying selling pressure on the cryptocurrency.

Investors await the Fed’s interest rate decision

Currently, Bitcoin is about 20% below its peak of $73,780, while gold continues its consistent rise.

Furthermore, it is expected that Bitcoin and other cryptocurrencies’ volatility will increase in the coming days due to anticipation surrounding the next moves by the U.S. Federal Reserve (Fed) regarding interest rates.

The expectation is that changes in interest rates by the Fed will directly influence investors’ behavior toward risk assets like Bitcoin.

A smaller-than-expected rate cut could stimulate increased demand for these assets, leading to a temporary rise in their prices.

On the other hand, a deeper rate cut could signal more serious problems in the U.S. economy. As a result, this would drive investors to seek refuge in safer assets, such as gold.

- Solana Price Analysis – December 18, 2024: The Slippery Slope of SOL 🚀📉 - December 18, 2024

- Bitcoin Price Analysis – 16/12/2024: A Dance in the Ascending Channel - December 16, 2024

- What is Monero, Price Predictions for 2025–2030, and Why Invest in XMR? - December 16, 2024