Table of Contents

Bitcoin has become one of the most sought-after assets in financial markets, and its growing popularity has led to the introduction of new investment tools. Spot Bitcoin ETFs provide an easy, secure, and regulated way to gain exposure to Bitcoin through traditional stock exchanges without the need to hold the cryptocurrency directly.

This guide will explain in detail how to invest in a Spot Bitcoin ETF, why it is gaining massive popularity, and the steps you need to follow to invest safely and effectively. If you are looking for a regulated and accessible way to gain exposure to Bitcoin, a Spot Bitcoin ETF is the ideal option.

What is an ETF?

An ETF (Exchange Traded Fund) is a publicly traded investment fund that tracks the performance of a specific asset or index. Investors can buy and sell ETFs on traditional stock exchanges, just like stocks, making them highly liquid and accessible.

ETFs can track various asset classes, including:

✅ Stock indices (e.g., S&P 500, Nasdaq)

✅ Commodities (gold, silver, oil)

✅ Bonds and currencies

✅ Cryptocurrencies, such as Spot Bitcoin ETFs

The main advantage of ETFs is that they allow investors to gain exposure to an asset without directly owning it, eliminating the complexities of storage and security—especially crucial for cryptocurrencies.

What is a Spot Bitcoin ETF?

A Spot Bitcoin ETF is a specific type of ETF that holds actual Bitcoin and allows investors to trade its shares on the stock exchange. This means that when you purchase shares of this ETF, you own a portion of the fund that holds real BTC, and your shares correspond to the amount of Bitcoin held by the fund.

How is a Spot Bitcoin ETF different from a Futures Bitcoin ETF?

🔹 A Spot Bitcoin ETF holds real Bitcoin, while a Futures Bitcoin ETF only speculates on future BTC prices using derivative contracts.

🔹 Spot ETFs are less risky, as their value is directly tied to Bitcoin’s market price.

🔹 Futures ETFs are more volatile, as they involve additional management costs related to futures contracts.

The approval of the first Spot Bitcoin ETFs in 2024 was a major breakthrough in regulated cryptocurrency investing, providing institutional and retail investors with easier access to Bitcoin through traditional financial markets.

Why is a Spot Bitcoin ETF So Popular?

Investing in Bitcoin through a Spot Bitcoin ETF offers several advantages, making it highly attractive to investors worldwide.

✅ Easy access to Bitcoin – No need to buy BTC on crypto exchanges, manage private keys, or handle complex transactions.

✅ No security risks – Your Bitcoin is securely held by an institution, eliminating the threat of hacks or lost access to wallets.

✅ Regulated environment – Spot Bitcoin ETFs are subject to financial regulations, increasing trust and credibility.

✅ Institutional adoption – Many large institutions cannot directly purchase Bitcoin, but they can safely invest through ETFs.

Due to these benefits, Spot Bitcoin ETFs are expected to attract billions of dollars and become one of the most significant investment vehicles in the cryptocurrency industry.

Where to Invest in a Spot Bitcoin ETF?

Spot Bitcoin ETFs are available on traditional stock exchanges, where their shares can be traded similarly to stocks.

Some of the most popular Spot Bitcoin ETFs include:

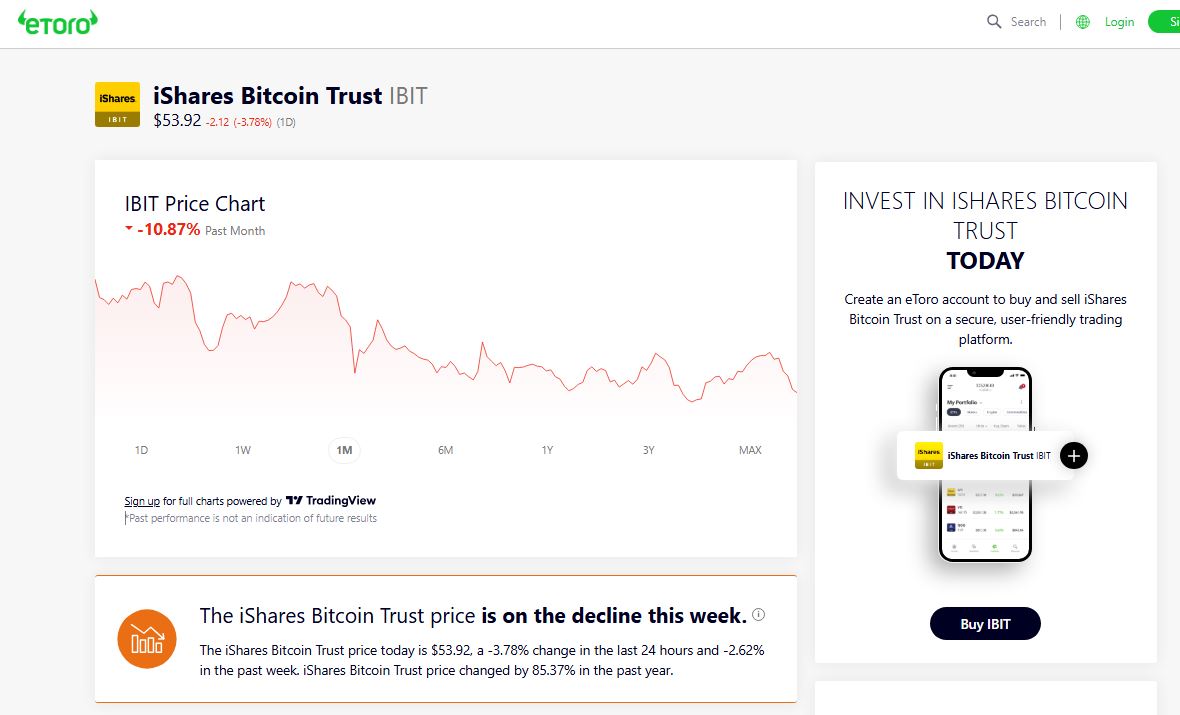

🔹 BlackRock iShares Bitcoin Trust (IBIT) – The largest and fastest-growing Bitcoin ETF.

🔹 Fidelity Wise Origin Bitcoin Trust (FBTC) – Low fees and strong backing from Fidelity.

🔹 Grayscale Bitcoin Trust (GBTC) – Transitioned from a private fund to a fully tradable ETF.

🔹 ARK 21Shares Bitcoin ETF (ARKB) – Managed by ARK Invest.

💡 Where to buy a Bitcoin ETF?

You can invest through traditional brokerage platforms, such as:

- XTB, DEGIRO, eToro – Suitable for European investors.

- Fidelity, Charles Schwab, Interactive Brokers – US brokers with access to the largest ETFs.

How to Invest in a Spot Bitcoin ETF – Step by Step

1️⃣ Choose a Broker

Select a platform that offers access to Bitcoin ETFs. Key factors to consider:

✔ Low trading fees

✔ Security and regulation

✔ Availability of the specific ETF you want to buy

2️⃣ Open an Investment Account

✔ Fill out your personal details and verify your identity

✔ Deposit funds via bank transfer or credit card

3️⃣ Find a Bitcoin ETF

✔ Search for the ETF by its ticker (e.g., IBIT, FBTC, GBTC)

4️⃣ Purchase ETF Shares

✔ Choose the number of shares

✔ Select the order type (market, limit, stop-loss)

✔ Confirm your purchase

5️⃣ Monitor Your Investment

✔ Regularly check the ETF’s performance

✔ Diversify your portfolio

Conclusion – Is It Worth Investing in a Spot Bitcoin ETF?

✅ A safe and regulated way to invest in Bitcoin

✅ No need to manage private keys

✅ Access for both retail and institutional investors

✅ Long-term growth potential

If you believe in Bitcoin’s future, a Spot Bitcoin ETF is one of the easiest and safest ways to gain exposure to its price movements

![How to Buy X Stocks [Twitter] – A Step-by-Step Guide 14 How to Buy X Stocks [Twitter] – A Step-by-Step Guide](https://cryptheory.org/wp-content/uploads/2025/02/2-14-350x250.jpg.webp)