On November 12, 2024, the cryptocurrency landscape experienced significant developments that have captured the attention of investors, analysts, and enthusiasts worldwide. From Bitcoin’s unprecedented surge to regulatory shifts and technological advancements, the day’s events underscore the dynamic and rapidly evolving nature of the crypto market. Below is a comprehensive overview of the top cryptocurrency news stories from November 12, 2024.

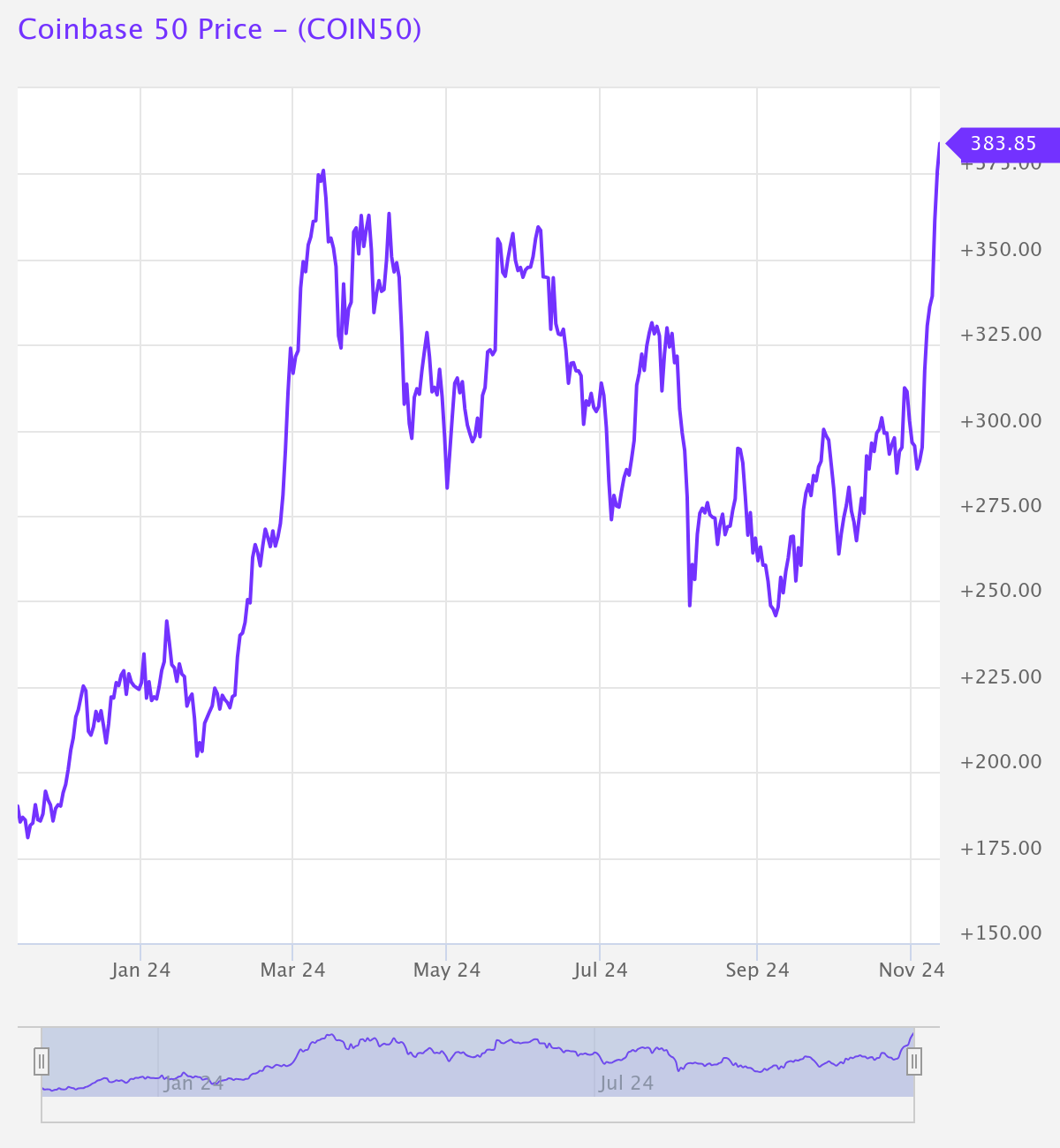

Coinbase Stock Hits a 3-Year High

Coinbase’s stock surged to its highest closing price since November 2021, reflecting renewed investor confidence. This growth comes amid a broader cryptocurrency rally and the re-election of Donald Trump, which many see as a boost for the crypto sector. Analysts attribute Coinbase’s success to its expanding global footprint, robust user base, and innovative offerings like institutional crypto custody services.

Source: TradingView

Strategic partnerships with financial giants like BlackRock have further solidified Coinbase’s position in the market. The exchange’s user-friendly platform continues to attract retail investors, while its advanced trading tools cater to institutional clients. Coinbase’s emphasis on regulatory compliance also makes it a go-to choice for institutions venturing into digital assets. As the market matures, Coinbase is well-positioned to capitalize on the growing adoption of cryptocurrencies.

Looking forward, Coinbase is also exploring integration with decentralized finance (DeFi) protocols, which could open new revenue streams. Its proactive approach to listing emerging altcoins has attracted a diverse user base, making it one of the most versatile exchanges globally. Despite ongoing market volatility, Coinbase’s innovative strategies and strong reputation have made it a beacon of resilience in the crypto space. (source)

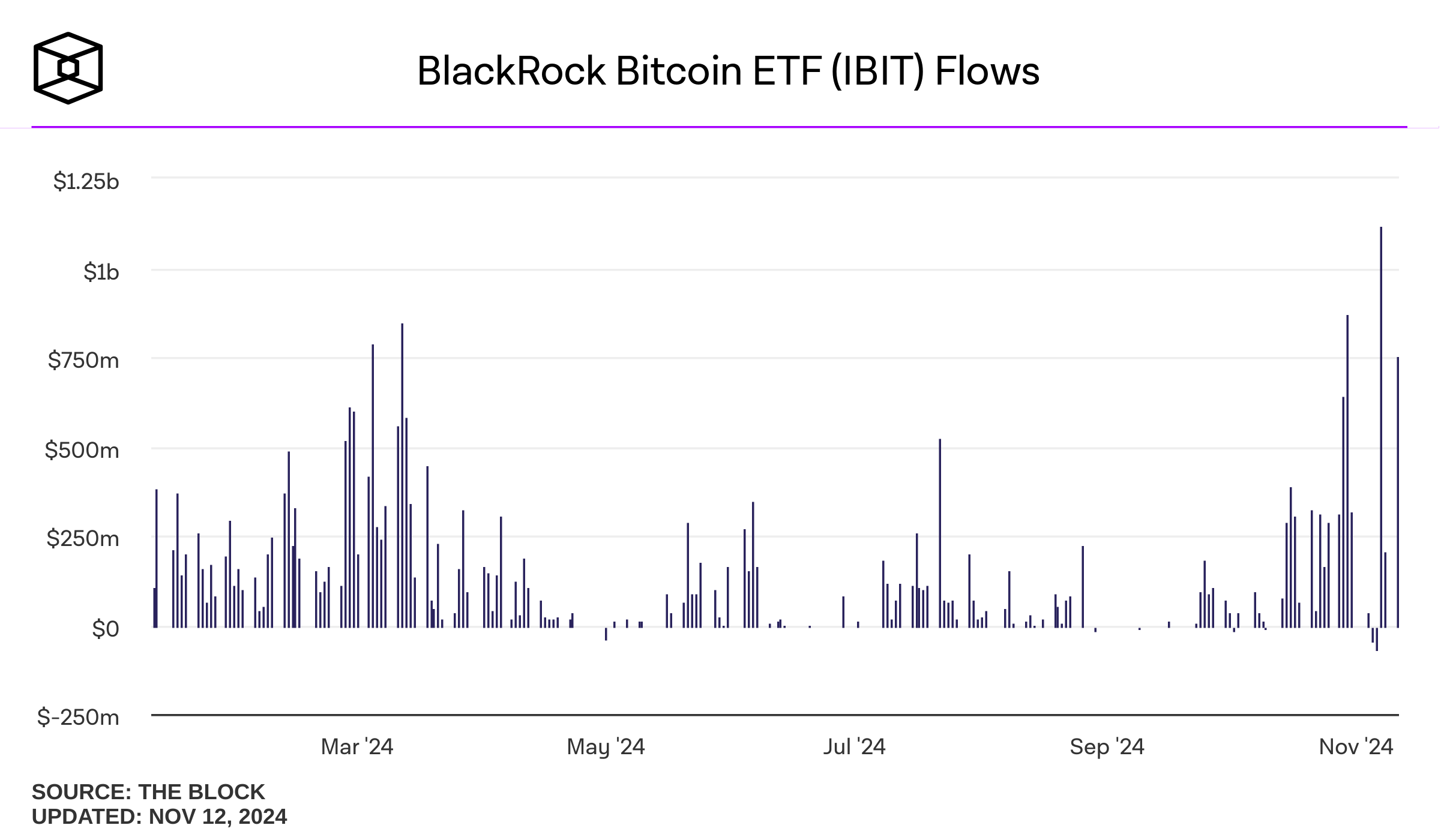

BlackRock’s Bitcoin ETF Breaks Record for Daily Inflows

BlackRock’s iShares Bitcoin ETF recorded unprecedented daily inflows, underscoring growing institutional demand for Bitcoin exposure. As a pioneer in traditional asset management, BlackRock’s crypto ventures lend credibility to the industry.

This ETF has set a new standard for cryptocurrency investment products, attracting significant attention from risk-averse investors. The fund’s structure allows investors to gain exposure to Bitcoin without dealing directly with the complexities of holding digital assets. Analysts predict that this success could spur the launch of additional ETFs targeting other cryptocurrencies, further legitimizing the market.

Moreover, the record-breaking inflows reflect a growing appetite for regulated investment vehicles in the crypto space. Institutional adoption of Bitcoin ETFs signals a shift toward mainstream acceptance, potentially paving the way for broader crypto adoption. BlackRock’s initiative demonstrates how traditional financial players can drive innovation in the digital asset market.

MicroStrategy Adds 27,200 BTC to Its Treasury

MicroStrategy announced another significant Bitcoin purchase, acquiring 27,200 BTC worth over $2 billion. CEO Michael Saylor reiterated the company’s belief in Bitcoin as a long-term store of value. This acquisition is one of the largest Bitcoin buys by a publicly traded company and reflects growing confidence in cryptocurrency as a corporate treasury asset. Despite price volatility, MicroStrategy’s Bitcoin holdings now exceed $10 billion, showcasing its commitment to the digital gold narrative.

MicroStrategy has acquired 27,200 BTC for ~$2.03 billion at ~$74,463 per #bitcoin and has achieved BTC Yield of 7.3% QTD and 26.4% YTD. As of 11/10/2024, we hodl 279,420 $BTC acquired for ~$11.9 billion at ~$42,692 per bitcoin. $MSTR https://t.co/uCt8nNUVqd

— Michael Saylor⚡️ (@saylor) November 11, 2024

Analysts view MicroStrategy’s move as a bold statement on Bitcoin’s potential as a hedge against inflation and fiat currency devaluation. The company’s aggressive accumulation strategy has set a precedent for other corporations considering crypto investments. With each purchase, MicroStrategy solidifies its reputation as a Bitcoin evangelist.

Looking ahead, MicroStrategy’s focus on Bitcoin could inspire other publicly traded companies to adopt similar strategies. As the crypto market matures, the integration of digital assets into corporate treasuries is likely to become more commonplace, further boosting institutional adoption.

Meme Coins Market Cap Reaches $120 Billion

The meme coin market capitalization hit a record $120 billion, reflecting increasing interest in meme-based cryptocurrencies. Despite their speculative nature, these tokens have captured the imagination of retail investors.

Projects like Dogecoin and Shiba Inu continue to dominate, but newer meme coins are also gaining traction. These tokens often leverage internet culture and community engagement to drive adoption. While critics argue that meme coins lack intrinsic value, their popularity demonstrates the power of social media in shaping investment trends.

The surge in meme coin interest highlights the evolving nature of the crypto market. By combining humor, relatability, and speculative appeal, meme coins have carved out a unique niche in the digital asset space.

Ethereum 3.0 Proposal Unveiled at Devcon

At the annual Devcon conference, Ethereum Foundation researcher Justin Drake introduced the “Ethereum 3.0” proposal, aiming to enhance scalability and security. The proposed upgrades focus on implementing sharding and zero-knowledge proofs to increase transaction throughput and reduce fees. This initiative is expected to address current network congestion issues, paving the way for broader adoption of decentralized applications (dApps) and smart contracts. The community has responded positively, viewing this as a pivotal step toward Ethereum’s evolution.

Tether Launches Wallet Development Kit for Non-Custodial Wallet Integration

Tether, the issuer of the USDT stablecoin, has introduced a Wallet Development Kit (WDK) designed to facilitate the integration of USDT into non-custodial wallets. This initiative aims to promote the adoption of stablecoins by providing developers with tools to seamlessly incorporate USDT into decentralized finance (DeFi) applications. The WDK includes features such as secure key management and multi-chain support, enhancing the utility and accessibility of Tether in the crypto ecosystem.

🤖 Introducing WDK by Tether: an open-source, self-custodial toolkit for developers to create Bitcoin and USD₮ wallets for humans, AI and robots. Built for a resilient future where your financial independence is in your hands.

Dive into the docs and get started!

Learn More:… pic.twitter.com/UpiV94saMr— Tether (@Tether_to) November 11, 2024

Coinbase Launches COIN50 Index Tracking Top Cryptocurrencies

Coinbase has unveiled the COIN50 Index, a benchmark designed to track the performance of the top 50 cryptocurrencies by market capitalization listed on its platform. This index provides investors with a comprehensive view of the crypto market’s movements, offering insights into market trends and asset performance. The COIN50 is expected to serve as a valuable tool for both retail and institutional investors seeking to gauge the overall health of the cryptocurrency market.

Shiba Inu Faces Volatility Amid Profit-Taking

Shiba Inu (SHIB) experienced significant volatility on November 12, 2024, as traders scrambled to secure profits following a sharp rally earlier in the week. The token saw its price retrace from the $0.00003100 resistance level, dipping toward the $0.00002300 support. Analysts attributed the decline to high-volume sell-offs driven by profit-taking and a lack of fresh catalysts to sustain the bullish momentum. Despite the downturn, SHIB’s trading volume remains robust, hinting that buyers may step in at lower levels to support a potential recovery. Traders are advised to monitor key support zones for signs of stabilization.

Read more: Shiba Inu (SHIB) Price Analysis 13/11/2024: The Woof and the Whimper

Top 5 cryptocurrency gainers and losers are as follows:

Top 5 Gainers:

- Goldcoin (GLC): Increased by 135.3% to $0.07540, with a 24-hour trading volume of $50,515.52.

- BONGO CAT (BONGO): Rose by 121.0% to $0.06994, with a 24-hour trading volume of $9,158,674.

- STRATEGIC BITCOIN RESERVE (SBR): Gained 92.9%, reaching $2.93, with a 24-hour trading volume of $11,812,499.

- Peanut the Squirrel (PNUT): Increased by 86.7% to $0.9122, with a 24-hour trading volume of $1,672,340,796.

- First Convicted RACCON (FRED): Rose by 75.8% to $0.05365, with a 24-hour trading volume of $37,470,765.

Top 5 Losers:

- PAAL AI (PAAL): Decreased by 55.9% to $0.1331, with a 24-hour trading volume of $59,841,860.

- Happy Cat (HAPPY): Dropped by 31.7% to $0.02048, with a 24-hour trading volume of $24,454,663.

- ORIGYN Foundation (OGY): Fell by 26.3% to $0.004985, with a 24-hour trading volume of $202,919.

- Cronos (CRO): Decreased by 26.1% to $0.1575, with a 24-hour trading volume of $436,759,752.

- CorgiAI (CORGIAI): Dropped by 25.3% to $0.001464, with a 24-hour trading volume of $1,927,648.

These figures reflect the dynamic nature of the cryptocurrency market, where prices can fluctuate significantly within short periods. Investors are advised to conduct thorough research and exercise caution when making investment decisions.

The most important cryptocurrency news of November 12, 2024: Conclusion

The cryptocurrency landscape on November 12, 2024, showcased remarkable progress and resilience. From technological breakthroughs to regulatory advancements, the day underscored the dynamic nature of the crypto ecosystem. These developments highlight the industry’s potential to drive innovation and transform traditional financial systems.

As we look ahead, the growing adoption of blockchain technology and the increasing collaboration between traditional finance and crypto projects signal a promising future for the sector. Stay tuned for more updates as the crypto world continues to evolve at a rapid pace.

- Michaël van de Poppe: Bitcoin to Hit $500,000 This Cycle? 🚀💸 Or Just Another Crypto Fairy Tale? - December 21, 2024

- What is the Meme Coin Bonk, Price Predictions 2025–2030, and Why Invest in BONK? - December 18, 2024

- BNB Price Analysis: 17/12/2024 – To the Moon or Stuck on a Layover? - December 17, 2024