As the cryptocurrency landscape continues to evolve, November 3, 2024, brought several significant developments. From market movements to regulatory updates, these events are shaping the future of digital assets. Below is a comprehensive overview of the most impactful cryptocurrency news from the last weekend.

Crypto Industry’s Record Election Spending Aims for Regulatory Favor

The cryptocurrency industry has invested approximately $160 million in the current election cycle, surpassing traditional corporate political spending. Major firms such as Ripple and Coinbase are leading these contributions, aiming to influence favorable regulatory changes. Key legislative goals include establishing clear frameworks for stablecoins and crypto tokens, potentially shifting oversight from the Securities and Exchange Commission (SEC) to the Commodity Futures Trading Commission (CFTC). Despite the substantial lobbying efforts, significant legislative progress may not materialize until after the new Congressional session in 2025.

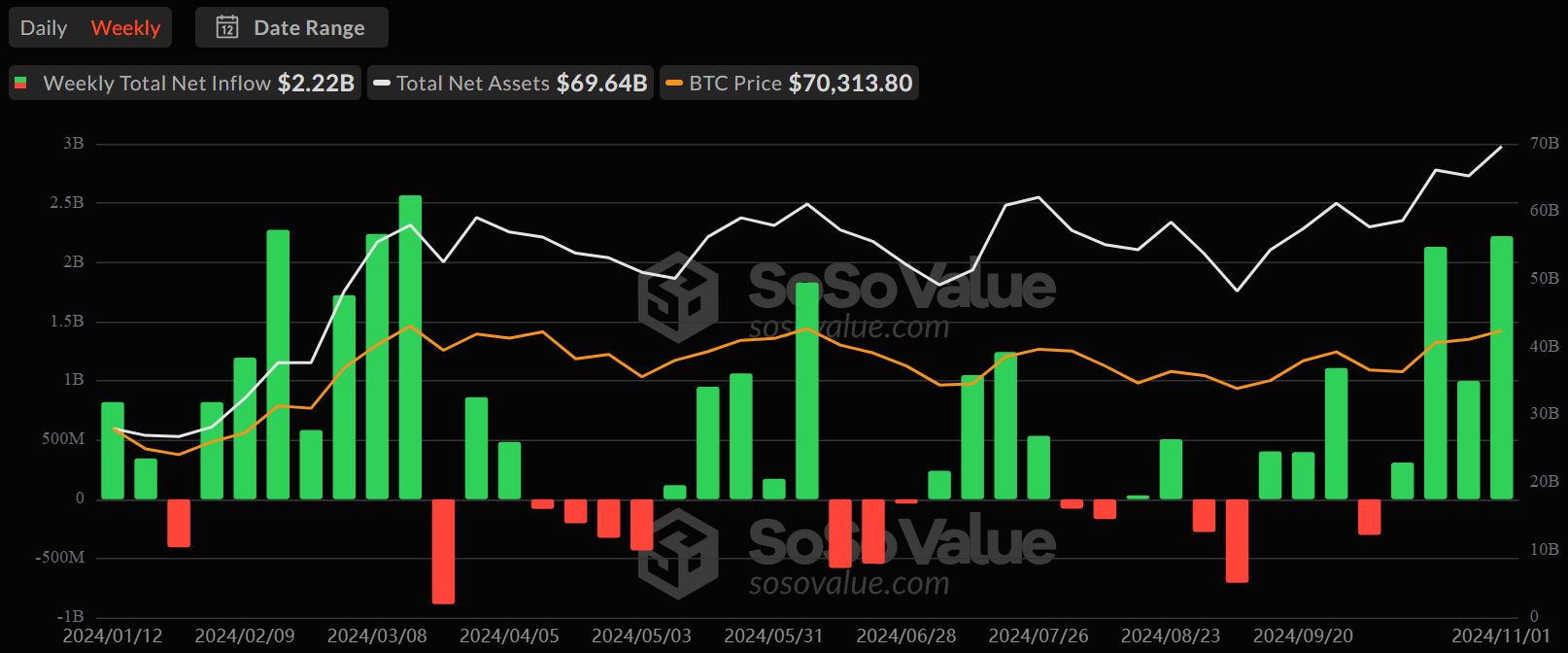

Crypto ETFs See Significant Inflows Ahead of U.S. Election

Investors have significantly increased their investment in cryptocurrency ETFs ahead of the U.S. presidential election, particularly those tracking Bitcoin. On November 1, Bitcoin ETFs saw net inflows of $917.2 million, with BlackRock’s iShares Bitcoin Trust ETF alone attracting $872 million. This surge is driven by optimism for possible crypto-friendly legislation if Trump’s party gains control. The crypto derivatives market is also bracing for high volatility, with potential daily price swings projected through November 8.

Ripple Expands Partnership with UAE to Enhance Cross-Border Payments

Ripple has strengthened its partnership with the United Arab Emirates to facilitate faster and more cost-effective cross-border payments using its RippleNet technology. This expansion comes as the UAE seeks to position itself as a global hub for digital finance. Ripple’s collaboration aims to streamline remittance services, benefiting both businesses and individual customers in the region. By leveraging blockchain technology, Ripple aims to make international payments as simple as domestic ones, thus positioning itself as a leader in financial technology innovation.

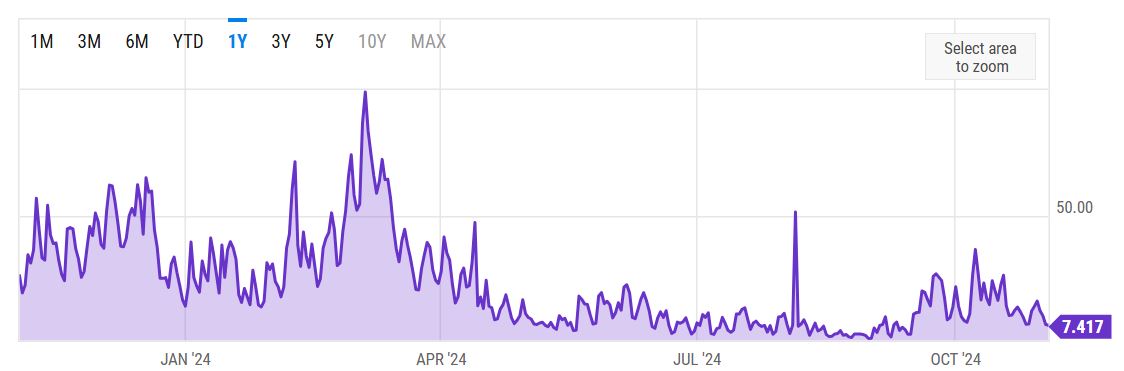

Ethereum Gas Fees Hit Six-Month Low as Network Activity Slows

Ethereum gas fees have dropped to their lowest levels in six months due to a decrease in on-chain activity. The average transaction fee now hovers around $1.30, a stark contrast to the highs seen during the summer of 2024. Analysts attribute this reduction to a slowdown in DeFi and NFT activity on the Ethereum network. However, some view this dip as a window for developers to focus on optimizing and preparing for future demand. Lower gas fees make Ethereum more accessible for users, potentially drawing interest back into DeFi and NFT spaces.

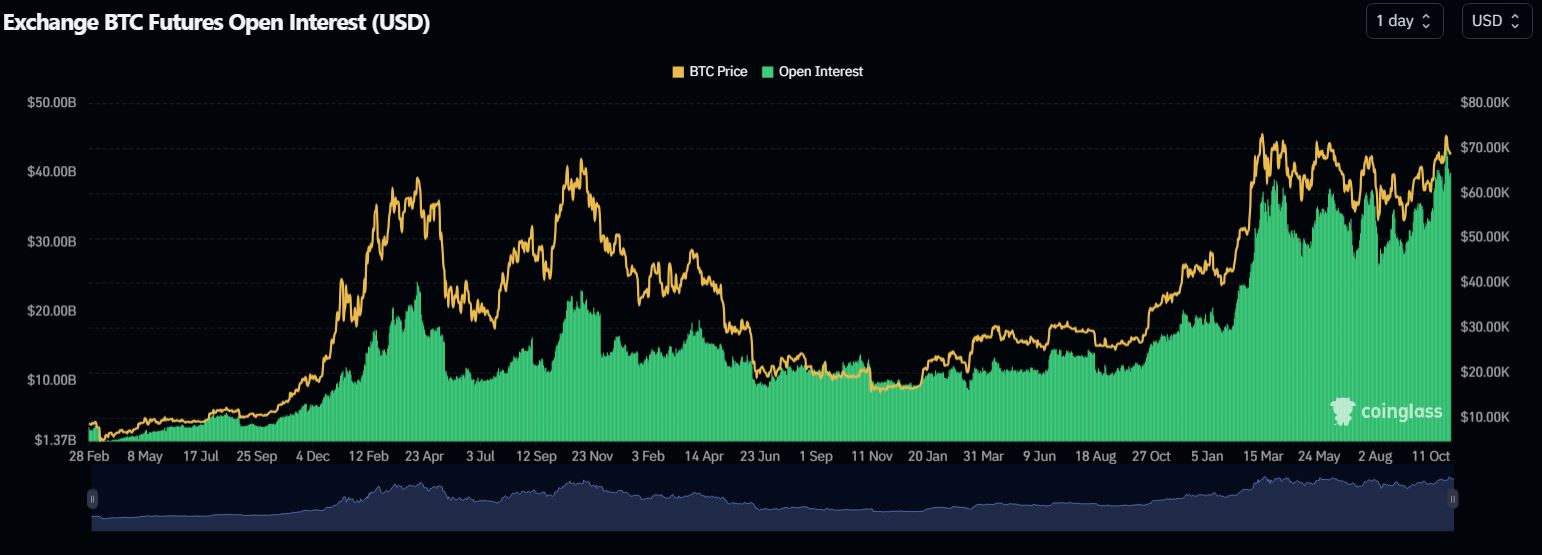

Bitcoin Derivatives Market Signals Anticipated Volatility

Bitcoin’s derivatives market is signaling heightened volatility as traders prepare for the potential impacts of the U.S. presidential election on the crypto market. The increase in open interest for Bitcoin futures and options reflects traders’ expectations of significant price swings in the coming days. Analysts suggest that the election’s outcome, coupled with anticipated changes in crypto regulation, could lead to substantial price fluctuations, with potential impacts on Bitcoin’s spot price. If pro-crypto policies are implemented post-election, this could set the stage for continued growth in Bitcoin’s price; however, regulatory uncertainty could equally lead to price corrections. The volatility observed in the derivatives market highlights how closely financial instruments are tied to broader economic and political conditions, signaling a cautious approach by traders ahead of major policy shifts. This anticipated volatility underscores the role of political factors in shaping the future of digital assets.

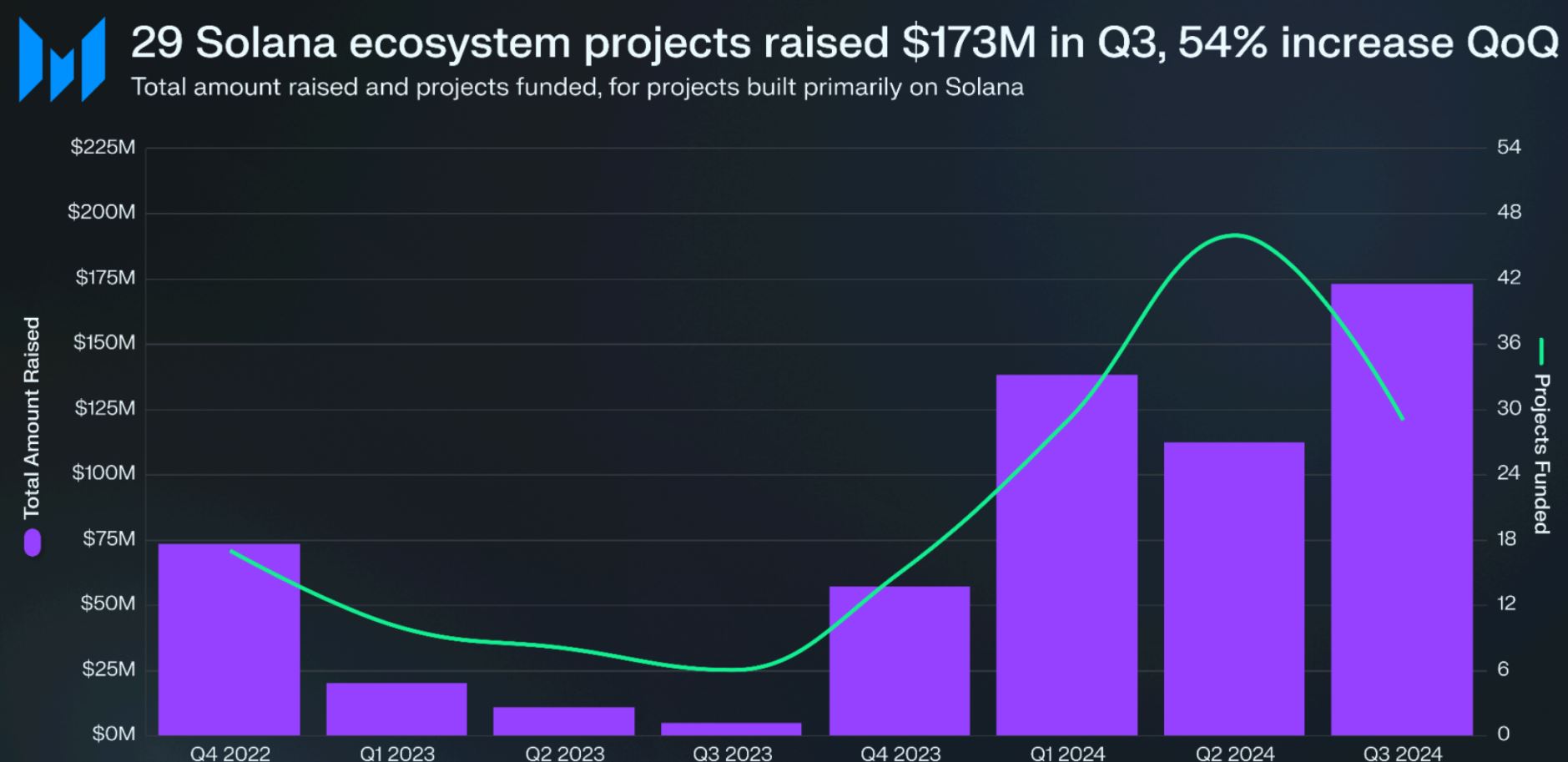

Institutional Investments in Solana DApps Surge

Institutional investments in Solana-based decentralized applications (DApps) have surged by 54% in Q3 of 2024, reaching $173 million. This increase is a testament to the growing confidence in Solana’s ecosystem, known for its scalability and low transaction costs. Institutional investors are particularly attracted to Solana’s DeFi and NFT sectors, as these applications continue to gain popularity among retail users. With Solana’s expanding ecosystem, industry experts predict that the network will play a crucial role in the future of DeFi, offering investors a robust alternative to Ethereum. The rise in investment also reflects Solana’s ability to attract high-profile partnerships, positioning it as a major player in the blockchain space. This trend is expected to continue as more institutions seek exposure to blockchain technology beyond Bitcoin and Ethereum.

Tether Announces Dirham-Pegged Stablecoin on TON Blockchain

Tether has announced plans to launch a Dirham-pegged stablecoin on the TON blockchain, a move aimed at strengthening its presence in the Middle East. This new stablecoin, tied to the United Arab Emirates Dirham (AED), represents Tether’s first regional currency-pegged stablecoin outside of USD, EUR, and CNH-pegged tokens. The TON blockchain, known for its speed and efficiency, will enable Tether to provide users in the Middle East with faster and more reliable digital asset services. The initiative reflects Tether’s strategic efforts to diversify its stablecoin offerings and tap into emerging markets. Industry experts view this move as a positive development, potentially increasing stablecoin adoption in regions with high remittance volumes. This announcement comes as the UAE ramps up its efforts to become a global hub for digital finance and blockchain innovation.

The top 5 gainers in the last 24 hours are:

- Sui (SUI) +4.80%

- Conflux (CFX) +3.13%

- Immutable (IMX) +3.07%

- JasmyCoin (JASMY) +2.78%

- Brett (BRETT) +2.59%

Top 5 losers are:

- THORChain (RUNE) -5.32%

- Flare (FLR) -4.31%

- Popcat (POPCAT) -4.22%

- FLOKI (FLOKI) -2.79%

- Kaia (KAIA) -2.44%

Conclusion: The most important cryptocurrency news of November 3,2024

In conclusion, November 3, 2024, brought several notable developments in the cryptocurrency market, from strategic partnerships and technological advancements to significant investment moves by major players. The evolving regulatory landscape and the outcome of the U.S. election will likely play a pivotal role in shaping the industry’s future. As blockchain technology continues to mature, stakeholders in the crypto world are closely watching these trends, positioning themselves for a transformative year ahead.

- Michaël van de Poppe: Bitcoin to Hit $500,000 This Cycle? 🚀💸 Or Just Another Crypto Fairy Tale? - December 21, 2024

- What is the Meme Coin Bonk, Price Predictions 2025–2030, and Why Invest in BONK? - December 18, 2024

- BNB Price Analysis: 17/12/2024 – To the Moon or Stuck on a Layover? - December 17, 2024