As the United States embarks on its presidential election, the cryptocurrency landscape is experiencing significant developments. From regulatory shifts to technological advancements, November 5, 2024, has been a pivotal day for the crypto community. Below is a comprehensive overview of the most impactful events:

U.S. Presidential Election Sparks Crypto Market Volatility

The U.S. presidential election between Donald Trump and Kamala Harris has introduced notable volatility in the cryptocurrency markets. Analysts predict that Bitcoin could experience significant price movements based on the election outcome. A Trump victory is anticipated to boost Bitcoin’s price, while a Harris win might lead to a temporary decline. However, long-term trends are expected to be influenced more by macroeconomic factors than the election results.

Hedge Fund Manager Predicts Post-Election Market Movements

Renowned hedge fund manager Jim Roppel predicts significant market movements following the tight U.S. presidential election. While the election results will impact market volatility, Roppel believes the upcoming Federal Reserve meeting and tech earnings will have a more substantial effect on investors. He remains optimistic about Bitcoin’s performance, advising investors to stay calm and adhere to their investment strategies.

UK Government Holds Over £3 Billion in Seized Bitcoin

After seizing 61,000 bitcoins from Jian Wen, a former takeaway worker involved in a massive investment scam, the UK government now holds over £3 billion in Bitcoin. This makes the UK government the third-largest Bitcoin holder globally. Authorities are considering various options for these assets, including returning them to victims, selling, or even destroying some digital assets. The situation highlights the complexities of managing such volatile assets.

Binance Challenges SEC’s Amended Complaint

Binance’s legal team has filed a motion to dismiss the U.S. Securities and Exchange Commission’s (SEC) amended securities complaint. The exchange argues that the SEC’s allegations lack merit and that the regulatory body has overstepped its authority. This legal battle underscores the ongoing tension between cryptocurrency exchanges and regulatory authorities.

“The SEC pays lip service to the Court’s ruling that crypto assets are not in and of themselves “securities,” but refuses to accept the logical conclusion of that ruling,” the filing said.

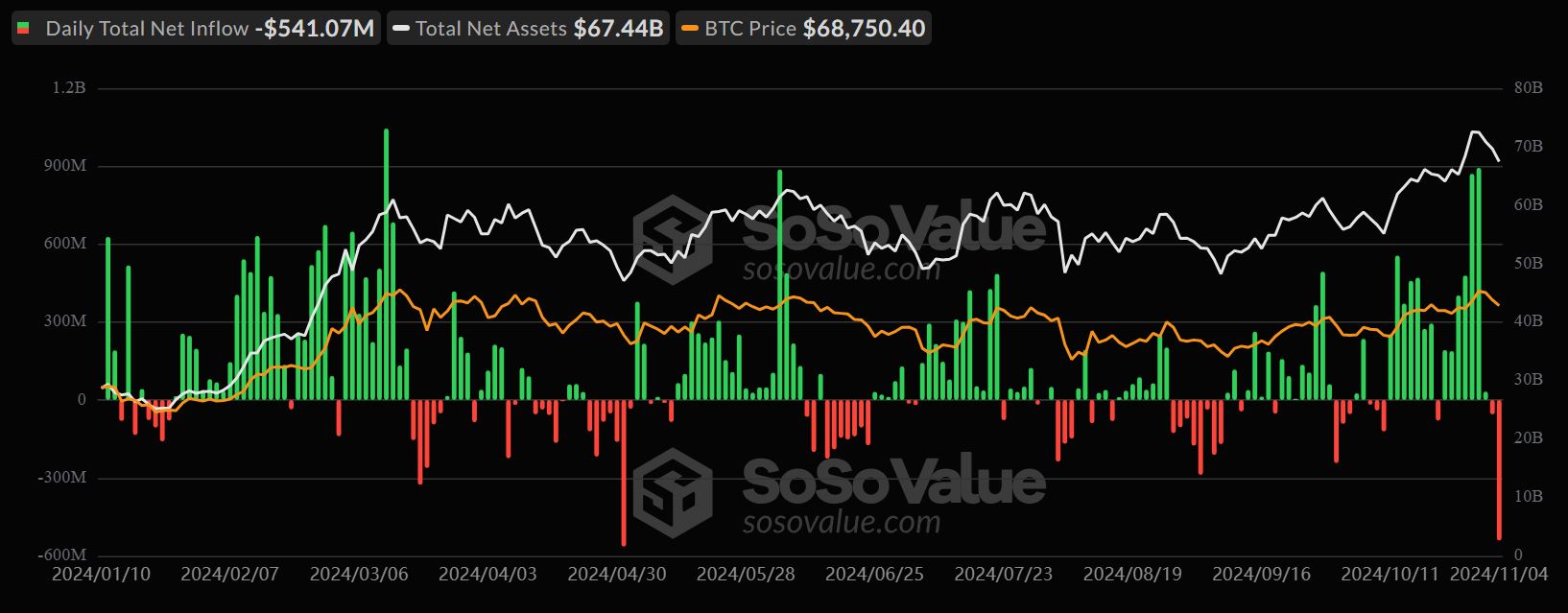

Spot Bitcoin ETFs Experience Significant Outflows

Spot Bitcoin ETFs have seen $541 million in outflows, marking the largest daily negative flow since May. This trend indicates investor caution amid the current market volatility and the uncertain outcome of the U.S. presidential election. Analysts suggest that these outflows may be temporary, with potential for recovery post-election.

Ethereum Devcon Attendee Victim of Robbery in Bangkok

An attendee of Ethereum’s Devcon conference has fallen victim to a violent robbery in Bangkok. The individual was reportedly assaulted and had valuable items stolen. This incident raises concerns about the safety of crypto enthusiasts traveling for conferences and highlights the need for increased security measures at such events.

Swift, UBS, and Chainlink Complete Pilot for Tokenized Funds Settlement

Financial giants Swift, UBS, and Chainlink have successfully completed a pilot project for settling tokenized funds. This initiative demonstrates the potential for blockchain technology to streamline financial transactions and reduce settlement times. The successful pilot could pave the way for broader adoption of tokenized assets in traditional finance.

Cameron Winklevoss Urges Crypto Community to Support Trump

Cameron Winklevoss, co-founder of Gemini, has called on the crypto community to vote for Donald Trump in the presidential election. He argues that a Trump administration would be more favorable to the crypto industry, potentially leading to more supportive regulations. This endorsement reflects the industry’s desire for a regulatory environment conducive to innovation.

The Harris-Biden Administration has cost the crypto industry $500 million in legal fees. Vote Trump and this goes to $0. Vote Harris and this will balloon to $ billions. Choose wisely.

— Cameron Winklevoss (@cameron) November 5, 2024

Metaplanet Joins CoinShares Blockchain Global Equity Index

Metaplanet has been officially added to the CoinShares Blockchain Global Equity Index, marking a major step for the company as it secures its position in global blockchain markets. The inclusion of Metaplanet demonstrates its influence and the broader interest in blockchain-focused equities, reflecting investor confidence in blockchain technology. Industry analysts expect this addition to boost Metaplanet’s visibility and attract more institutional investors interested in blockchain.

Ripple Labs Increases Investment in Carbon Reduction Initiatives

Ripple Labs has announced an increase in its commitment to environmental sustainability, pledging to invest an additional $100 million in carbon offset and reduction projects. This move aligns with Ripple’s goal to become carbon neutral by 2030 and highlights its dedication to environmental responsibility amid the growing criticism of blockchain’s carbon footprint. Ripple’s enhanced focus on sustainability is aimed at addressing regulatory concerns while positioning itself as a leading environmentally-conscious player in the crypto industry.

Japanese Banking Giant Launches Crypto Custody Services

Mitsubishi UFJ Financial Group (MUFG), one of Japan’s largest banks, has launched a cryptocurrency custody service aimed at institutional investors. The service, which covers Bitcoin, Ethereum, and select stablecoins, allows MUFG’s clients to securely store digital assets within the bank’s infrastructure. MUFG’s entry into crypto custody represents a significant endorsement of the digital asset space, further legitimizing cryptocurrency in traditional financial sectors.

Conclusion: The Most Important Cryptocurrency News of November 5, 2024

November 5, 2024, has proven to be a transformative day for cryptocurrency, with notable events shaping the market amid the U.S. presidential election. The election outcome, alongside advancements in blockchain technology, the launch of new financial products, and efforts toward sustainability, will likely drive substantial change across the crypto landscape in the coming months.

As cryptocurrencies gain institutional acceptance and as companies work toward greener solutions, the crypto market is evolving quickly. Investors and enthusiasts alike will be closely watching how these developments unfold, especially as regulations and industry dynamics adapt to both political and technological changes.

- Michaël van de Poppe: Bitcoin to Hit $500,000 This Cycle? 🚀💸 Or Just Another Crypto Fairy Tale? - December 21, 2024

- What is the Meme Coin Bonk, Price Predictions 2025–2030, and Why Invest in BONK? - December 18, 2024

- BNB Price Analysis: 17/12/2024 – To the Moon or Stuck on a Layover? - December 17, 2024

![Best Platforms for Copy Trading in [current_date format=Y] 20 Best Platforms for Copy Trading](https://cryptheory.org/wp-content/uploads/2024/12/copy-trading-120x86.jpg)