October 28, 2024, brought significant developments in the cryptocurrency market, from Bitcoin’s price surge to regulatory shifts and security updates. Here’s a comprehensive overview of the top 10 news stories with insights.

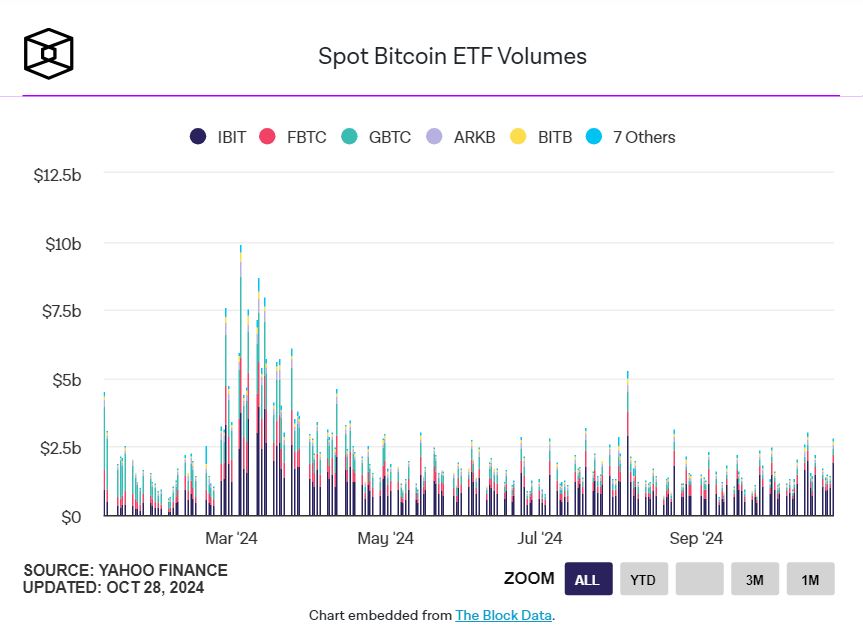

1. Bitcoin Surges Past $70,000 with ETF Inflows

Bitcoin climbed over $70,000, driven by strong inflows into Bitcoin ETFs. This achievement marks Bitcoin’s highest point in seven months, with analysts suggesting that institutional investment and positive sentiment are fueling the growth. Continued ETF inflows may indicate an extended rally as investors prepare for upcoming U.S. elections. Read more on The Block.

2. Ethereum Faces Pressure as Layer 2 Adoption Rises

Ethereum’s mainnet is seeing reduced activity as users turn to Layer 2 solutions for lower fees and faster transactions. This trend highlights the growing competitiveness of Layer 2 networks, which may eventually force Ethereum to adapt its core network to maintain its edge.

3. Tether CEO Addresses Reserve Concerns Amid Investigation Rumors

Tether’s CEO spoke out against speculation surrounding USDT’s reserves, providing reassurance to investors amid reports of a U.S. government investigation. This clarification helped stabilize USDT and reassured the market, especially as stablecoins remain critical for liquidity.

4. U.S. Recovers Millions from Recent Crypto Hack

The U.S. government recovered $19.3 million in crypto assets following a recent hack. This retrieval is part of ongoing efforts to enhance crypto security and underscores the government’s dedication to combating cybercrime in the digital space.

5. Solana’s Phantom Wallet Experiences Downtime

Phantom, Solana’s popular wallet, faced an outage during the anticipated GRASS token airdrop, causing account balances to display incorrectly. This incident has raised concerns about Solana’s ability to handle high traffic, especially during peak events.

6. Bitcoin Predicted to Hit $125,000 if Republicans Win

Analysts at Standard Chartered projected that Bitcoin’s price could reach $125,000 if Republicans secure congressional control, based on favorable policies and potential economic boosts. The report underscores the possible political influence on crypto markets.

7. Vitalik Buterin Defends Ethereum Foundation’s ETH Sales

Ethereum’s co-founder, Vitalik Buterin, defended the foundation’s ETH sales, explaining it as a strategy to fund development. The statement comes amid community scrutiny over whether these sales could affect ETH’s price stability.

Buterin’s remark followed a report from crypto tracking platform Lookonchain in September, which revealed that the Ethereum Foundation had sold almost 3,466 ETH (valued at approximately $9.67 million at that time) since the start of the year. Lookonchain noted that these sales occurred roughly every 11 days, with each transaction involving an average of 151 ETH (worth around $421,000).

“One internal reason why has been that we don’t want to be in the situation of being forced to make an “official choice” in the event of a contentious hard fork,” Buterin wrote. “One interesting idea around this that is being considered is giving some grants in the form of “you can stake our ETH, you choose how as long as it’s ethical, and keep the upside”.”

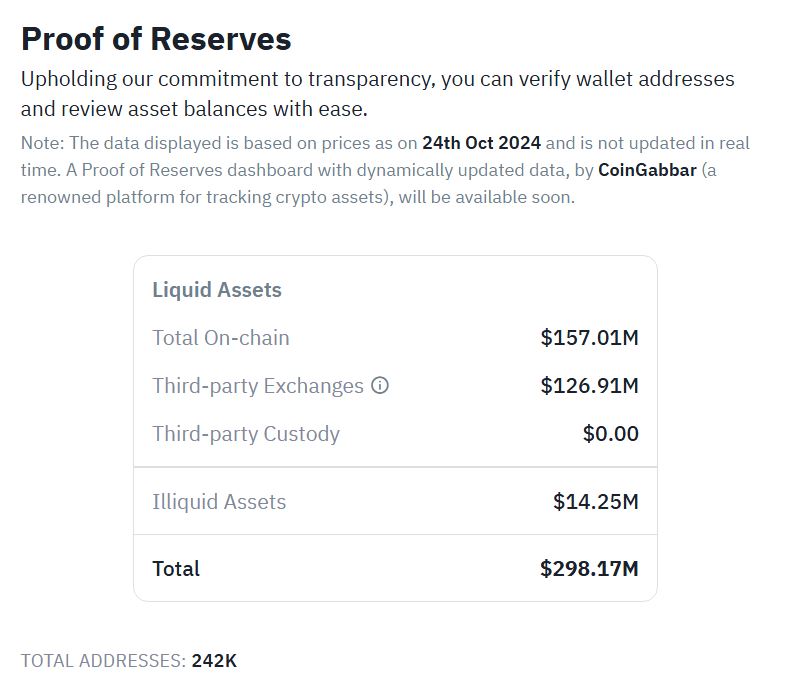

8. WazirX Publishes Proof of Reserves After $230M Hack

Following a major hack, WazirX released a Proof of Reserves report to address transparency concerns. This move aims to restore trust in the exchange, which has faced criticism over security lapses.

9. MicroStrategy Stock Surges as Bitcoin Price Climbs

MicroStrategy, a publicly-traded company with substantial Bitcoin holdings, saw its stock reach new highs alongside Bitcoin’s rally. The company’s strategy of accumulating Bitcoin has proven to be lucrative, with its shares rising in tandem with Bitcoin’s market price. MicroStrategy’s success highlights the potential gains for companies holding Bitcoin on their balance sheets, especially as Bitcoin edges closer to $72,000.

10. Emory University Invests $16 Million in Bitcoin Trust

In a groundbreaking move for academic institutions, Emory University invested $16 million in the Grayscale Bitcoin Mini Trust. This decision places Emory among the first universities to adopt Bitcoin as part of their investment portfolios, following the lead of companies like Tesla and Block. This institutional adoption reflects a growing belief in Bitcoin’s long-term potential as a hedge against traditional economic risks.

Bitcoin’s latest market movements

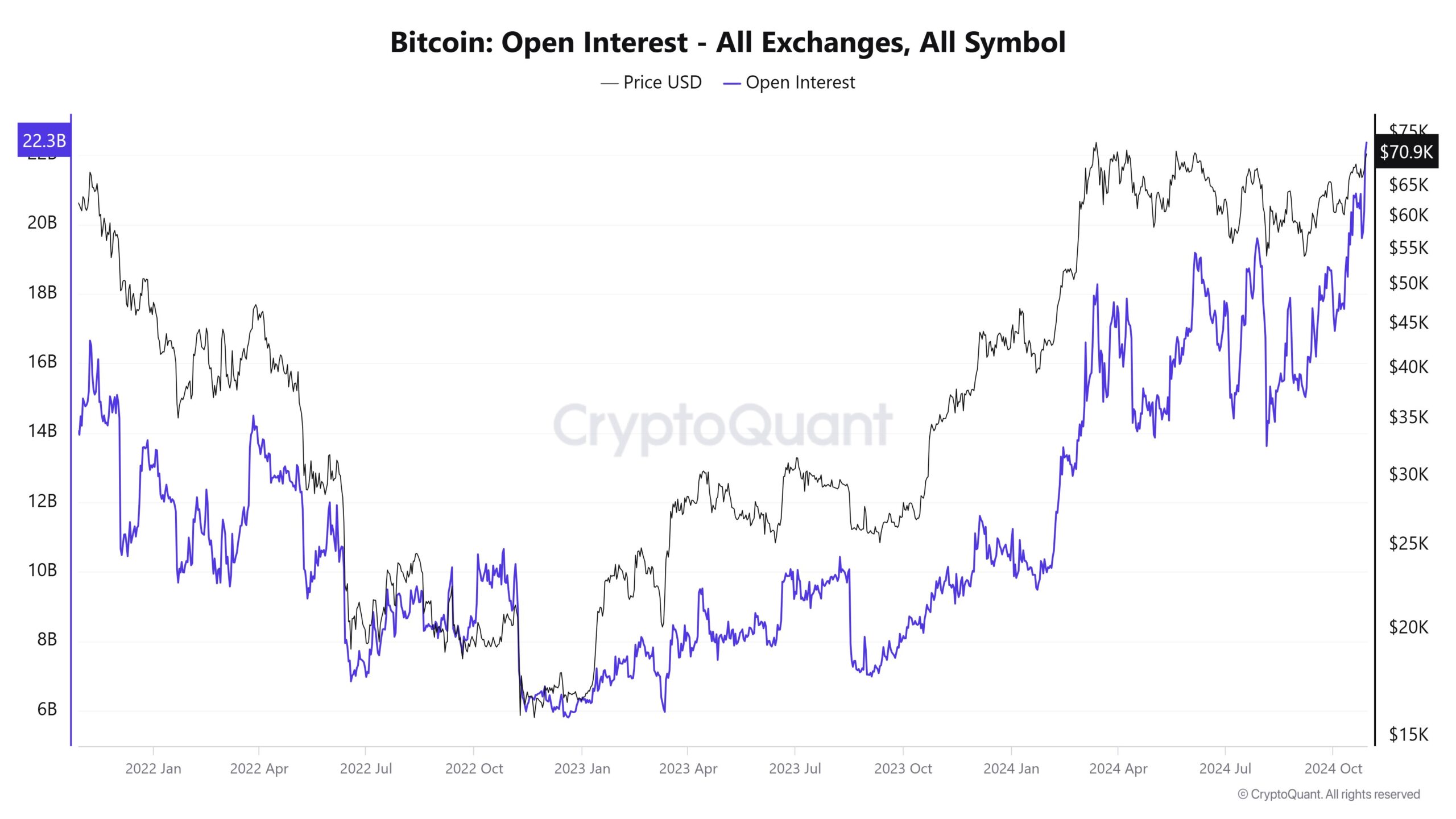

Bitcoin has recently shown notable market activity, with a mix of bullish indicators and potential challenges. Following a rally that pushed it past the $65,000 barrier, Bitcoin is now approaching the $71,000 mark, driven by strong investor sentiment and large inflows into Bitcoin ETFs. This optimism is partially fueled by the upcoming U.S. elections, with analysts predicting that a favorable regulatory environment could further boost Bitcoin’s performance. Some even project that a Republican victory might help Bitcoin achieve new highs, potentially exceeding its all-time high of $73,666.

Alongside rising prices, Bitcoin’s open interest across derivatives markets has also surged, reaching around $22.3 billion (all-time high ois $39 billion). This metric, representing the total outstanding futures and options contracts, reflects strong market engagement. However, there is also cautious optimism, as the long-short ratio indicates a near-equal split between buying and selling volume, suggesting that traders remain divided on Bitcoin’s short-term direction.

Moreover, recent interest rate cuts and global liquidity injections have supported Bitcoin’s rally, as investors shift from low-yield assets to riskier ones like cryptocurrencies. Analysts point out that the combination of macroeconomic factors and increased adoption by institutional players, including notable investments by entities like MicroStrategy, could keep Bitcoin on an upward trend, possibly reaching between $75,000 to $100,000 by year-end.

In conclusion, while Bitcoin’s recent momentum signals growth potential, factors like profit-taking by long-term holders and geopolitical events may influence its stability in the near term. The upcoming months, particularly post-election, will be critical in determining whether Bitcoin can sustain this rally or face a pullback.

Conclusion: The most important cryptocurrency news of October 28, 2024

October 28, 2024, underscored the cryptocurrency market’s dynamic nature, with notable gains, regulatory challenges, and security updates. As the crypto landscape evolves, these stories reflect the sector’s growing significance in global finance. For investors and enthusiasts, staying informed on these trends is essential for navigating this volatile yet promising industry.

- Solana Price Analysis – December 18, 2024: The Slippery Slope of SOL 🚀📉 - December 18, 2024

- Bitcoin Price Analysis – 16/12/2024: A Dance in the Ascending Channel - December 16, 2024

- What is Monero, Price Predictions for 2025–2030, and Why Invest in XMR? - December 16, 2024