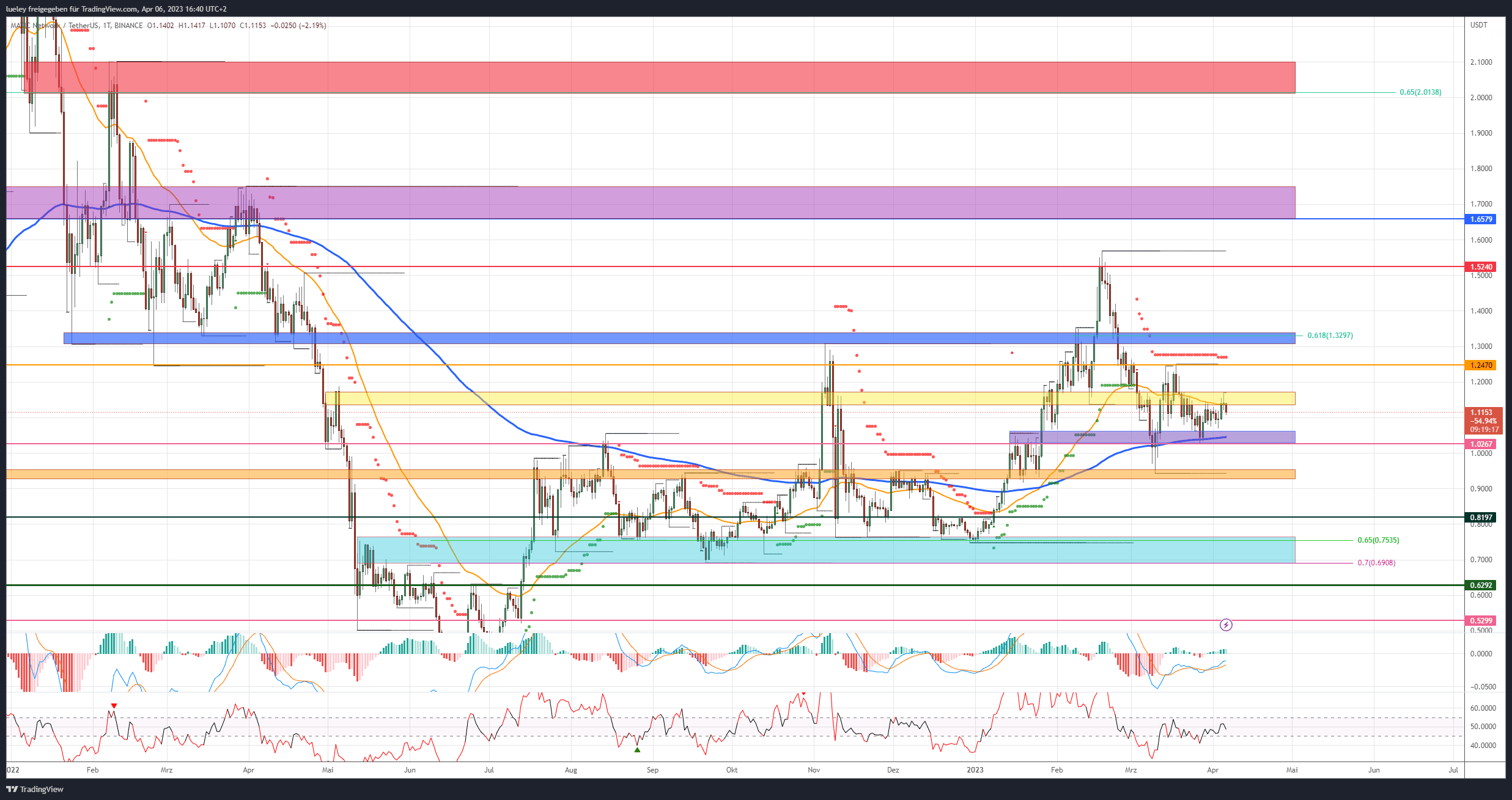

Ethereum Layer 2 project Polygon (MATIC) price has been in correction since mid-February. As a result, the MATIC price slipped to the old breakout level of the 2023 price rally at $0.95. Here, the buy side was able to stabilize Polygon and buy back up to the horizontal resistance at $1.25. A new wave of corrections then set in towards $1.02. Although the bulls recently prevented a renewed fall towards the previous month’s low, they themselves did not succeed in recapturing the yellow resistance zone at 1.17 US dollars in the last few trading days. Despite a new gaming partnership with the crypto project Immutable (IMX), there has recently been a lack of technical impetus in the charts. Only a sustained breakout above the last intermediate high of 1.25 US dollars should give the MATIC course new impetus.

Polygon: The bullish price targets

Bullish price targets: 1.17 USD/1.13 USD, 1.25 USD, 1.33 USD, 1.52 USD, 1.65/1.75 USD, 2.01 USD/2.09 USD, 2.44 USD

As a result of the recent sell-off, MATIC price slipped back below the EMA50 (orange) on the daily chart. Despite this price correction, the buy side defended the EMA200 (blue) on a daily close basis. Now it is up to the bulls not to give up the purple support zone around this important moving average and to initiate a breakout above the USD 1.17 mark. If the recapture succeeds, the previous month’s high of 1.25 US dollars will come into focus. The supertrend in the daily chart also runs in this area.

Only when this area has been sustainably overcome will there be room in the direction of the golden pocket of the current movement at 1.33 US dollars. At this point, the MATIC course could turn south again. If, on the other hand, the bulls manage to stabilize above the blue resist zone, a renewed attempt towards the high for the year is conceivable.

If this resistance at $1.52 can also be broken, Polygon should continue to gain momentum and march into the purple zone between $1.66 and $1.75. The MATIC course failed several times in this area in March 2022. A price setback should therefore not come as a surprise.

If the USD 1.75 mark is also dynamically overcome in the future, the focus will shift to the Golden Pocket of the overriding movement. The red resist zone between $2.01 and $2.09 is acting as the maximum target area for now. Here is to plan with increased profit-taking.

MATIC course: The bearish price targets

Bearish price targets: 1.02 USD, 0.95 USD/0.92 USD, 0.82 USD, 0.75 USD/0.69 USD, 0.63 USD

In the last MATIC price analysis, a potential false breakout at US$1.51 was discussed and a drop below US$1.30 was rated as a short-term termination of the trend movement. Although the secondary scenario has occurred and the MATIC price seems to have been capped below USD 1.30 since then, the bulls still have the upper hand.

In order to initiate a new sell-off in the direction of the orange zone, the sell-side must first push Polygon sustainably below the purple support area and thus below the EMA200. Only a daily closing price below this area would cloud the chart picture in favor of the seller side. If the price falls below the price level of 1.02 US dollars for a long time, a preliminary decision will be made at the previous month’s low of 0.95 US dollars.

A medium-term directional decision can be expected here. An abandonment of this area should correct Polygon’s price on a direct path to as high as $0.82. A retest of the turquoise support area would be increasingly likely. In addition to the annual low of January 1st, the parent Golden Pocket can also be found in the zone between USD 0.75 and USD 0.69. For the time being, this zone represents the maximum bearish price target. The probability of a new long entry by the bulls can be rated as high.

Looking at the indicators

The RSI indicator has been in the neutral zone between 45 and 55 in the last ten trading days without any impetus. Only a breakout of this area should initiate a directional decision. Although the MACD indicator has activated a new buy-signal in the last few days, it is trading below its 0-line. The long signal would only be confirmed if it were exceeded back into the positive area.

Also in the weekly chart, the RSI is back in the neutral zone and has thus reduced its overbought state. The MACD indicator, on the other hand, is about to generate a sell signal. A sustained price weakness until the end of the week on Sunday should generate a fresh short signal here.

- CryptoQuant Analyst: Bitcoin Nowhere Near Its Peak – Buckle Up, Hodlers! - December 21, 2024

- Chainalysis: $2.2 Billion Lost to Crypto Hacks in 2024 - December 21, 2024

- Bank of Japan leaves interest rate unchanged: Impact on the macroeconomy and the crypto market - December 20, 2024

![Top 10 Cryptocurrency Platforms for Grid Trading in [current_date format=Y] 26 Top 10 Cryptocurrency Platforms for Grid Trading](https://cryptheory.org/wp-content/uploads/2024/12/grid-trading-120x86.jpg)