Table of Contents

Predicting the development of the value and price of BTC is a thorny but at the same time very popular topic. There are several methods that help us with predictions. What do you need to know about them?

Acceptance rate

Of course, if more and more people want certain goods and the same number of units are in circulation, the price will of course tend to rise. It is the rule of supply and demand that governs every market in the world.

If one year of hail destroys the crop of tomatoes and edible tomatoes is less than expected, it is logical that the price of tomatoes on the market will rise as demand remains the same. But imagine for a moment that people suddenly want to buy tomatoes much more than in previous years. Demand will increase and the availability of tomatoes will decrease, so the price will increase much more than in the previous case.

Demand can grow due to two factors: participants are stable and the amount of demand is increasing, or the amount of demand is stable but the number of participants is increasing. A combination of these two options is also possible

Example of acceptance rate

In the following example, it is only assumed that the number of participants grows with the same amount of goods. So, on the one hand, we have Satoshi Nakamoto, who defined that BTC must become increasingly scarce over time, and on the other hand, it is possible to increase the price of BTC thanks to new people gradually entering the market.

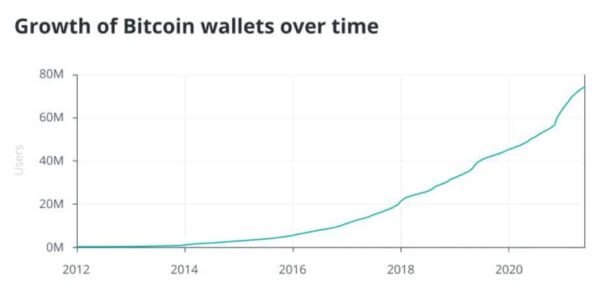

It is therefore necessary to study the rate of acceptance of cryptocurrencies on world markets in order to understand where the BTC value is heading and where, in general, the class of cryptocurrency assets may go in the future.

The growth in the number of wallets is not exactly exponential, but it is approaching. To predict its growth in the future, it is necessary to use an “indirect ratio” that can best estimate its curve. To do this, you must first convert the graph to a logarithmic scale and then calculate the function that best approximates it.

Estimate of BTC value

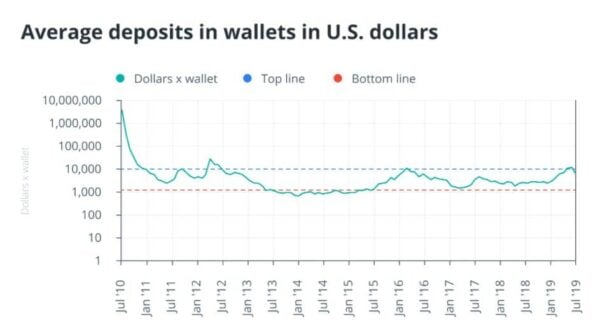

In order to estimate the growth in the value of BTC using the number of wallets in circulation, it will be necessary to estimate the average amount contained in each individual wallet using a relatively simple function: BTC capitalization / number of wallets.

An estimate of the BTC value that each wallet contains on average is now available. However, the data suggest something completely different: 70% of wallets have 0.01 BTC or less, while 2% of wallets own more than 95% of BTC in circulation and the exchange owns approximately 7%.

These data capture the huge growth potential of BTC in the future, because those who own a large portion are unlikely to sell it, because they know BTC and its potential well. Those with 0.01 BTC or less will be tempted to buy more and, of course, new wallets open every month.

However, the average value of the contents of these wallets, expressed in US dollars, can be highlighted by averaging:

Because the average of these deposits is conditioned by the value of the BTC price in order to best estimate the “range” of prices that BTC could get to, the red dashed line represents the tenth percentile of wallets deposited in US dollars; while the dashed blue line represents the 90th percentile. This “range” allows you to frame what the entire capitalization of BTC should be over time based on the estimated BTC uptake rate.

This estimate does not take into account several factors. For institutional investors entering the market, the average amount per wallet could be much higher than the blue band specified in the example.

Conclusion

BTC is becoming more and more popular, so it is definitely worth knowing the possibilities of predicting its price in the future.

- CryptoQuant Analyst: Bitcoin Nowhere Near Its Peak – Buckle Up, Hodlers! - December 21, 2024

- Chainalysis: $2.2 Billion Lost to Crypto Hacks in 2024 - December 21, 2024

- Bank of Japan leaves interest rate unchanged: Impact on the macroeconomy and the crypto market - December 20, 2024