One of the main reasons for the record-breaking Bitcoin performance that the cryptocurrency is currently showing was the behavior of the central banks. Because the US monetary authorities around Jerome Powell have decided to raise the key interest rate again. At 0.25 percent, however, the interest rate hike met the expectations of market participants. An increase in the key monetary policy rate to up to 4.75 percent was priced in accordingly. There was no negative reaction from the (crypto) market.

Mining stocks benefit even more

The generally good trend in the Bitcoin market is also reflected in BTC shares. More specifically, bitcoin-related securities act like a kind of leverage on the price. In January, Marathon Digital Investors (MARA) achieved dream returns of 135 percent. MARA is an international mining company based in Las Vegas.

Bitcoin Halving hype

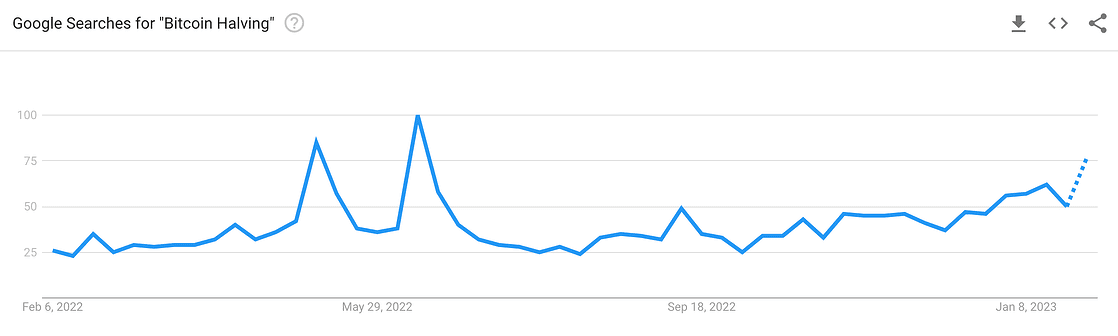

The influence of the next Bitcoin halving cannot be dismissed out of hand. Although the Subsidy block is not expected to halve to 3.125 BTC per block until spring 2024, the hype surrounding the halving is already fueling the BTC rate in advance. A look at Google Trends also shows that the public encourages this narrative. Search queries for the pair of terms “Bitcoin Halving” on Google have more than doubled since October 2022.

However, the actual halving effect on the Bitcoin price should be less and less ex post. Because “even if the percentage drop stays the same, each bitcoin halving will become increasingly insignificant in terms of absolute issuance,” writes The block in their latest newsletter. After all, at 91.8 percent, a large part of the BTC has already been mined; new price highs would therefore be triggered by a demand shock rather than a supply shock, according to the authors.

Nevertheless: As past halvings have shown, the collective anticipation of a reward halving alone can create buying pressure on the market.

- CryptoQuant Analyst: Bitcoin Nowhere Near Its Peak – Buckle Up, Hodlers! - December 21, 2024

- Chainalysis: $2.2 Billion Lost to Crypto Hacks in 2024 - December 21, 2024

- Bank of Japan leaves interest rate unchanged: Impact on the macroeconomy and the crypto market - December 20, 2024

![Best Platforms for Copy Trading in [current_date format=Y] 27 Best Platforms for Copy Trading](https://cryptheory.org/wp-content/uploads/2024/12/copy-trading-120x86.jpg)