The process redistribution of BTC supply between the different levels continues.

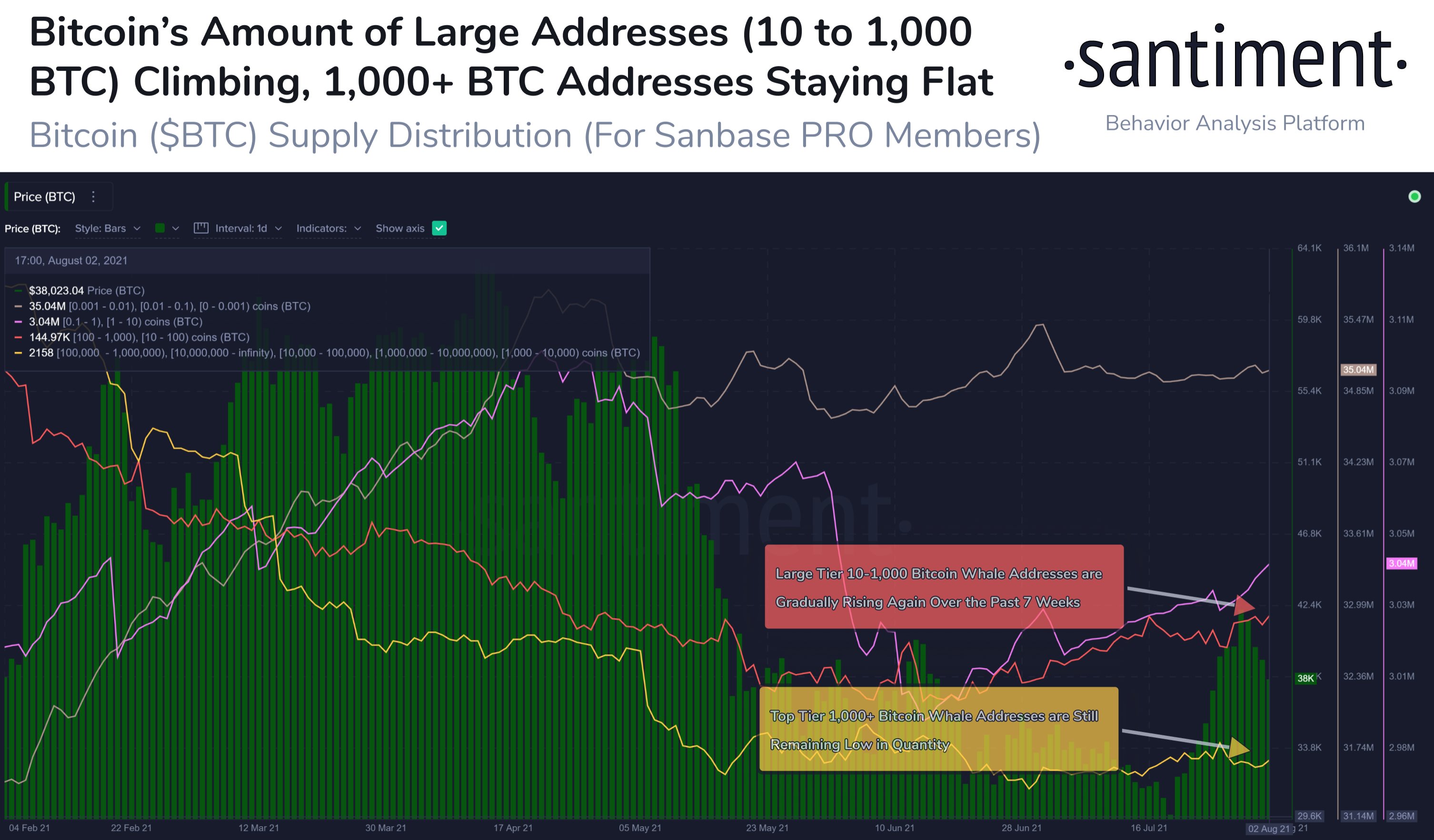

In particular, as Santiment points out, the accumulation of whales continues, while the level of stock market wallets remains low. At the end of June, the number of both addresses with 0.1 to 10 BTC and addresses with 10 to 1,000 BTC increased. In contrast, the number of addresses with more than 1,000 BTC remains largely stable.

Specifically, there are now about 2,100 addresses that contain more than 1,000 BTC, while at the beginning of the year there were many more.

Many of these addresses come from exchanges or companies that manage them on behalf of their customers, and the fact that their number decreases during the year makes it clear that many users are likely to collect their coins and move them to their own wallets. .

The process redistribution of BTC supply

Let’s omit more than 35 million addresses with less than 0.1 BTC, which have not been growing since mid-May. The most interesting dynamic remains the increase in addresses with more than 0.1 but less than 1,000 BTC.

The number of addresses of average users, ie. of those on which it is between 0.1 BTC and 10 BTC is approximately 3 million. This is more than the number at the end of June and the beginning of the year, but lower than in mid-April, when the price of BTC reached an all-time high.

In contrast, the number of whale addresses, i.e. of those with between 10 BTC and 1,000 BTC, it is around 145,000 and higher than it was at the end of June. However, it is still lower than at the beginning of the year and more or less corresponds to mid-April.

So these are two different trends, the only thing they have in common is the increase since the end of June, when the accumulation phase probably began.

- Solana Price Analysis – December 18, 2024: The Slippery Slope of SOL 🚀📉 - December 18, 2024

- Bitcoin Price Analysis – 16/12/2024: A Dance in the Ascending Channel - December 16, 2024

- What is Monero, Price Predictions for 2025–2030, and Why Invest in XMR? - December 16, 2024