Table of Contents

Shiba Inu (SHIB):

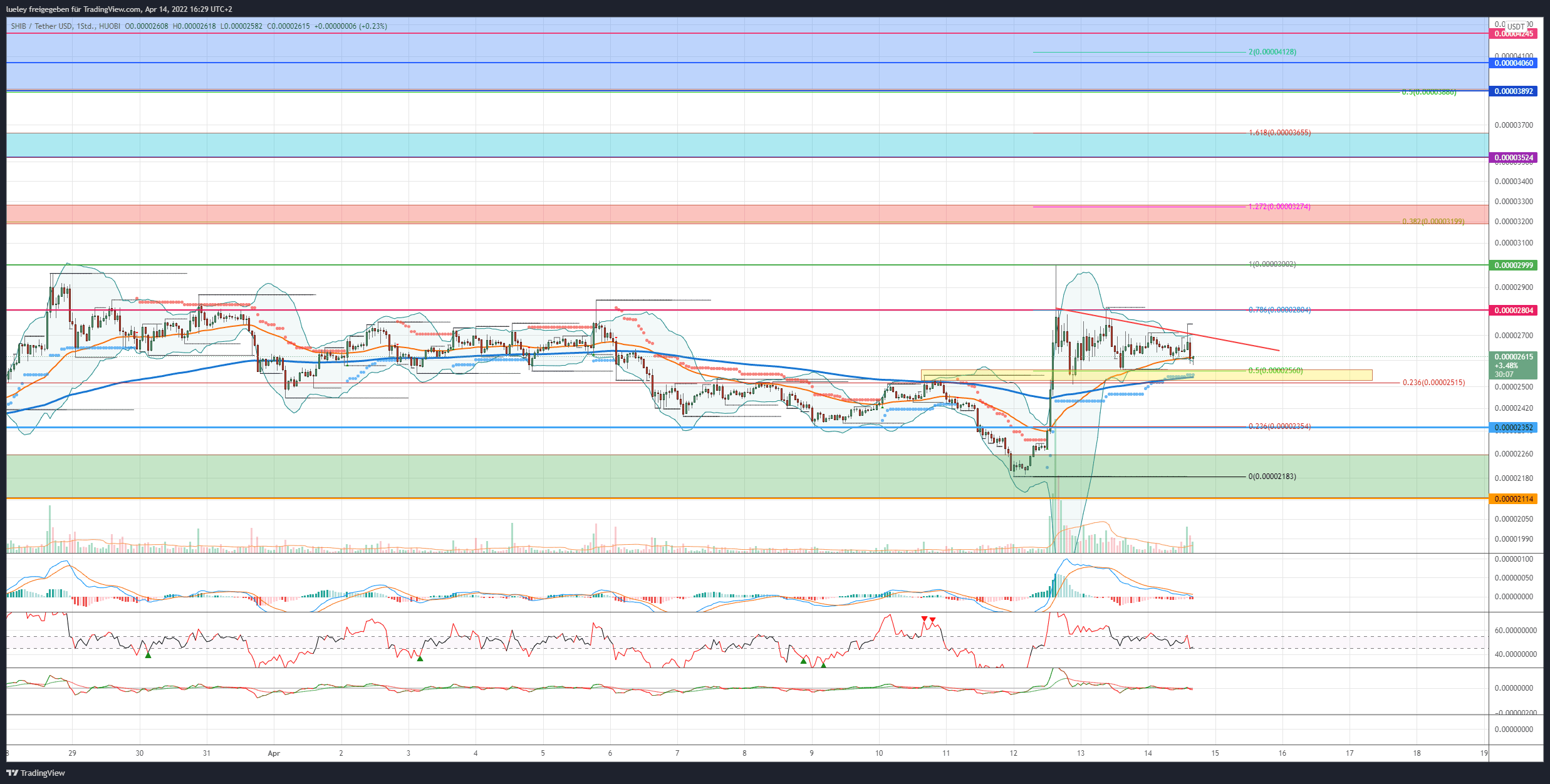

- Course (SHIB): $0.00002570 (previous day: $0.00002817)

- Short-term resistances/goals: $0.00002804, $0.00003002, $0.00003119/3274, $0.00003524, $0.00003655

- Short-term supports: $0.00002613, $0.00002560, $0.00002515, $0.00002352, $0.00002183, $0.00002114

Hourly chart Price analysis based on the pair of values SHIB/USD on Huobi

Shiba Inu daily forecast:

- The SHIB course tends weaker after the Robinhood news.

- Shiba Inu is currently threatening to give way back into the yellow support area.

- The relevant trading range is between $0.00002613 and $0.00002804 on the hourly chart.

- A dynamic breakout above $0.00002804 will activate higher targets beyond $0.00003002.

Bullish Scenario (Shiba-Inu)

Recently it has become quiet around the memecoin Shiba Inu. SHIB transactions have recently declined significantly. The addition of Shiba Inu as a new trading pair on meme stock investor-loved platform Robinhood sent SHIB price up sharply at the start of the week.

Shiba Inu is currently trading in a sideways movement. The contracting Bollinger Bands indicate a timely, dynamic breakout.

To do this, the bulls must stabilize the SHIB rate above USD 0.00002560 by the hourly closing rate.

If the buyer side succeeds in letting the SHIB price break out of the triangle in a timely manner, a jump in price up to USD 0.00002804 should be planned.

If this resistance can also be broken by the hourly close, the trend should extend towards the weekly high at $0.00003002.

This is where the first investors will want to make a profit.

More upside imaginable

Only when the bulls can generate enough buying momentum in the coming trading days to sustainably break through this resistance level will the next important target zone between USD 0.00003199 and USD 0.00003274 come into the focus of investors.

In addition to old horizontal resists from the daily chart, the higher-level 38 Fibonacci retracement and the 127 Fibonacci extension of the current movement are waiting here in the red resistance area.

In the first attempt, the SHIB course will bounce off here to the south.

If Shiba-Inu can also overcome this zone in the coming weeks, the maximum target area between USD 0.00003524 and USD 0.00003655 will be activated. The 161 extension in particular is of great importance.

Bearish Scenario (Shiba Inu)

If the SHIB price breaks back below the cross support from the lower Bollinger band and EMA50 (orange), a fall back to the yellow support zone should be planned. Here is the 50 Fibonacci retracement paired with the Supertrend and the EMA200.

In the first attempt, the SHIB course should find a bottom here.

However, if the bears can generate enough selling pressure and Shiba Inu then slides below the higher-level Fibonacci 23 retracement at USD 0.00002515, this would be a clear indication of weakness.

Thereafter, the SHIB price is likely to drop further and correct back towards USD 0.00002354. This support was already of increased relevance in the past. In addition, the 23 Fibonacci retracement of the current price movement can also be found here.

In the short term, a rebound to the north is very likely.

A retest of the weekly low is likely

Since Shiba Inu, like most cryptocurrencies, is influenced by the price development of BTC (BTC), a sustained weakness in the crypto key currency should also weigh on the SHIB price.

If Shiba Inu sustains a fall below USD 0.00002354, the correction will immediately extend to the green support zone. A retest of the weekly low at USD 0.00002183 should therefore not come as a surprise.

The maximum bearish price target from the hourly chart represents the bottom of the green support area at $0.00002114.

The RSI as well as the MACD indicator in the hourly chart do not currently indicate a clear tendency for a direction. However, both indicators show a sell signal in the hourly chart, which speaks more for a retest of the yellow support zone.

- Michaël van de Poppe: Bitcoin to Hit $500,000 This Cycle? 🚀💸 Or Just Another Crypto Fairy Tale? - December 21, 2024

- What is the Meme Coin Bonk, Price Predictions 2025–2030, and Why Invest in BONK? - December 18, 2024

- BNB Price Analysis: 17/12/2024 – To the Moon or Stuck on a Layover? - December 17, 2024