The unexpectedly high demand for the first Swiss crypto stamp caused inconvenience to the national postal service. Swiss Post has announced that it has to deal with technical problems when, on the day the innovative offer is made available, a large number of orders arrive at its online store at once.

Demand for the first crypto stamp is unexpectedly high

The Swiss Post announced the “crypto stamp” initiative in September and was presented as an attempt to “bridge the gap between the physical and digital worlds in philately”. The state-owned company has joined forces with blockchain service provider Inact to create a brand that is the first of its kind.

When the crypto stamp was launched on the morning of Thursday, November 25, demand was so high that it “temporarily led to technical problems on postshop.ch,” the Swiss bank told AWP. According to the spokesman, the postal service was contacted by many people interested in obtaining a stamp several weeks before the launch.

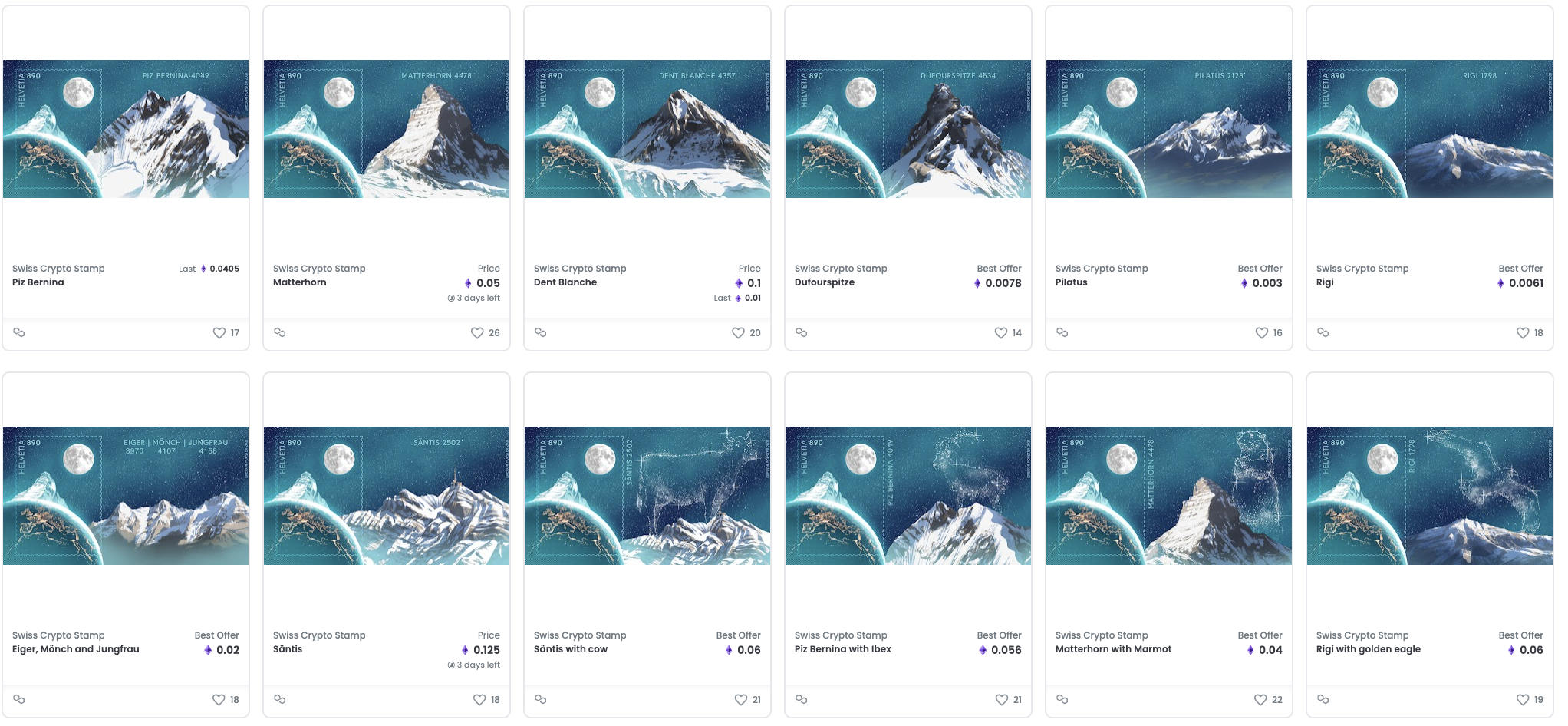

The publication details that the crypto stamp consists of two parts – a physical one, which can be purchased for 8.90 Swiss francs ($ 9.50), and a corresponding digital image showing one of the 13 designs. Each physical stamp provides access to a digital representation stored on a blockchain that can be collected and traded.

“At first glance, the Swiss crypto stamp looks like any ordinary stamp. It is self-adhesive, shows the Matterhorn and the moon on a blue background and has a face value of 8.90 francs. Owners can use it to postal items just like any other stamp,” Swiss Post explained in a statement issued on September 30, noting: “But the crypto stamp is digital and it is a digital collector’s item. “

The Swiss Post and Inacta plan to issue about 175,000 crypto stamps with 65,000 copies of the most common digital design and only the 50 most rare. Three-quarters of the limited editions were purchased during the first three hours of the day of launch.

In the last few years, Switzerland has established itself as a major cryptocurrency-friendly destination in the heart of Europe. Hundreds of companies in the blockchain industry are based or represented in the Swiss crypto valley, based in the canton of Zug. Even state-owned enterprises are looking for involvement in the cryptocurrency sector.

In 2018, the Swiss Post announced cooperation with the telecommunications service provider Swisscom on a blockchain infrastructure project aimed at meeting the security requirements of banks. Earlier this year, the banking subsidiary Postfinance launched a mobile application that provides clients with access to more than a dozen cryptocurrencies.

Is it worth investing in the BTC government bond?

- CryptoQuant Analyst: Bitcoin Nowhere Near Its Peak – Buckle Up, Hodlers! - December 21, 2024

- Chainalysis: $2.2 Billion Lost to Crypto Hacks in 2024 - December 21, 2024

- Bank of Japan leaves interest rate unchanged: Impact on the macroeconomy and the crypto market - December 20, 2024