Decentralized exchanges on the Solana blockchain, also known as Solana DEXs, have become an essential part of the DeFi (Decentralized Finance) ecosystem. With Solana’s turbo-charged speed and rock-bottom transaction fees, it’s practically tailor-made for hosting decentralized exchanges. These perks have cultivated a strong DEX ecosystem on Solana, empowering users to trade freely without the need for centralized exchanges or middlemen.

Solana now hosts hundreds of projects, and its popularity in the DeFi and NFT spaces is only climbing higher. Thanks to decentralized exchanges, users can swap tokens directly from their wallets, which boosts transaction security and transparency. In this article, we’ll dive into the Top 10 DEXs on Solana based on trading volume, complete with links and the latest trade volume data. We’ll also guide you through a step-by-step tutorial on how to use Raydium DEX, so you’ll be swapping like a pro in no time!

Top 10 Solana DEXs by Trading Volume

This overview highlights the best decentralized exchanges (DEXs) on the Solana blockchain, offering a variety of services from simple token swaps to advanced derivatives and lending options. Each DEX gives users unique ways to leverage the Solana ecosystem efficiently.

Raydium

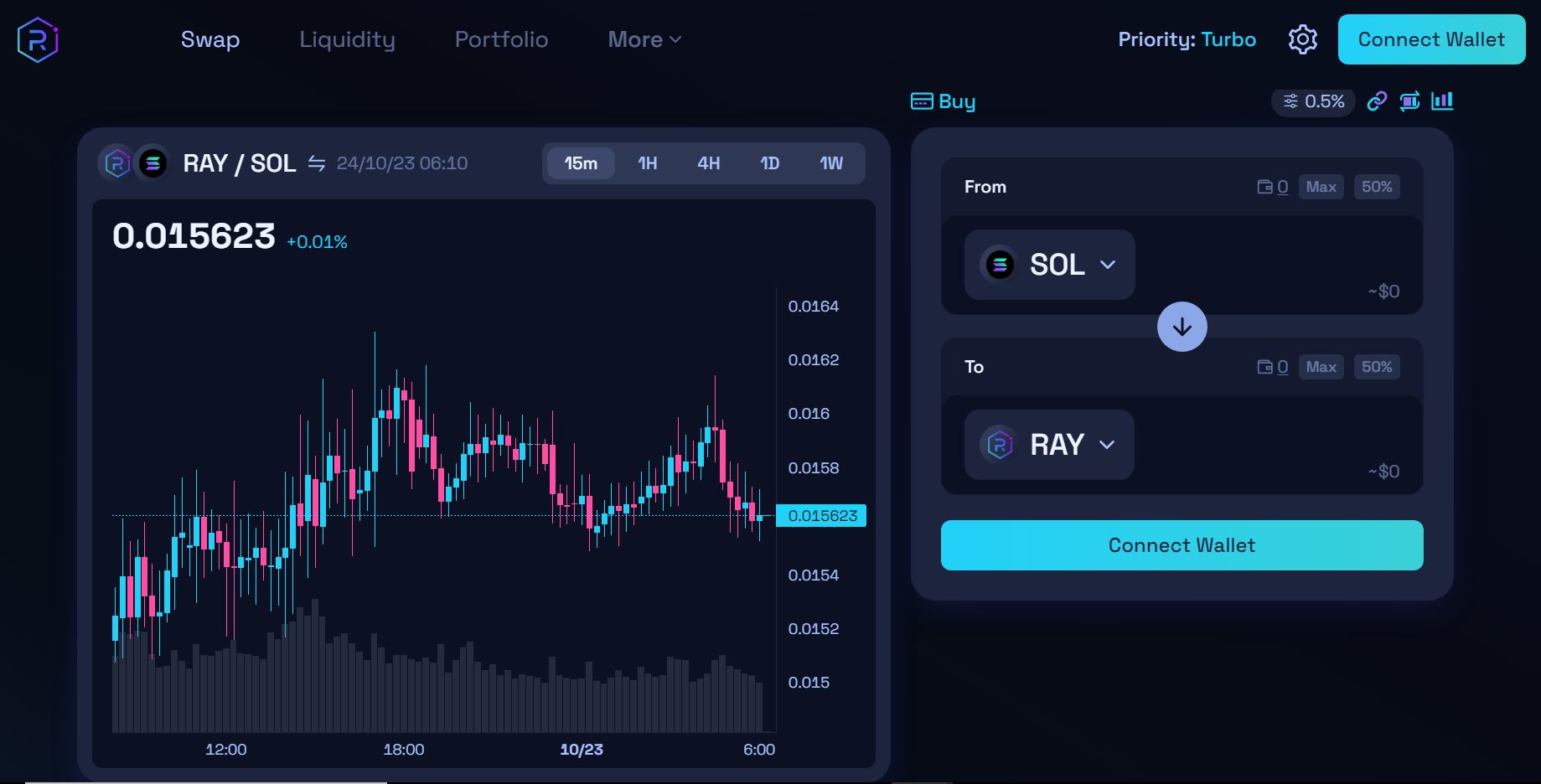

Raydium is a leading DEX on Solana, providing users with fast and efficient token trading through its Automated Market Maker (AMM). Known for its integration with Serum’s order book, Raydium offers improved liquidity and more competitive trading conditions. It also supports staking and yield farming, enabling users to earn returns by contributing to liquidity pools.

- Cumulative Trading Volume: $159.5 billion

- Daily Volume: $1.15 billion

Cropper

- Why Online Advertisers Should Request Website Traffic Data from Google Analytics Instead of Using SEO Tools Like MOZ or Ahrefs? - March 24, 2025

- North Carolina’s Bold Move: State Bill Proposes Investing 10% of Public Funds in Bitcoin - March 22, 2025

- Justin Sun Stakes $100 Million in Ethereum on Lido – What Does It Mean for the Market? - March 19, 2025

![How to Buy X Stocks [Twitter] – A Step-by-Step Guide 14 How to Buy X Stocks [Twitter] – A Step-by-Step Guide](https://cryptheory.org/wp-content/uploads/2025/02/2-14-350x250.jpg.webp)

![Best Platforms for Copy Trading in [current_date format=Y] 15 Best Platforms for Copy Trading](https://cryptheory.org/wp-content/uploads/2024/12/copy-trading-350x250.jpg.webp)