Table of Contents

Bitcoin derivatives are financial instruments whose value is derived from the price of Bitcoin. They allow investors to trade based on speculations about the future price of this cryptocurrency without needing to own it. Derivatives offer various benefits, such as hedging against risk and leveraging, meaning that investors can control larger positions than their actual capital would allow. This article focuses on the top exchanges for trading Bitcoin derivatives, highlighting the leverage available on each platform.

1. Binance

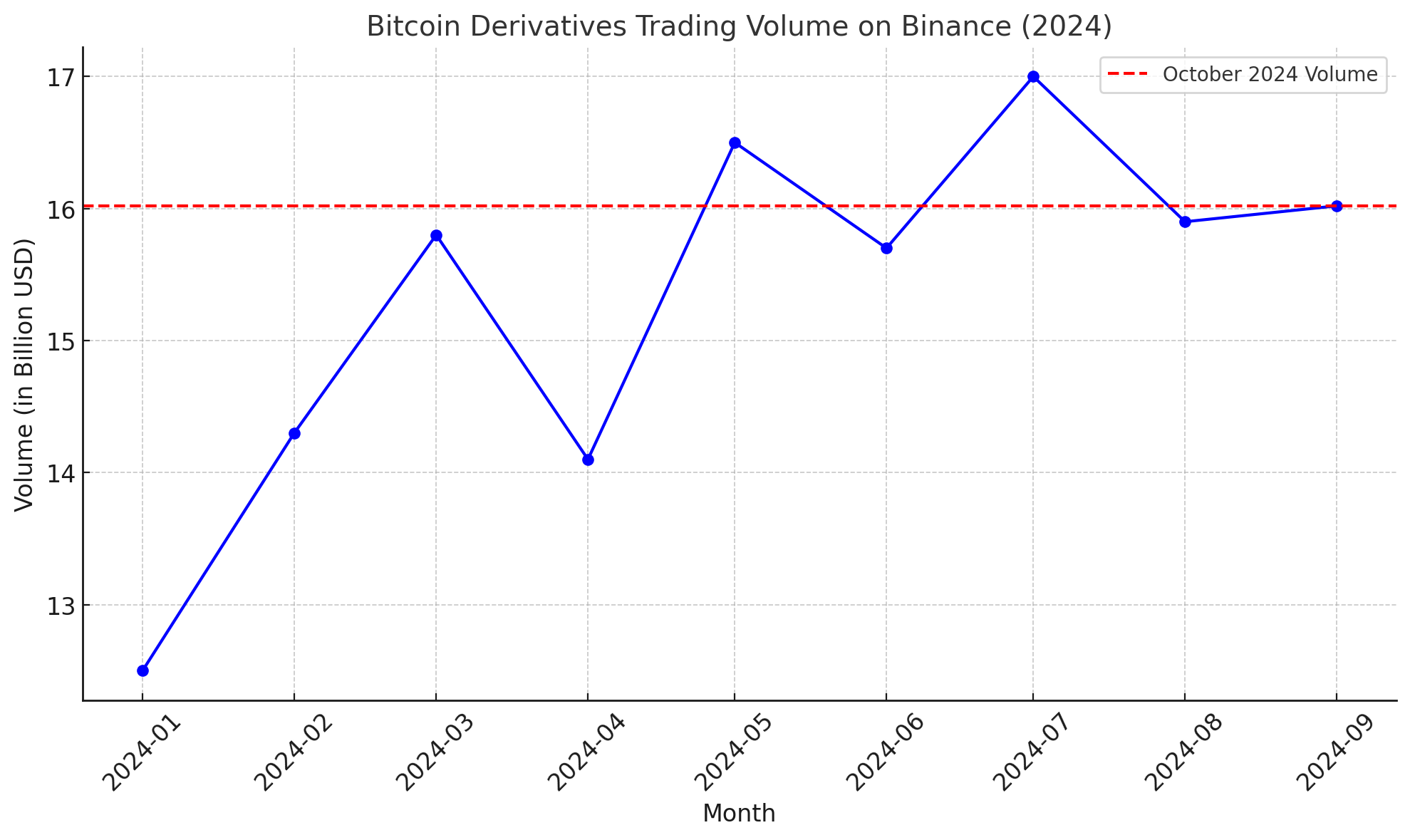

Binance is one of the largest cryptocurrency exchanges in the world, offering a wide range of derivative trading pairs, including Bitcoin. Its Binance Futures platform allows traders to leverage up to 125x on certain products, making it one of the most attractive options for speculators seeking high potential gains. Binance offers a variety of derivatives, including futures contracts, perpetual contracts, and options. Despite a recent drop in trading volumes, where the derivatives trading volume fell by 21% to $1.25 trillion in September 2024, Binance remains a dominant player with a 40.7% market share in derivatives trading. Its user-friendly interface and educational tools make it suitable for both beginners and experienced traders.

As of October 11, 2024, the 24-hour Bitcoin derivatives trading volume on Binance is approximately $16.02 billion, making Bitcoin one of the most actively traded assets on the platform. This volume represents the total traded amount through Bitcoin futures and options, indicating strong interest from both institutional and retail traders, despite general market volatility. The total open interest in Binance’s futures market is around $16.81 billion, signaling sustained interest in Bitcoin derivatives trading.

2. Bybit

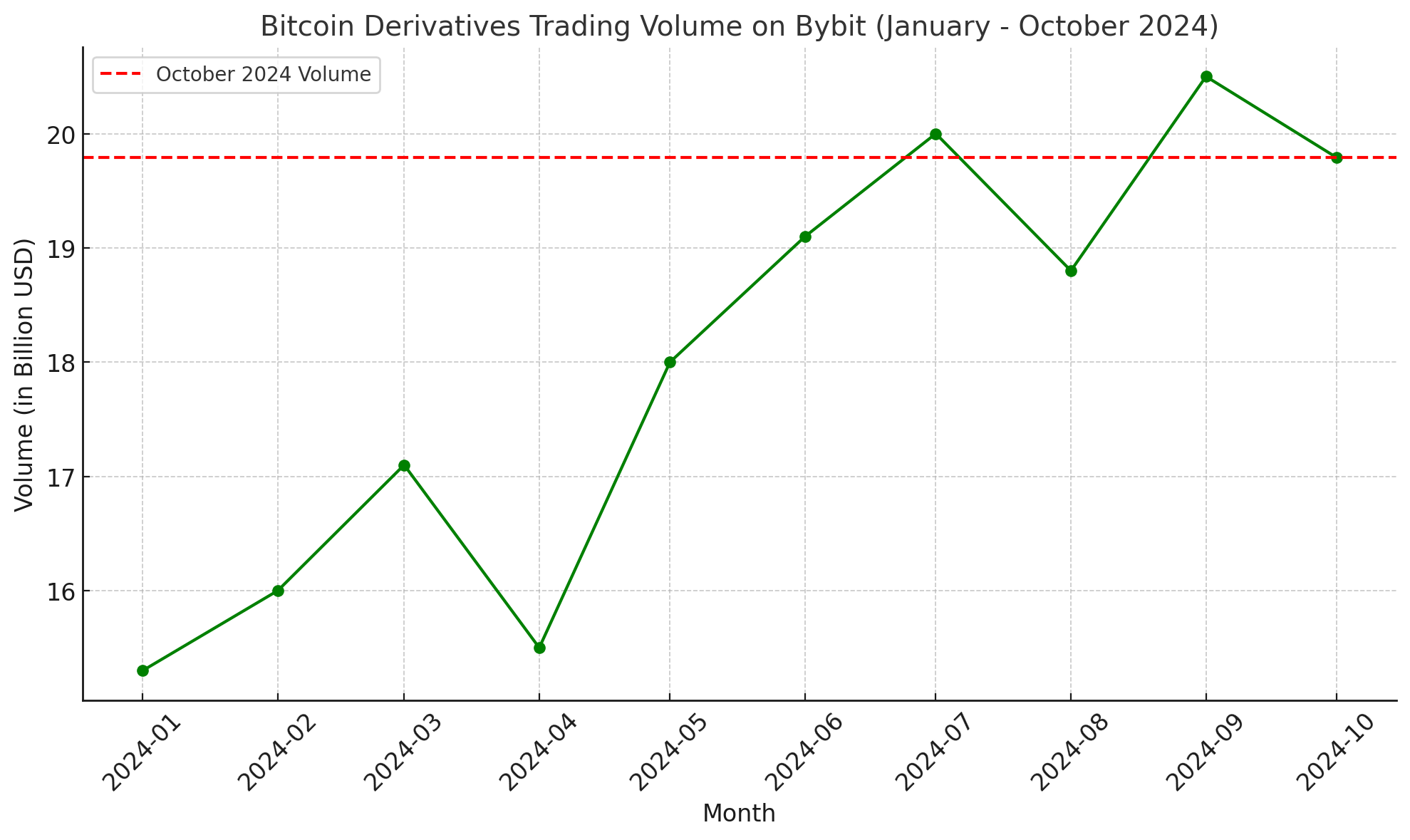

Bybit is another popular player in the cryptocurrency derivatives market, known for its platform’s speed and advanced technology. Bybit offers leverage up to 100x on Bitcoin futures and perpetual contracts, attracting traders who aim to maximize profits from short-term price movements. In recent months, Bybit has maintained stable trading volumes, despite seasonal market declines. Unlike some exchanges, Bybit focuses exclusively on derivatives trading, without supporting traditional spot trading, making it a preferred choice for professional traders specializing in derivatives. Additionally, the platform features an Insurance Fund to protect traders from liquidation risks during periods of extreme volatility.

As of October 11, 2024, the 24-hour Bitcoin derivatives trading volume on Bybit reached approximately $19.79 billion, with open interest standing at $11.66 billion. Bitcoin remains one of the most actively traded assets on the platform, contributing significantly to this volume, with the BTC/USDT pair alone accounting for over $8.46 billion in daily trading. Bybit has firmly established itself as one of the leading players in the cryptocurrency derivatives market, offering high-leverage trading and advanced features.

3. Crypto.com

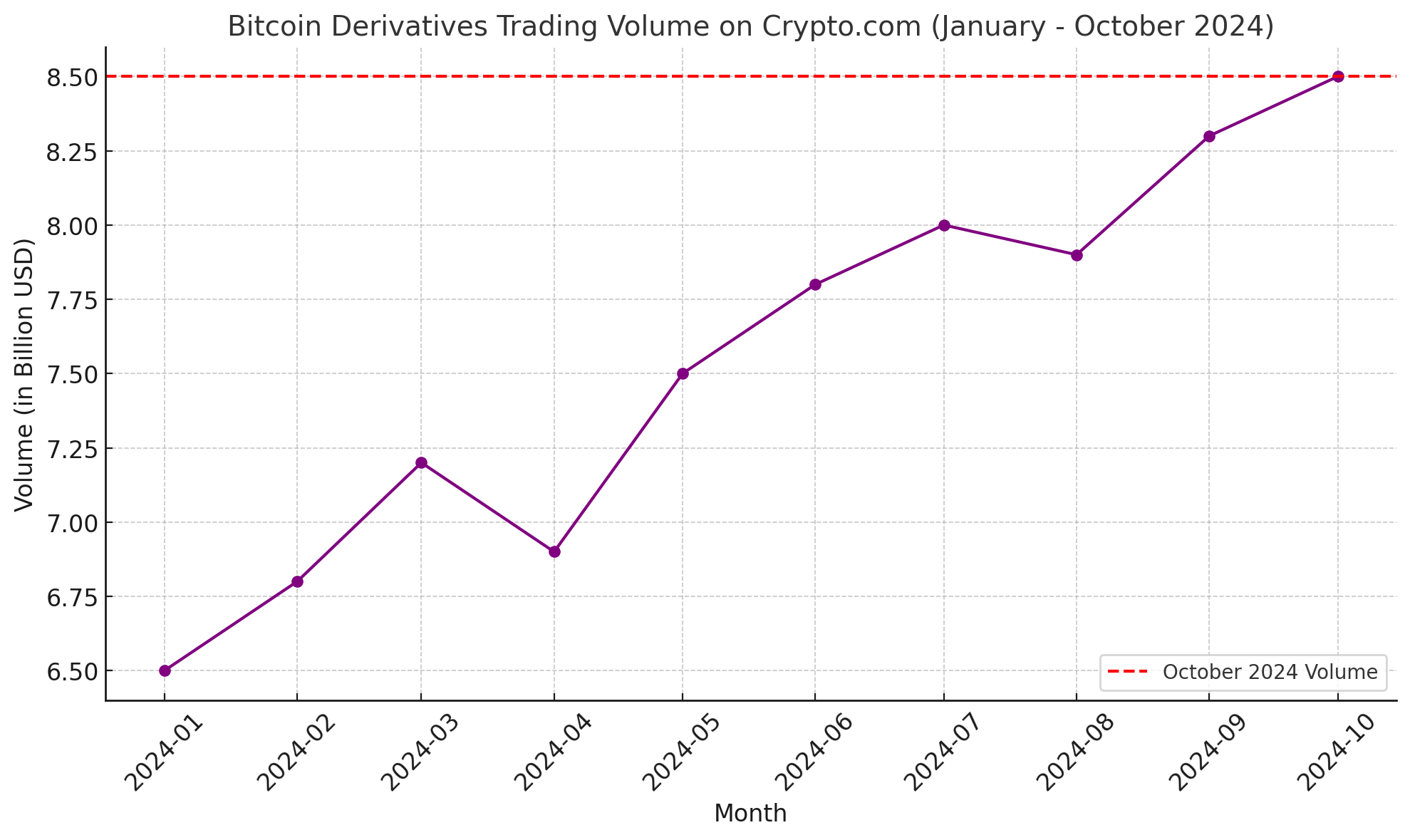

Crypto.com has gradually become a major player in the cryptocurrency derivatives space, as evidenced by a notable increase in trading volumes during September 2024, where its spot and derivatives volumes surged by over 40%. The exchange now offers leverage of up to 100x on Bitcoin derivatives, catering to experienced traders. One of the strengths of Crypto.com is its user-friendly interface, which, along with integrated services such as staking, appeals not only to traders but also to long-term investors. The platform emphasizes security, with a robust fund protection system and regular security audits. Thanks to its growth in trading volumes, Crypto.com became the fourth-largest exchange by total trading volume in September 2024.

As of October 11, 2024, the 24-hour Bitcoin derivatives trading volume on Crypto.com reached approximately $8.5 billion, demonstrating steady interest in futures and options trading on the platform. Over the past year, Crypto.com has experienced significant growth in the derivatives market, largely driven by institutional interest and the onboarding of new retail participants. This growth has solidified Crypto.com’s position as a major player in the cryptocurrency derivatives space.

4. OKX

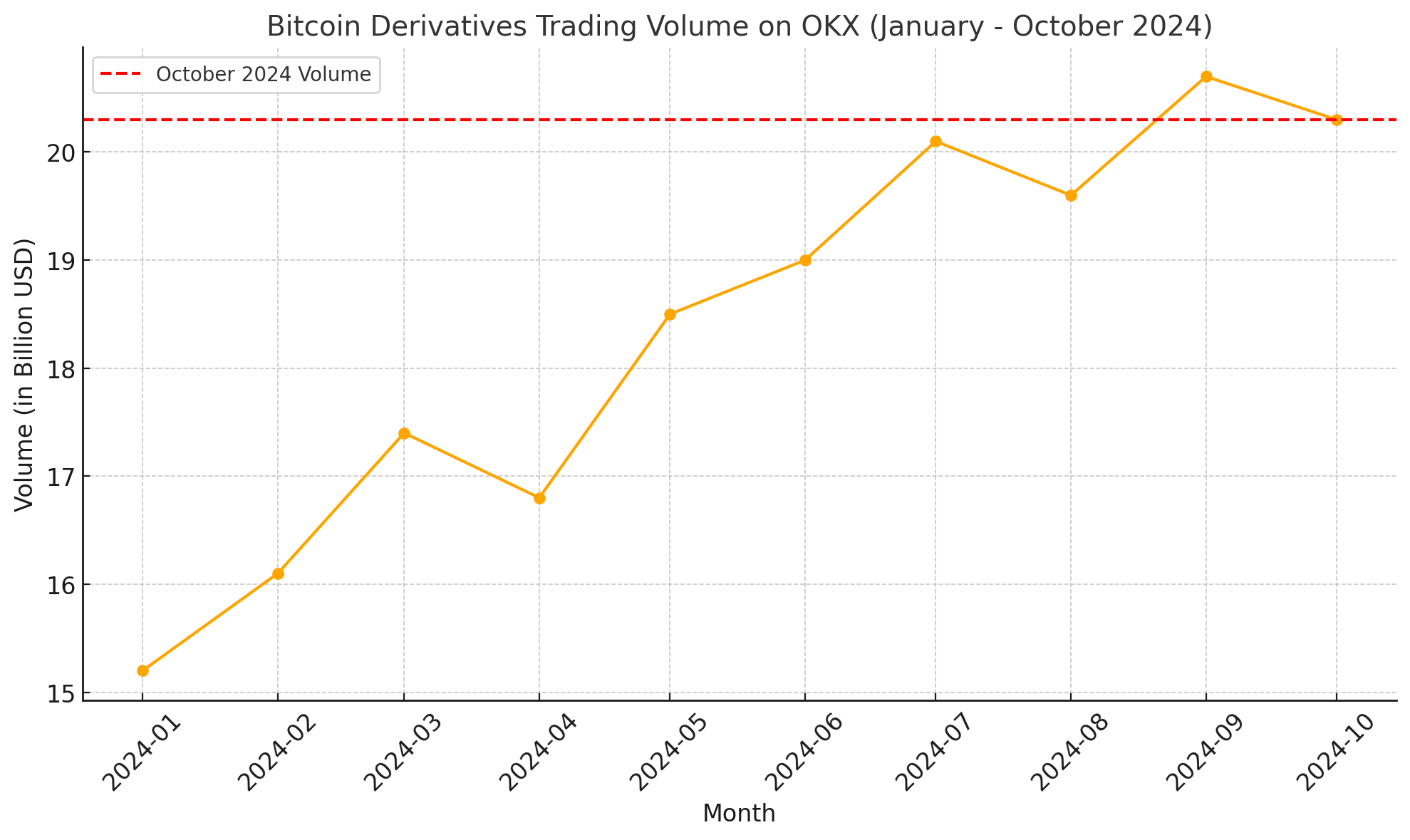

OKX is another strong player in the cryptocurrency derivatives sector, known for its wide range of products and tools for professional traders. OKX offers leverage up to 125x on Bitcoin derivatives, attracting traders seeking high-leverage opportunities. The exchange provides both futures and perpetual contracts and is known for its low fees and high liquidity. Despite recent market volatility, OKX continues to maintain high trading volumes, with its derivative products considered among the best in the market. OKX is also focused on innovation, regularly adding new products, including NFT derivative trading. Additionally, the platform is favored for its advanced trading tools, such as risk management and market analysis features, which enable traders to manage their positions more effectively.

As of October 11, 2024, the 24-hour Bitcoin derivatives trading volume on OKX reached approximately $20.3 billion, with open interest sitting at around $5.7 billion. OKX continues to be one of the leading platforms for Bitcoin derivatives trading, supported by high institutional participation and a growing user base. This strong market presence makes OKX a top choice for traders seeking liquidity and advanced tools for trading Bitcoin derivatives.

5. Deribit

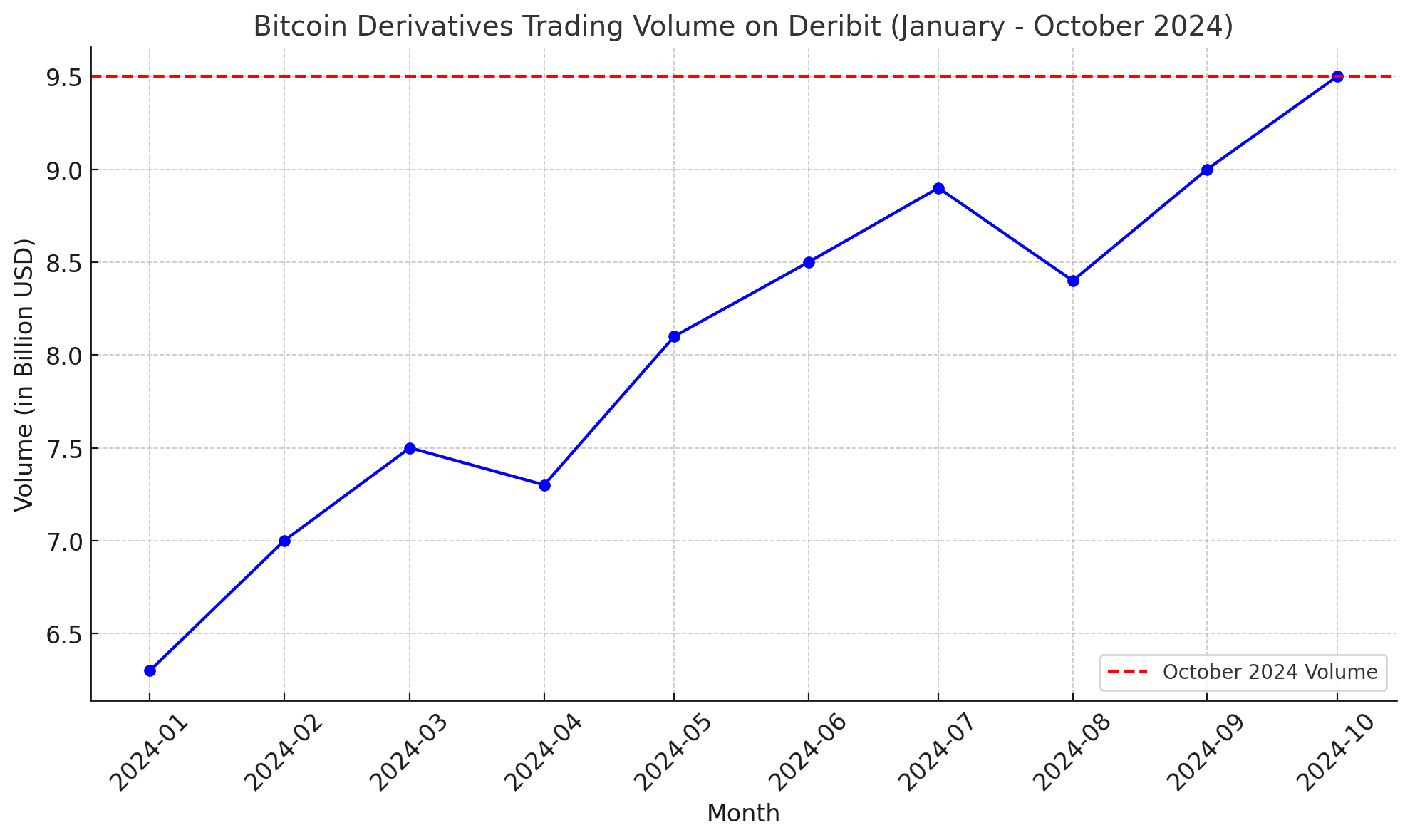

Deribit is a specialized exchange focused on cryptocurrency options and futures trading, with Bitcoin derivatives forming the core of its offerings. The platform provides leverage up to 50x on Bitcoin futures contracts, enabling traders to maximize profits from short-term market movements. Deribit is particularly popular among professional traders specializing in options, as it is one of the few exchanges offering cryptocurrency options contracts. The exchange is known for its excellent liquidity and low latency, which makes it highly attractive to institutional investors. Although Deribit does not offer spot trading, it remains an ideal choice for those focusing on sophisticated trading strategies using derivatives.

As of October 11, 2024, the 24-hour Bitcoin derivatives trading volume on Deribit was approximately $702 million, with open interest exceeding $2 billion. Deribit maintains its position as the leading platform for trading Bitcoin options, handling 70% of the total Bitcoin options trading volume. This platform is favored by both institutional and retail investors who utilize its tools for risk management and hedging against market fluctuations, making it a go-to for options traders.

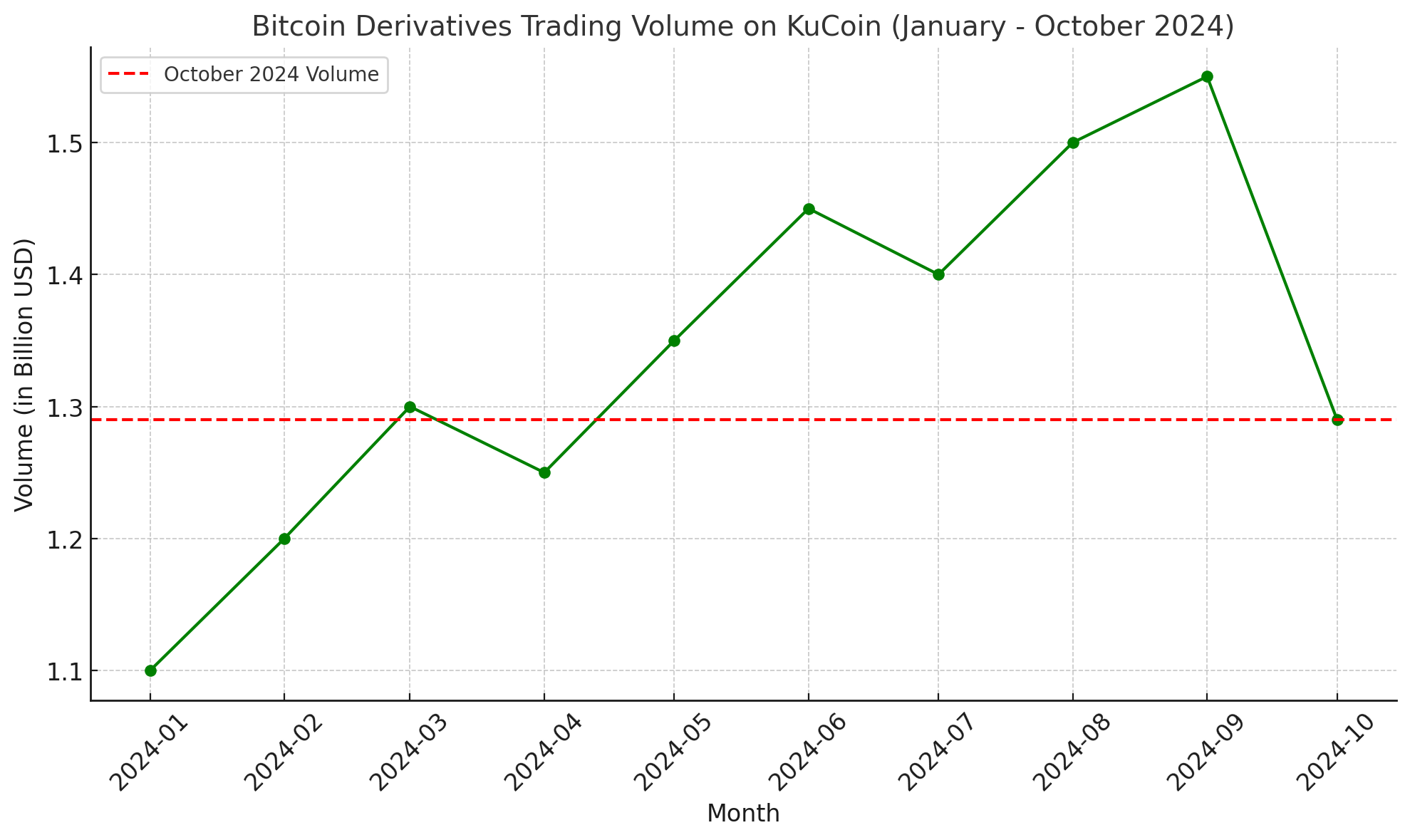

6. KuCoin

KuCoin is a popular cryptocurrency exchange that has expanded its offerings to include derivative products in recent years. KuCoin Futures provides leverage up to 100x, allowing traders to capitalize on Bitcoin and other cryptocurrency price movements. One of KuCoin’s strengths is its wide range of cryptocurrency pairs, giving traders the opportunity to diversify their portfolios. Known for its user-friendly interface and low fees, KuCoin is ideal for both beginners and experienced traders. The exchange also offers a variety of market analysis tools, helping traders make informed decisions. Additionally, KuCoin is recognized for its active community and rewards program, which allows users to gain extra benefits while trading.

As of October 11, 2024, the 24-hour Bitcoin derivatives trading volume on KuCoin was approximately $1.29 billion, with the BTC/USDT pair being the most actively traded, contributing significantly to the overall volume.

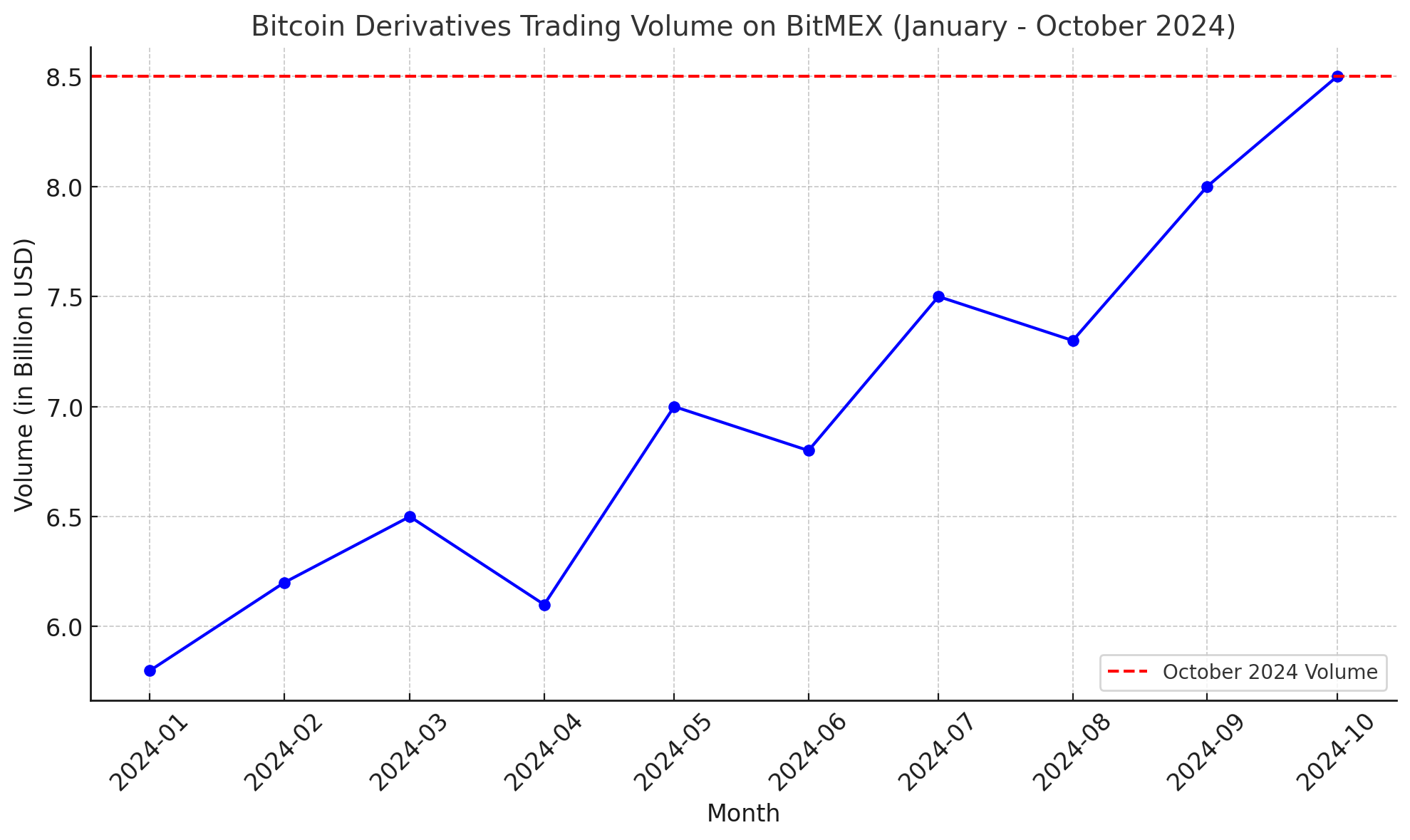

7. BitMEX

BitMEX is one of the oldest and most well-known exchanges specializing in Bitcoin derivatives trading. It offers leverage up to 100x on futures and perpetual contracts, making it a favorite among professional traders. BitMEX focuses primarily on Bitcoin derivatives, and its platform is renowned for its robustness and speed. While BitMEX has faced declining trading volumes in recent years due to increased competition, it remains a key player in the market due to its transparency and high-quality security measures. The exchange also provides a variety of advanced features, such as risk management tools and portfolio management strategies, catering to traders looking for sophisticated trading options.

As of October 11, 2024, the 24-hour Bitcoin derivatives trading volume on BitMEX reached approximately $391.77 million, with open interest (OI) standing at $552.78 million. The most popular products on the platform include futures and perpetual swap contracts, with the BTC/USD pair making up a significant portion of the daily trading volume.

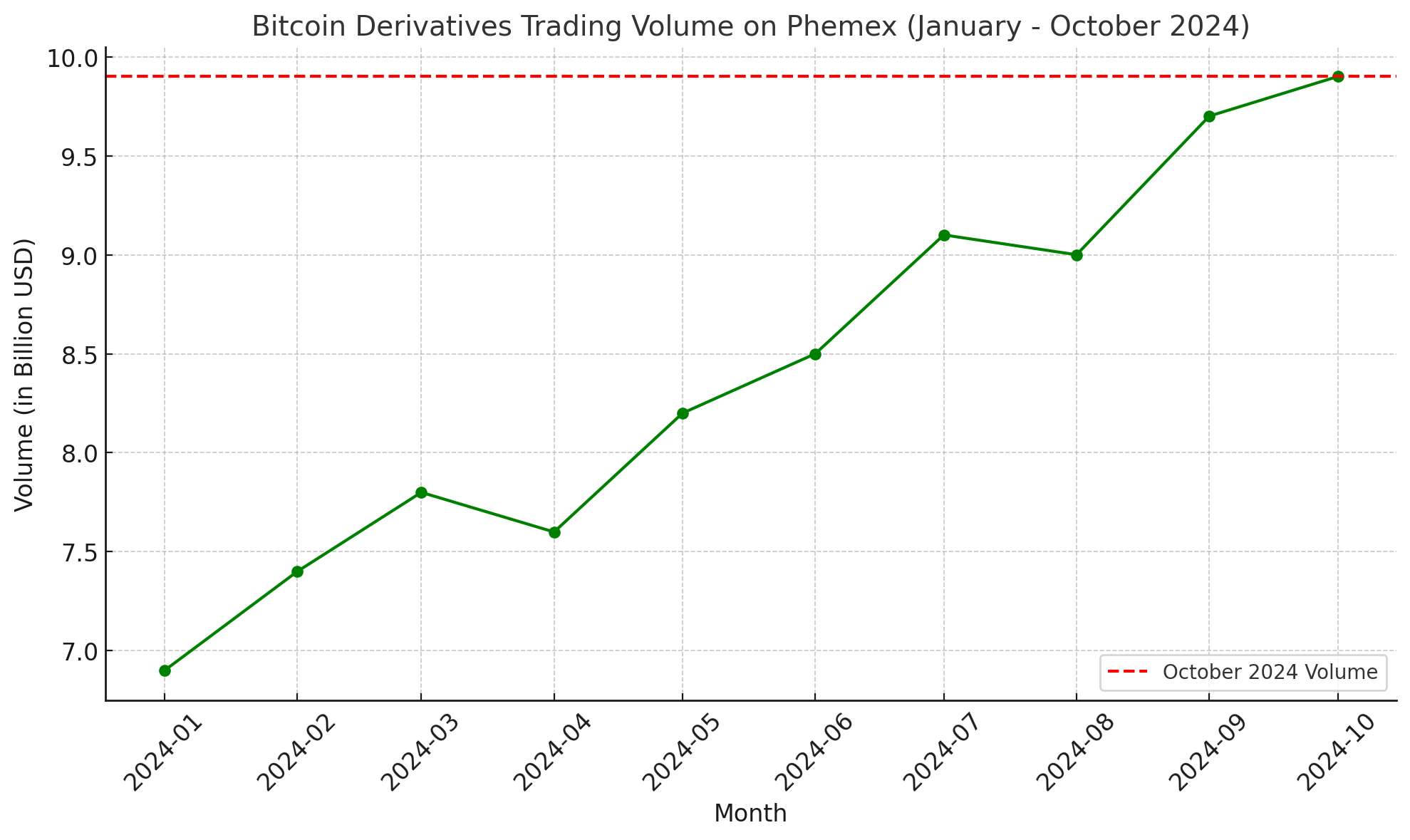

8. Phemex

Phemex is a relatively new exchange that has quickly gained popularity due to its simplicity and robust infrastructure. It offers Bitcoin derivatives trading with leverage up to 100x, making it an attractive choice for both beginner and advanced traders. Phemex stands out for its fee-free model for premium users, which differentiates it from other exchanges. The platform is particularly appealing to new users because of its easy registration process and user-friendly interface. However, as it is still growing, liquidity may be lower compared to more established competitors, which could be a potential downside for larger-scale traders.

As of October 11, 2024, the 24-hour Bitcoin derivatives trading volume on Phemex was approximately $991.2 million, with open interest (OI) reaching $1.7 billion. The most actively traded pair on the platform is BTC/USDT, reflecting significant interest in Bitcoin derivatives on Phemex.

9. Kraken

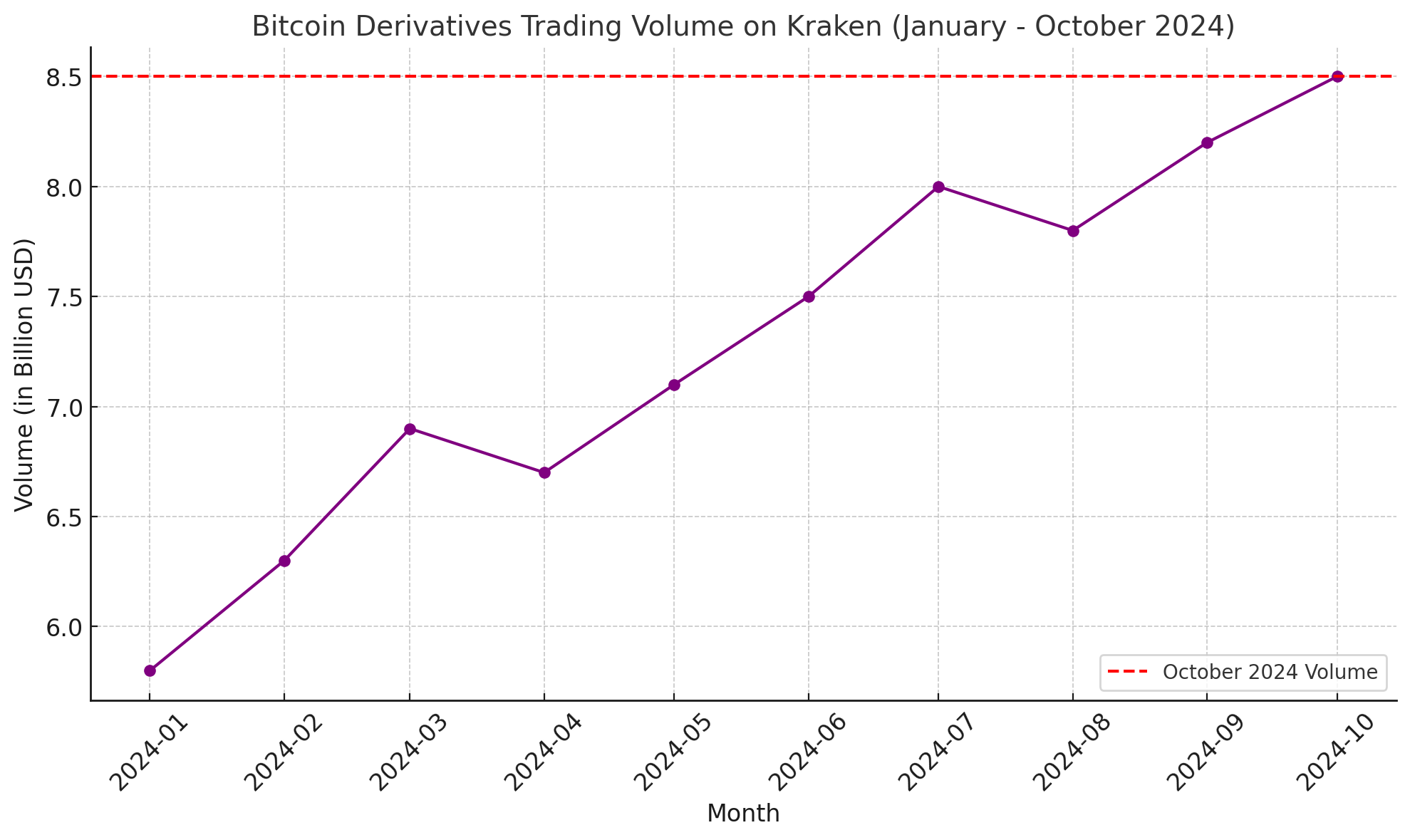

Kraken is one of the longest-running cryptocurrency exchanges, offering not only spot trading but also futures contracts on Bitcoin and other cryptocurrencies. Kraken Futures provides leverage up to 50x, which is lower compared to some competing exchanges, but still sufficient for most traders. Kraken is well-known for its high level of security and transparency, which is important for investors who prioritize asset protection. Despite its strong platform, Kraken has occasionally faced criticism for its user interface, which may not be as intuitive as some newer exchanges, potentially making it less appealing for beginners. However, its reputation for safety and compliance makes it a reliable choice for more experienced traders.

As of October 11, 2024, the 24-hour Bitcoin derivatives trading volume on Kraken was approximately $660 million, reflecting the platform’s steady role in the cryptocurrency derivatives market.

10. Huobi

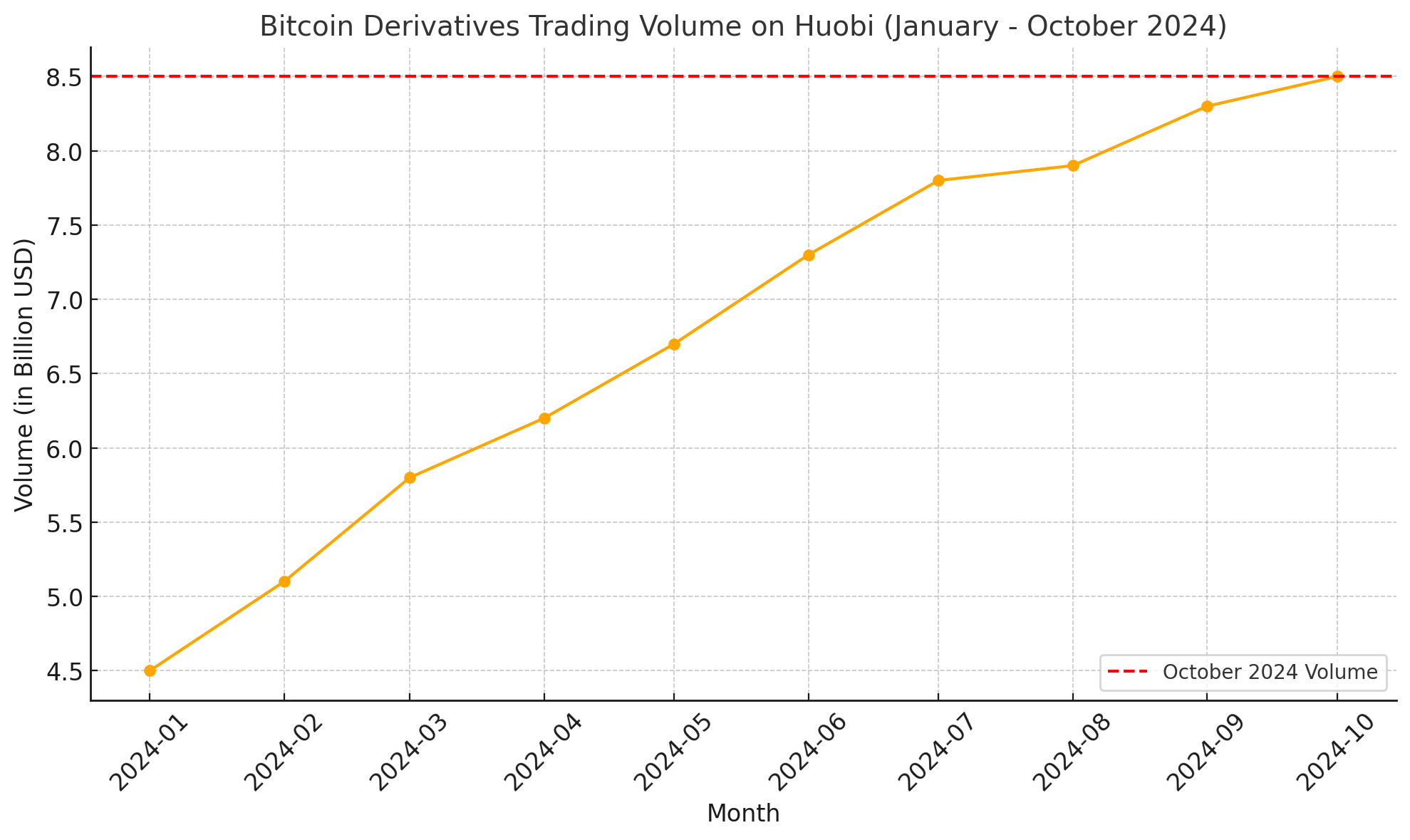

Huobi is one of the longest-running cryptocurrency exchanges, offering a wide range of derivative products, including Bitcoin futures, perpetual contracts, and options. Traders can use leverage of up to 125x on Bitcoin derivatives, making it highly attractive for experienced traders aiming for maximum profits. Huobi focuses on providing high liquidity and fast transactions, ensuring smooth trading even during periods of high market volatility. The platform also offers advanced risk management tools, which are essential for trading with high leverage. These features make Huobi a preferred choice for professional traders who require robust tools and reliable performance in the derivatives space.

As of October 11, 2024, the 24-hour Bitcoin derivatives trading volume on Huobi was approximately $557.4 million, with the total trading volume, including both spot and derivatives, reaching $1.1 billion.

Advantages and Disadvantages of Investing in Bitcoin Derivatives

Investing in Bitcoin derivatives comes with its pros and cons, which are essential for traders and investors to consider before engaging in the market. Below are the key points:

Advantages:

- Leverage:

One of the most significant benefits of derivatives trading is the ability to use leverage. This allows traders to control larger positions than their actual capital would permit. For example, with 100x leverage, a trader can open a position that is 100 times their initial deposit. While this increases the potential for profit, it also increases the risk of losses. - Hedging against risk:

Derivatives allow traders to hedge their portfolios against adverse price movements. For instance, if someone holds a long-term Bitcoin investment, they can hedge against potential price drops by using a futures contract to bet on a price decline. This way, they can protect their assets in case the price of Bitcoin decreases. - Flexibility and diversification:

Bitcoin derivatives give traders the ability to use sophisticated strategies, such as short selling or arbitrage. These strategies can help traders diversify their portfolios and potentially profit even when the market is declining. - Better price discovery:

Derivative markets often reflect investors’ expectations of future prices, providing better price discovery. This can help investors understand market sentiment and prepare for future price movements.

Disadvantages:

- Higher risk:

Using leverage increases the potential risk. While leverage can maximize profits, it can also lead to losses that may exceed the initial investment. Inexperienced traders who don’t understand risk management could quickly lose their entire capital. - Complexity:

Trading derivatives requires a deeper understanding of financial markets and complex trading strategies. This can be difficult for beginners who may lack the experience or knowledge needed to properly utilize these instruments. - Market volatility:

Cryptocurrencies, including Bitcoin, are notorious for their high volatility. Trading derivatives in such markets can be dangerous because even small price movements can lead to significant losses, especially when high leverage is involved. - Regulation and legislation:

Some jurisdictions have strict rules regarding derivatives trading, which can limit the availability of these products for investors in certain countries. Additionally, regulatory changes may impact how these markets operate.

Conclusion: Top Exchanges for Trading Bitcoin Derivatives

Bitcoin derivatives offer excellent opportunities for speculative investors seeking high returns or protection against market volatility. However, with the potential for high profits comes significant risk, so it’s crucial that traders understand both the advantages and disadvantages of these products. Choosing the right exchange and having a solid understanding of the market are key factors for successful Bitcoin derivatives trading.

- Why Online Advertisers Should Request Website Traffic Data from Google Analytics Instead of Using SEO Tools Like MOZ or Ahrefs? - March 24, 2025

- North Carolina’s Bold Move: State Bill Proposes Investing 10% of Public Funds in Bitcoin - March 22, 2025

- Justin Sun Stakes $100 Million in Ethereum on Lido – What Does It Mean for the Market? - March 19, 2025