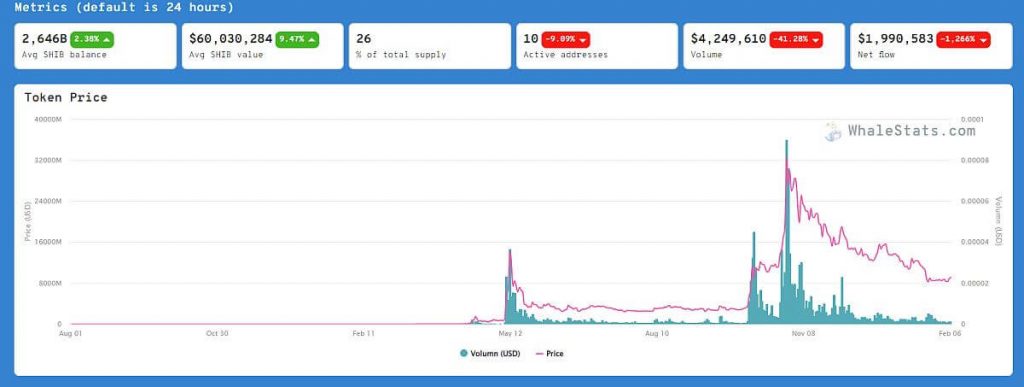

According to WhaleStats, whales currently hold 26% of total supply Shiba Inu. Because the tracker does not count the address associated with the exchanges, it is difficult to determine the actual percentage of large network owners.

The growing number of whales stabilizes volatility

With the increase in the number of crypto whales, assets tend to lose previous volatility, which was recorded when almost 100% of traders in the market were short-term speculators. Based on the ownership mix, Shiba Inu is considered a medium-term asset, with most holders investing in the asset at least six months ago.

Whenever a whale takes control of an asset, its correction usually stops because the big holders constantly accumulate a token or coin, instead of selling it. Large sales volumes usually appear at the end of bull runs, when retail purchasing power exceeds unrealized losses, which then turn into unrealized gains.

The accumulation of Shiba Inu by whales began when the token lost almost 30% of its value after reaching an all-time high in October 2021. This year, the whale was bought by SHIB worth almost 300 million dollars in just a few days in February.

Ledger Nano X Review and Where to Buy Nano X (2022)

- What Could Bitcoin’s Price Be in 25 Years? A Lambo or Just a Latte?” 🚀💸 - December 23, 2024

- Solana Price Analysis – December 18, 2024: The Slippery Slope of SOL 🚀📉 - December 18, 2024

- Bitcoin Price Analysis – 16/12/2024: A Dance in the Ascending Channel - December 16, 2024