Table of Contents

What is Bitcoin?

With Bitcoin, you don’t need a bank because it is the bank. But instead of coffee and paper, it uses blockchain. That’s a digital ledger where all transactions are recorded, like keeping track of who owes you money for beer – except it’s secured with cryptography and verified by thousands of computers around the world. Plus, there will never be more than 21 million bitcoins, meaning Bitcoin doesn’t know what inflation is – unlike your regular savings account.

People use it like digital gold because it holds value better than your old coin collection or insurance policy. And yes, you can not only buy Bitcoin but also mine it – if you have enough energy and a supercomputer in your basement.

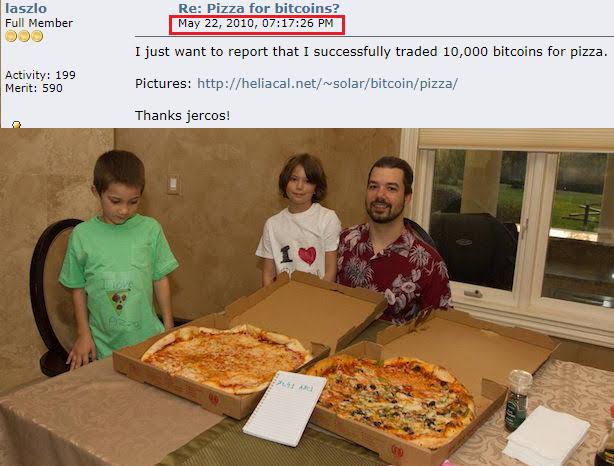

A brief history of Bitcoin: From pizza to crypto legend

In 2009, the first Bitcoin was mined by Satoshi Nakamoto – a hero still unknown to this day – in his living room. The first transaction was in 2010 when someone paid 10,000 BTC for two pizzas. Yep, ten thousand bitcoins!

In 2013, Bitcoin’s price broke the $1,000 mark for the first time, sparking the first crypto-mania. And the boom was on! Despite all the ups and downs (like a rollercoaster), Bitcoin kept growing. 2024 set a record when BTC reached $73,750. Although it dropped a bit afterward, it’s still holding strong, and people are taking it more seriously than ever.

Price prediction for 2024: Halving fever

2024 is like Christmas for Bitcoin – the halving event was here, meaning miners will only get 3.125 BTC for mining a block. This should reduce supply and push up the price. The launch of spot Bitcoin ETFs is helping significantly. Bitcoin is expected to fluctuate between $50,000 and $100,000. So, if you were hoping to buy a Lambo, you might need to wait.

Price prediction for 2025: Bitcoin on the way to the stars

2025 will bring more adoption of Bitcoin ETFs and possibly bigger institutional investments. Price? Some optimists believe Bitcoin will break the $100,000 mark and could even reach $150,000. But, as with predictions, they’re like weather forecasts – sometimes it’s sunny, but it might rain.

Price prediction for 2026: Bear market on the horizon?

2026 might be a bit quieter, as after every big bull run (growth period), there’s usually a correction phase – the so-called bear market. That’s when investors say, “OK, we’ve made enough, time to take a break.” The price could fall back to $60,000–$80,000, which would be a healthy dip after the previous halving and growth. This period might be an ideal time for new investors to buy at lower prices before Bitcoin starts growing again.

Price prediction for 2027: Return of the bulls?

2027 might bring a new bull run as Bitcoin will recover from the bear market. It’s possible that in this year, Bitcoin will start climbing again. Prices could get back to $100,000–$120,000, as investors start jumping on board again, expecting another growth spurt before the next halving in 2028. This year could also see greater Bitcoin adoption in the financial sector and among major corporations, supporting further growth.

Price prediction for 2028: Halving around the corner again

2028 will be the year of the fourth halving, which traditionally means a lot of hype around Bitcoin. The price could reach new highs, with some experts predicting Bitcoin will trade between $150,000 and $200,000, while speculators and long-term holders will expect another wave of growth. As in previous halving cycles, we can anticipate increased demand and reduced supply.

Price prediction for 2029: Bitcoin on a bull market

2029 could be another exciting growth period for Bitcoin, especially if it follows the classic bull market cycle after the previous halving in 2028. With a reduced supply of new bitcoins and increasing demand, the price could reach $200,000 to $300,000. This growth will likely be driven by broader adoption of Bitcoin as a global store of value and further acceptance by institutional investors.

Price prediction for 2030: The journey to half a million?

By 2030, Bitcoin could either be the digital equivalent of gold that everyone wants to own, or it could be the old buddy you keep on a flash drive just for nostalgia. Estimates range from $250,000 to $500,000 – if everything goes well and governments don’t overregulate Bitcoin. Or it could become the main currency of the digital world, used for everything from buying coffee to investing in spaceships.

Top 10 Bitcoin Price Predictions: Experts’ Opinions

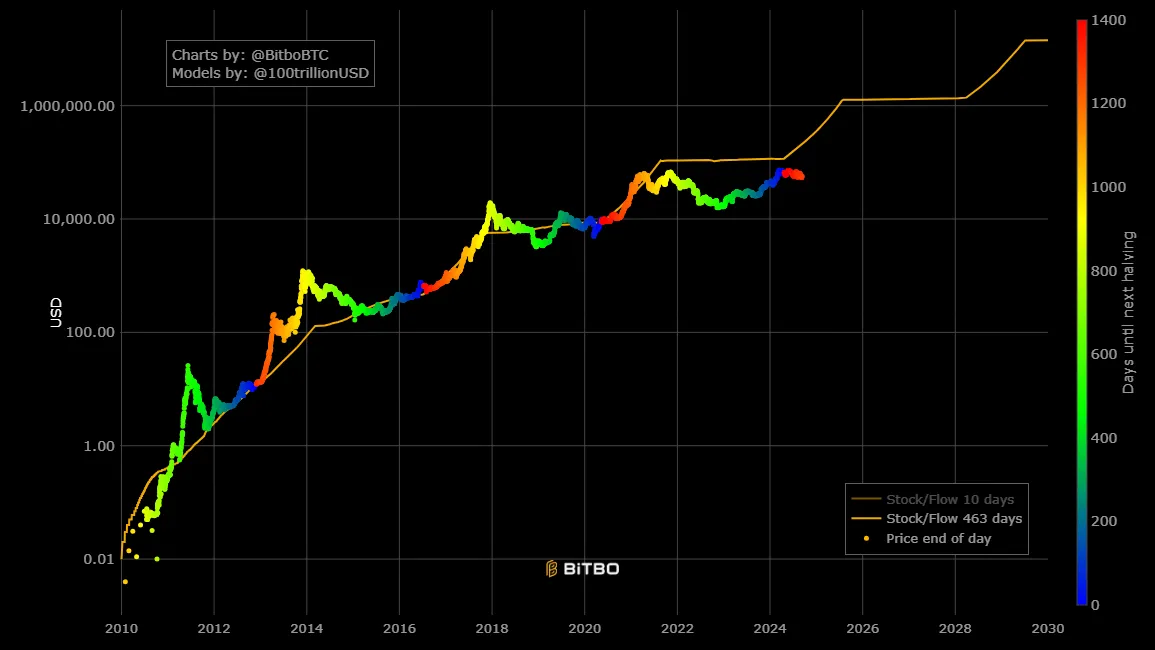

Price prediction for 2030 according to the Stock-to-Flow Model

According to the Stock-to-Flow (S2F) model by PlanB, Bitcoin is expected to continue growing in 2030 thanks to its ever-increasing scarcity and demand. The model, which takes into account Bitcoin’s limited supply (a maximum of 21 million coins), predicts that the price could reach up to $1 million or more. This growth will be driven primarily by Bitcoin’s adoption as digital gold and the growing interest from institutions and governments worldwide, searching for alternatives to traditional currencies.

Summary of future trends

Although Bitcoin goes through cycles of growth and correction, its long-term trajectory is clear to many experts – due to its limited supply and increasing demand, its growth should continue. Who knows, one day you might buy a family house or a Ferrari for just 1 BTC!

Recommendation: Be prepared for both bull and bear markets, and remember that predictions are like the weather – you can expect sunshine, but always bring an umbrella.

Bitcoin price history: Rocket start and turbulent landings

Bitcoin’s price has never been boring. In 2010, you could buy a pizza for 10,000 BTC (which today would be worth billions). But then things got interesting. In 2013, Bitcoin broke the $1,000 mark, and the whole world started going crazy. 2017? That was the real crypto explosion when it skyrocketed to an unbelievable $20,000. Then came 2018, and Bitcoin took a breather, falling to $3,000. But like a true hero, it came back to reach an all-time high of $69,000 in 2021. The year 2022? That was like dropping your ice cream – the price plummeted to between $15,000 and $25,000.

2023 was a recovery period for Bitcoin after the falling prices of 2022. Following the turbulent year when its price dropped to around $15,000, Bitcoin began growing again in 2023, partly due to positive news about the potential approval of spot Bitcoin ETFs in the United States. This was seen as a huge milestone, opening doors to institutional investors and boosting Bitcoin’s credibility in traditional financial markets. As a result, Bitcoin’s price reached between $35,000 and $45,000 by the end of 2023.

In the first half of 2024, Bitcoin’s price continued to rise, especially due to the halving. Historically, halvings have led to a dramatic increase in Bitcoin’s price as they slow the rate at which new bitcoins are brought to market. The anticipation of reduced supply and the influx of capital into Bitcoin ETFs caused investors to increase their positions, leading to a price of $73,750 by March.

Bitcoin ETFs: Entering the world of serious investments

2024 marked a breakthrough with the approval of spot Bitcoin ETFs in the U.S. It’s like Bitcoin getting an invite to the gala evening of traditional investment funds. ETFs backed by physical bitcoins attracted institutional investors and gave Bitcoin more credibility in traditional financial markets. Spot ETFs mean that when you invest, you really own a piece of Bitcoin, not just a contract about its future price.

Future plans: Where is Bitcoin heading?

Bitcoin has bigger plans than Elon Musk has for Mars. With innovations like the Lightning Network, developers are working to speed up transactions and reduce fees, so one day we might pay for coffee with Bitcoin without the long wait. Plus, work is underway to improve transaction security and anonymity with technologies like Schnorr signatures. Bitcoin’s future depends on how well it integrates into mainstream finance, but the potential is there.

The last Bitcoin: Endgame in 2140

Attention miners! The last Bitcoin will be mined sometime around 2140. Every four years, a halving reduces miners’ rewards. So, if you’re planning to mine, you still have plenty of time – around another 116 years.

What could be the price of the last bitcoin?

Conclusion

Investing in Bitcoin can be attractive to those seeking long-term growth and protection against inflation. With a limited supply of 21 million coins and increasing adoption as digital gold, it has the potential to become a significant store of value. Blockchain technology provides security and transparency, contributing to investor trust. Moreover, predictions indicate substantial price growth in the coming years. With gradual adoption by institutional investors and the introduction of ETFs, Bitcoin is increasingly seen as a serious investment asset.

- Why Online Advertisers Should Request Website Traffic Data from Google Analytics Instead of Using SEO Tools Like MOZ or Ahrefs? - March 24, 2025

- North Carolina’s Bold Move: State Bill Proposes Investing 10% of Public Funds in Bitcoin - March 22, 2025

- Justin Sun Stakes $100 Million in Ethereum on Lido – What Does It Mean for the Market? - March 19, 2025