Table of Contents

Polkadot is like the overachiever of the crypto world—a project so advanced it’s practically showing off. Focused on interoperability, scalability, and seamless collaboration between blockchains, it’s built on a modular architecture that screams efficiency. Whether you’re launching a blockchain project or just trying to impress your tech-savvy friends, Polkadot has you covered.

And if you’re here to find out where the DOT token might be heading in the future, buckle up—you’re in the right place to get the lowdown!

What is Polkadot?

Polkadot is like the ambitious kid in class who not only aces every test but also tutors the other kids. Designed by Gavin Wood, one of Ethereum’s co-founders, Polkadot aims to let different blockchains hold hands and work together. In simpler terms, it connects separate blockchain networks, enabling them to share data and communicate without centralizing everything. It’s basically building the decentralized internet of the future, where apps and services can run independently without needing a nosy central server.

At the heart of Polkadot is its Relay Chain, the main blockchain that provides security and consensus. Think of it as the sturdy backbone that keeps everything running smoothly. Then come the parachains—custom-built blockchains optimized for specific tasks like DeFi, gaming, NFTs, or data analytics. These parachains make Polkadot ultra-flexible and scalable. And if that wasn’t enough, there are bridges, magical gateways that let Polkadot chat with other blockchains like Ethereum and beyond.

Polkadot’s superpower? It combines ironclad security with the ability to customize blockchains, making it a magnet for developers and projects. Its ecosystem is growing faster than your to-do list on a Monday, positioning Polkadot as one of the brightest stars in the crypto universe.

Polkadot Ecosystem: Where Blockchains Unite

The Polkadot ecosystem is like the ultimate playground for decentralized app (dApp) developers. Its focus on interoperability and modularity attracts creators from all industries, from finance to gaming and even healthcare. Here’s what makes Polkadot’s ecosystem so awesome:

- Relay Chain: The superhero of Polkadot, providing security and consensus with its energy-efficient Nominated Proof-of-Stake (NPoS) algorithm. It’s the glue that holds the entire system together.

- Parachains: Custom-built blockchains tailored for specific use cases, from DeFi to identity management. With tools like Substrate, developers can build their dream parachains without breaking a sweat.

- Bridges: These handy connectors let Polkadot collaborate with other blockchains like Ethereum, Bitcoin, and more, creating a tightly knit ecosystem of blockchain buddies.

- Parathreads: The “pay-as-you-go” version of parachains. Perfect for smaller projects that don’t need a constant connection to the Relay Chain, making them budget-friendly.

- Developer Tools: Substrate is the ultimate cheat code for developers, providing an easy-to-use framework for creating custom blockchains without having to reinvent the wheel.

- Polkadot DAO: This decentralized autonomous organization ensures that project management and decision-making in the Polkadot network stay as decentralized as your office fridge on pizza day.

Backed by a vibrant community and relentless innovation, the Polkadot ecosystem is growing faster than a meme coin during a Twitter pump. It’s flexible, powerful, and just the kind of environment developers and projects love to call home.

Top 10 Applications on Polkadot by Trading Volume

Polkadot’s ecosystem is like a bustling digital metropolis filled with innovative projects that thrive on its interoperability and flexible architecture. From DeFi and identity management to real-world asset tokenization, these applications showcase what’s possible when blockchains work together. Here’s a rundown of the top 10 applications on Polkadot by trading volume—with a dash of humor to keep things fun:

- Acala Network: Acala is the financial hub of Polkadot, often dubbed the “DeFi hub” of the ecosystem. It offers a smorgasbord of DeFi goodies like the Acala Dollar (aUSD) stablecoin, decentralized loans, and token swaps. Acala is like the all-you-can-eat buffet of finance—low fees and high efficiency make it a top choice for both users and investors.

- Moonbeam: Moonbeam is like Ethereum’s long-lost twin, letting developers easily build and deploy dApps on Polkadot using Ethereum-compatible tools like MetaMask. It’s perfect for those who want the comfort of Ethereum’s ecosystem but with Polkadot’s perks, like lower latency and better scalability. Think of it as Ethereum with a makeover and a gym membership.

- Astar Network: Astar is the diplomat of Polkadot, bridging multiple blockchains to create a harmonious trading universe. It’s ideal for DeFi and NFT projects, offering developer incentives that are basically the blockchain version of free pizza at a hackathon. With its interoperability, Astar is one of Polkadot’s most valuable assets.

- Centrifuge: Centrifuge is where DeFi meets the real world. It allows users to tokenize physical assets—like invoices, loans, or real estate—and use them as collateral. It’s like turning your dusty old office chair into a shiny new NFT. Small businesses particularly love it as an alternative financing option.

- Phala Network: Phala is the blockchain bodyguard, specializing in data privacy and security. It offers decentralized cloud computing that keeps sensitive data under lock and key using trusted execution environments. If James Bond needed a blockchain, Phala would be his first choice.

- Bifrost: Bifrost is the multitasker of Polkadot, letting users stake their tokens while keeping them liquid for trading. It’s like earning interest on your savings account while still being able to spend your money at the mall. Perfect for maximizing returns without sacrificing flexibility.

- Karura: Think of Karura as Acala’s rebellious younger sibling. Built on Kusama, it’s where all the wild experimentation happens before rolling out on Polkadot. Offering similar DeFi services like loans and stablecoins, Karura is the testing ground for Polkadot’s boldest ideas.

- ChainX: ChainX is the international diplomat of Polkadot, managing cross-chain assets and ensuring seamless integration between networks. It’s like a universal translator for blockchain assets, making transfers as smooth as butter.

- Clover Finance: Clover Finance is the friendly neighborhood multi-chain platform, offering a user-friendly experience with low fees. It’s a bridge-builder, connecting traditional finance to the blockchain world. If Polkadot were a city, Clover Finance would be the bridge everyone loves to take selfies on.

- Litentry: Litentry is the blockchain’s identity guru, specializing in decentralized identity management. It’s perfect for projects that need secure identity verification, like DeFi platforms or admin systems. Think of it as the bouncer who checks your ID at the door of the DeFi club.

These applications don’t just leverage Polkadot’s unique features—they also fuel its growth. By creating innovative solutions and bridging the gap between blockchains, they make Polkadot a go-to choice for developers, businesses, and investors alike. It’s safe to say Polkadot is more than just a blockchain—it’s an ecosystem buzzing with potential.

Price History of Polkadot: A Rollercoaster Ride of Crypto Adventures

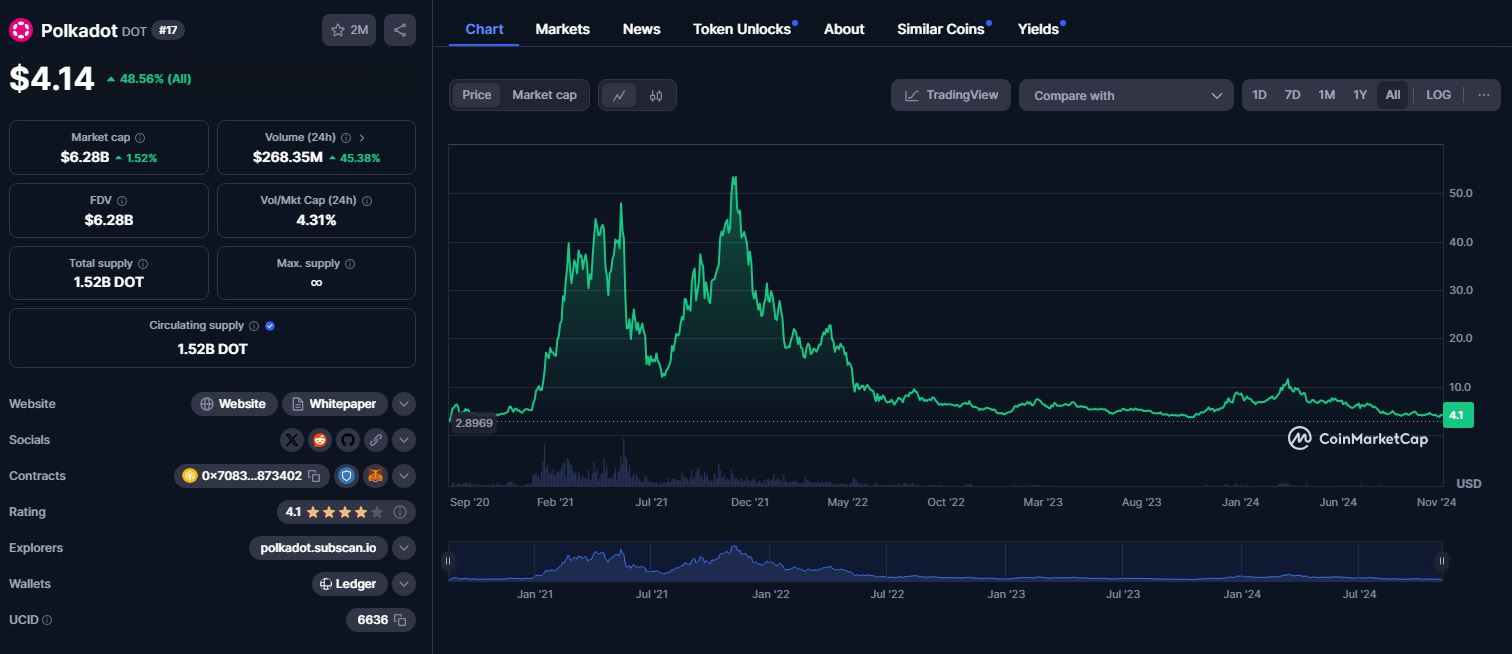

The price history of DOT is like a thrilling novel—packed with explosive growth, moments of calm, and dramatic dips, all while maintaining its status as a leader in interoperable blockchain technology. From its 2020 debut to the challenges of 2024, Polkadot has kept investors on their toes and proved that it’s more than just a one-hit wonder.

2020: The Grand Debut and Rapid Ascent

DOT made its debut in August 2020 with a starting price of around $2.90. Thanks to Polkadot’s innovative vision of blockchain interoperability, the token quickly gained traction among investors. By the end of its first chapter, DOT had stabilized around $5, signaling the market’s confidence in its long-term potential. It was like a freshman making varsity in their first season—impressive and full of promise.

2021: The Year of Breakthroughs and All-Time Highs

2021 was the year DOT truly flexed its muscles. Early in the year, its price skyrocketed, hitting $40 in February, fueled by the broader bull market and faith in Polkadot’s ability to scale and support developer projects.

The real highlight came in November when DOT soared past $55, setting its all-time high. This surge was largely driven by the launch of parachain auctions, allowing projects to secure spots on the Relay Chain. Investors saw this as a pivotal milestone, cementing Polkadot’s position as a long-term player in the blockchain space. It was like the blockbuster premiere of a movie everyone had been waiting for.

2022: The Bear Market Blues

2022 brought a change in mood as the bear market swept through the crypto world. DOT’s price tumbled from around $30 at the start of the year to roughly $6–7 by year’s end. The decline was a mix of macroeconomic challenges—rising inflation, higher interest rates, and reduced market liquidity.

Despite the dip, Polkadot didn’t sulk in a corner. It doubled down on expanding its ecosystem, proving it’s not just here for the hype. Think of it as the underdog training harder during the off-season, preparing for the next big game.

2023: A Year of Consolidation

In 2023, DOT found its groove. The price ranged between $4–8, while Polkadot focused on expanding its ecosystem and wooing new projects. Although it wasn’t a year of jaw-dropping moves, investors saw DOT as a solid long-term bet, thanks to its tech-savvy framework and dedicated community.

Polkadot also introduced enhanced bridges in 2023, strengthening its connections with non-Polkadot blockchains. It was like upgrading from dial-up to fiber optic—faster, better, and far more efficient.

2024: Challenging Conditions but Steady Progress

As of November 2024, Polkadot is navigating rough market waters, with its price hovering around $4.15. Despite the challenges, Polkadot remains a beacon of innovation in the crypto world. Its robust ecosystem and relentless technological advancements continue to earn the trust of its investors.

Think of 2024 as the resilience phase in Polkadot’s journey—a year that proves the project is here for the long haul, not just a quick moonshot. Whether the market storms calm or intensify, Polkadot’s strong foundation ensures it’s ready for whatever comes next.

Summary: Polkadot’s price history mirrors the highs and lows of the broader crypto market. From its dazzling debut to its steady resilience in 2024, DOT’s journey highlights its innovative spirit and enduring appeal. Whether you’re a thrill-seeker or a long-term believer, Polkadot has something for everyone—making it a crypto story worth following.

Polkadot Price Predictions for 2025–2030: A Humorous Look Into the Crystal Ball

Predicting Polkadot’s price feels like trying to forecast the weather on Mars—exciting, tricky, and full of wild possibilities. Based on technological progress, ecosystem growth, market trends, and macroeconomic factors, Polkadot remains one of the leading projects in the interoperable blockchain space. Here’s what the future might hold for DOT, year by year:

2025: Steady Growth Post-Bitcoin Halving

With Bitcoin’s halving in 2024 likely to trigger a bullish market, 2025 could be Polkadot’s time to shine. DOT is expected to reach $10–$15, driven by:

- Ecosystem Expansion: More projects launching parachains will increase demand for DOT like a Friday night rush for pizza.

- DeFi and NFT Adoption: Applications like Acala and Astar will attract users hungry for decentralized finance and shiny NFTs.

Developers will continue flocking to Polkadot, thanks to its Substrate framework. In short, 2025 is the year DOT flexes its muscles.

2026: Institutions Enter the Chat

By 2026, DOT could climb to $20–$25 as institutions start jumping on the Polkadot bandwagon. Key drivers include:

- Institutional Adoption: Big players seeking interoperable blockchain solutions will find Polkadot irresistible.

- Global Expansion: Expect a Polkadot invasion in regions like Asia and Latin America, where blockchain adoption is booming.

- Infrastructure Upgrades: Polkadot will likely improve scalability and interoperability, making it the Tesla of blockchains.

2027: Bull Market Bonanza

Brace yourselves for a wild ride! By 2027, DOT might dip slightly to $15–$20, as the market takes a breather. But don’t panic—this could also be a prime year for innovation. Expect:

- Diverse Applications: From healthcare to gaming, Polkadot will host apps that make your smartphone blush with envy.

- Full Parachain Integration: Projects will be firing on all cylinders, boosting the ecosystem’s value.

- Regulatory Clarity: Clearer rules in the US and Europe could draw in cautious investors.

2028: Bear Market Before the Bitcoin Halving

The pre-halving blues are real. DOT may drop below $20, but Polkadot’s tech-savvy resilience will keep it relevant. Expect:

- Bear-Proof Ecosystem: Polkadot’s diverse user base and innovations will cushion the blow.

- New Infrastructure: Bridges and solutions will strengthen cross-chain communication, making DOT a dependable companion in tough times.

2029: Recovery and Rebound

After Bitcoin’s 2028 halving, the market will likely bounce back, pushing DOT to $30–$35. Highlights of 2029:

- DeFi and Web3 Innovations: Polkadot will be the playground for groundbreaking decentralized internet ideas.

- Institutional Resurgence: Stabilized markets will reignite institutional interest, giving DOT a solid boost.

2030: Global Adoption and a New Peak

Fast forward to 2030, and Polkadot could hit $40–$50, cementing its position as a cornerstone of blockchain innovation. What’s fueling this rocket?

- Massive dApp Development: With a growing library of apps, Polkadot’s ecosystem will resemble a bustling app store.

- Eco-Friendly Blockchain: Its sustainability credentials will attract businesses and users looking for a green alternative.

- Technological Maturity: Fully integrated with traditional finance, Polkadot will be a key player in the Web3 revolution.

Conclusion: Polkadot’s Bright Future

Polkadot is like the Swiss Army knife of blockchain—versatile, efficient, and built to last. With its focus on interoperability, scalability, and security, Polkadot has the potential to become the backbone of the decentralized internet.

Its ecosystem and technology attract developers and investors alike, making it a long-term growth opportunity. While external factors like Bitcoin halvings and regulatory developments will influence its price, Polkadot’s strong foundation ensures it stays in the game.

For investors, Polkadot isn’t just another crypto—it’s a ticket to the future of decentralized innovation. Buckle up; the DOT journey is just getting started!

- Solana Price Analysis – December 18, 2024: The Slippery Slope of SOL 🚀📉 - December 18, 2024

- Bitcoin Price Analysis – 16/12/2024: A Dance in the Ascending Channel - December 16, 2024

- What is Monero, Price Predictions for 2025–2030, and Why Invest in XMR? - December 16, 2024