Table of Contents

XRP is a digital currency created by Ripple Labs that operates on the XRP Ledger (XRPL). It is a cryptocurrency designed for fast and inexpensive transactions, making it an ideal tool for interbank and international transfers. XRP is unique in its ability to provide on-demand liquidity and facilitate payments within seconds, which is significantly faster than traditional payment systems.

Use Cases for XRP

XRP has a wide range of uses, including:

- Interbank Payments: Banks and financial institutions use XRP to ensure fast and low-cost cross-border payments.

- Real-Time Payments: XRP enables instant money transfers between individuals and businesses.

- On-Demand Liquidity: Financial institutions can use XRP to ensure liquidity during transactions without the need for pre-funding accounts.

- Microtransactions: Due to low transaction fees, XRP is suitable for microtransactions and small payments.

- Asset Tokenization: The XRP Ledger allows for the creation and management of tokens representing various assets.

XRP Ecosystem

XRP ecosystem includes several key components and partners:

- RippleNet: A global payment network that uses blockchain technology to provide fast and reliable payment services.

- On-Demand Liquidity (ODL): A service that uses XRP to ensure liquidity during cross-border transactions.

- Xpring: Ripple’s initiative to support development on the XRP Ledger through investments and grants.

- Interledger Protocol (ILP): A protocol for connecting different payment systems, enabling interoperability between blockchains and traditional financial networks.

XRP Ledger and Its Features

XRP Ledger is a decentralized, open-source blockchain platform that supports fast and low-cost transactions. Key features of XRPL include:

- Fast Transactions: Transactions on the XRP Ledger are processed within 3-5 seconds.

- Low Fees: Transaction fees are very low, often less than a cent.

- Decentralization: XRPL is operated by thousands of validators worldwide, ensuring a high level of security and resilience.

- Support for Tokenization: XRPL allows for the creation and management of custom tokens.

- Interoperability: XRPL supports the Interledger Protocol, enabling connection with other blockchains and payment systems.

CBDC

Ripple Labs actively collaborates with central banks on the creation and implementation of central bank digital currencies (CBDCs). Through its technology and expertise, Ripple supports central banks in their efforts to develop secure, efficient, and interoperable digital currencies. RippleNet and the XRP Ledger provide a robust infrastructure that enables fast and inexpensive transactions, which is crucial for the successful implementation of CBDCs.

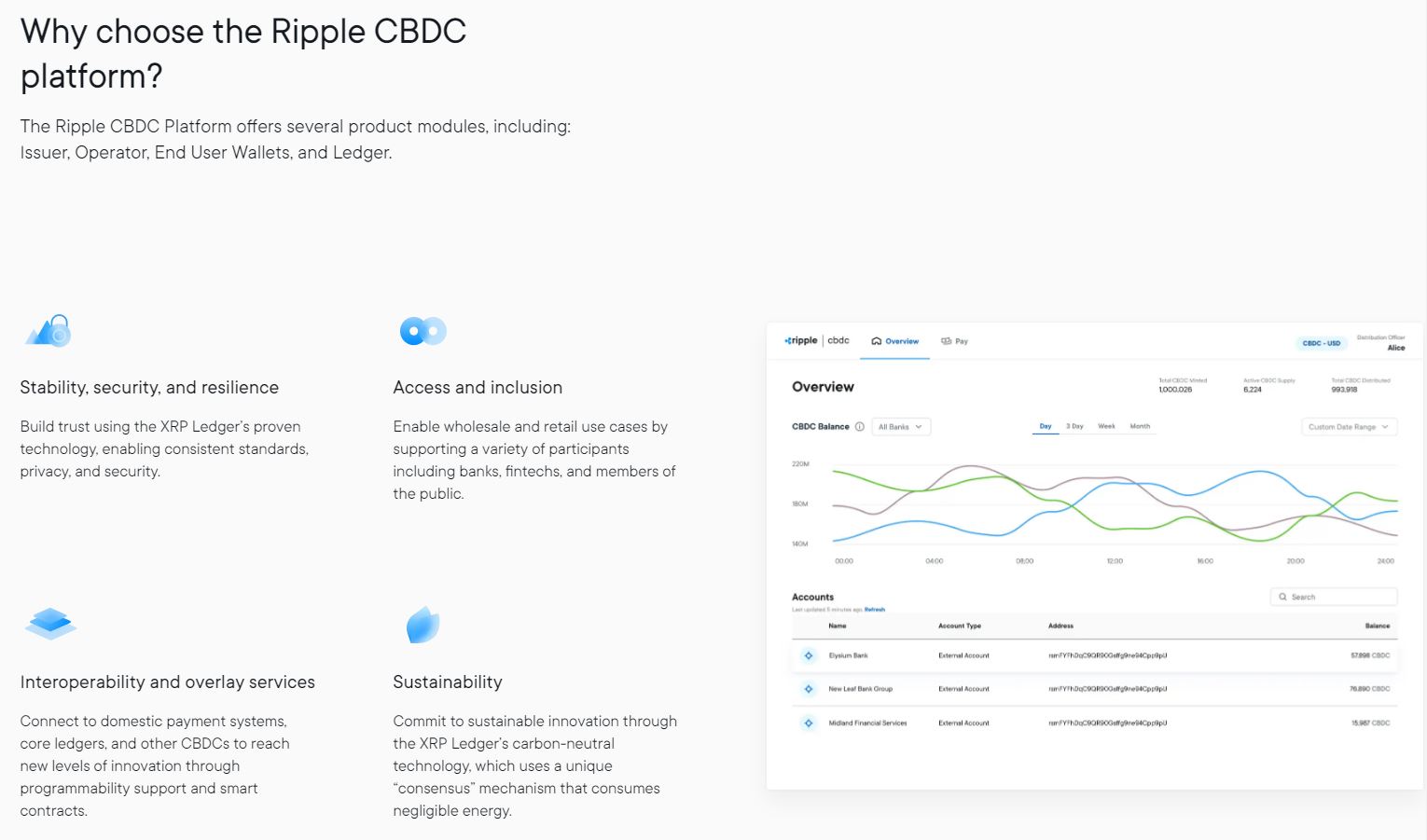

Ripple Labs has developed a robust platform for central banks to issue and manage their central bank digital currencies (CBDCs). This platform is based on XRP Ledger technology and provides a comprehensive solution for the entire CBDC lifecycle, from issuance to transactions and redemptions.

Key Features of the Ripple CBDC Platform

- Ledger Technology: The platform is built on a private ledger using XRPL technology, ensuring energy efficiency and high security.

- Minting and Management: It allows central banks to securely issue, distribute, and destroy digital currencies using advanced cryptographic tools.

- User Wallets: End users can securely hold and use digital currencies, similar to common payment applications, including offline transactions.

- Interoperability: Supports connection with domestic payment systems and other CBDCs, enabling new levels of innovation through programmability and smart contracts.

- Sustainability: The platform is designed with sustainability in mind, using a consensus mechanism that consumes minimal energy.

Examples of Implementation

Ripple is collaborating with several central banks on pilot projects:

- Palau: Creating a national digital currency to improve financial inclusion for citizens.

- Bhutan: A pilot project focused on retail and cross-border payments.

- Montenegro: A pilot project for CBDC in collaboration with the Central Bank of Montenegro.

Price Prediction for XRP 2024

The current price of XRP is $0.5491. Based on current trends and market-influencing factors, the following price development for XRP in 2024 can be assumed:

- Optimistic Scenario: In an optimistic scenario where Ripple successfully expands its global payment network RippleNet and gains new strategic partnerships, the price of XRP could grow significantly. If there is positive regulatory development and increased adoption of the technology, the price could reach up to $1.20. This scenario assumes that new implementations and technological improvements of Ripple will continue without major obstacles.

- Conservative Scenario: In a conservative scenario, the price of XRP will be more stable, with growth being gradual and less dramatic. Assuming stable growth of RippleNet and continued adoption without major market shocks or regulatory hurdles, the price could reach around $0.90 to $1.00. This scenario is based on the assumption that the current positive trends will continue, albeit possibly slower than in the optimistic scenario.

- Pessimistic Scenario: In a pessimistic scenario, where negative regulatory interventions or significant market barriers could occur, the price of XRP could see a decline. If adverse economic conditions or legal issues affecting Ripple and its technology arise, the price of XRP could drop to $0.40 to $0.50. This scenario considers the possibility of significant problems that could slow or negatively impact the growth and adoption of XRP.

Price Prediction for XRP 2025-2030

Predicting the price of cryptocurrencies is challenging due to their volatile nature. However, based on current trends and the potential of XRP technology, the following rough estimates can be provided:

- 2025: In 2025, the price of XRP is expected to be driven by increased adoption and the use of Ripple technology in the banking sector. Estimates range between $1 and $5. Key factors will be successes in regulatory negotiations and the expansion of partnerships with major financial institutions.

- 2026: The price of XRP could grow to $2 to $6 if Ripple manages to further expand its global payment network RippleNet and acquire additional strategic partners. Continued development of technologies and services offered by Ripple will also be an important factor.

- 2027: The price of XRP is expected to reach a range of $3 to $8 if positive regulatory changes continue and institutions’ interest in using XRP for cross-border payments and on-demand liquidity increases.

- 2028: In 2028, the price of XRP could reach $4 to $10, with further development of RippleNet and increasing use of XRP as a liquidity tool. Increased adoption in various industries and expanded collaboration with central banks could play a key role.

- 2029: The expected range is $5 to $12, depending on the overall growth of the cryptocurrency market and blockchain adoption. Further growth of XRP will depend on its ability to maintain a competitive edge and continue to innovate.

- 2030: The price of XRP could reach $6 to $15, assuming XRP is widely accepted as a standard payment tool. Successful integration with other payment systems and increased regulatory certainty could further support the growth of XRP’s value.

Factors Influencing the Price of XRP

- Regulatory Environment: Changes in regulations and legal frameworks can have a significant impact on the price of XRP. Positive regulatory developments could support growth, while negative interventions could cause a decline.

- Technology Adoption: Increased interest and adoption of RippleNet and On-Demand Liquidity (ODL) services could support the growth of the XRP price.

- Macroeconomic Conditions: The global economic situation, including factors such as inflation, interest rates, and geopolitical stability, can influence market sentiment and thus the price of XRP.

- Technological Innovations: Further development and improvements in Ripple and XRP Ledger technologies can attract more users and investors, which could support the growth of the price.

Price History of XRP

The price of XRP has experienced several significant periods of growth and decline:

- 2013: XRP was launched with a price of around $0.005. In the early years, the price remained at very low levels as cryptocurrencies were just starting to gain attention.

- 2017: By the end of the year, the price rose to over $3 due to increased interest in cryptocurrencies and the development of blockchain technologies. This growth was driven by speculation and increasing awareness of cryptocurrencies as an investment tool.

- 2018-2020: The price fluctuated between $0.2 and $0.6 due to various regulatory issues and market conditions. During this period, Ripple focused on developing its payment network and forming partnerships with financial institutions.

- 2021: XRP reached a price of over $1.5 due to increasing adoption and interest from institutional investors. This growth was also supported by positive news about new partnerships and technological innovations.

- 2022-2023: The price stabilized around $0.5 to $0.7, awaiting resolution of regulatory issues and further ecosystem development. During this period, Ripple continued to expand RippleNet and increase adoption of its technology.

XRP has grown by an incredible 9,300% since its launch.

Future Plans for XRP

Ripple Labs has several key plans for the future development of XRP and its ecosystem:

- Expansion of RippleNet: Ripple plans to further develop the global payment network RippleNet and acquire new partners. The goal is to expand into new regions and strengthen collaboration with major financial institutions.

- CBDC Support: Ripple collaborates with central banks to create and implement central bank digital currencies (CBDCs). Ripple actively develops technologies to support CBDCs and works with government institutions worldwide.

- Increasing Liquidity: Ripple plans to improve liquidity availability through the development of On-Demand Liquidity (ODL) services, enabling higher liquidity during transactions and reducing cross-border payment costs.

- Development on the XRP Ledger: Supporting developers and projects on the XRP Ledger through grants and investments from the Xpring initiative is another key plan. The goal is to attract more developers to develop applications and services on the XRP Ledger, which could increase the value and utility of this technology.

- Regulatory Cooperation: Ripple actively engages in dialogue with regulatory authorities to ensure favorable conditions for the growth and adoption of cryptocurrencies. Cooperation with regulatory authorities is key to creating a clear and stable regulatory framework that will support further development and adoption of XRP.

Conclusion

XRP is a digital currency created by Ripple Labs, designed for fast and inexpensive interbank and international transactions. XRP could benefit from increasing adoption and technological innovations. Future plans include expanding RippleNet, supporting CBDCs, increasing liquidity, and further development on the XRP Ledger, significantly contributing to the modernization of global financial systems.

- Michaël van de Poppe: Bitcoin to Hit $500,000 This Cycle? 🚀💸 Or Just Another Crypto Fairy Tale? - December 21, 2024

- What is the Meme Coin Bonk, Price Predictions 2025–2030, and Why Invest in BONK? - December 18, 2024

- BNB Price Analysis: 17/12/2024 – To the Moon or Stuck on a Layover? - December 17, 2024

![Best Platforms for Copy Trading in [current_date format=Y] 11 Best Platforms for Copy Trading](https://cryptheory.org/wp-content/uploads/2024/12/copy-trading-350x250.jpg)

![Top 10 Cryptocurrency Platforms for Grid Trading in [current_date format=Y] 13 Top 10 Cryptocurrency Platforms for Grid Trading](https://cryptheory.org/wp-content/uploads/2024/12/grid-trading-350x250.jpg)

![BingX Exchange: A Detailed Guide to Using, Trading, and Maximizing Features in [current_date format=Y] 15 BingX Exchange: A Detailed Guide to Using, Trading, and Maximizing Features](https://cryptheory.org/wp-content/uploads/2024/11/4-5-350x250.jpg)